As laws on repossessed auto sales ease, CFSP economists show consumer access to credit jumps

The study from the Consortium on Financial Systems and Poverty examines car loans from one of Brazil’s leading banks before and after a 2004 law that enabled banks to sell repossessed cars quickly without going through a lengthy court process.

“As far as we know, this research is the first to provide evidence that stronger creditor rights lead to a ‘democratization of credit’ – as lower-income, riskier borrowers were now granted a loan,” the research team of economists note.

The study, which is described in a working paper titled “Repossession and the Democratization of Credit,” was made by Juliano Assunção and Fernando Silva of Pontifícia Universidade Católica do Rio de Janeiro (PUC-Rio) and Efraim Benmelech of Harvard University.

The researchers examined 17,000 loan contracts from the period August 2003 to July 2005 – one year before and one year after the change in the law. According to the Brazilian central bank, credit for vehicles grew from R$34.7 billion (US$11.5 billion) in August 2004 to R$60.2 billion (US$27.9 billion) two years later.

Prior the change in the law, banks were able to repossess vehicles when borrowers defaulted on their loans but could not resell them until after a trial. As the auto market in Brazil grew, this came to mean a delay of two to three years, which discouraged banks from making car loans.

By eliminating the need for a trial to resell the car, the change in the law encouraged banks to expand the market for car loans to riskier, low-income borrowers, even though this led to a higher rate of default and repossession.

“Ultimately, the law has reformulated relationships among borrowers, creditors, and courts,” the economists wrote. “Borrowers and creditors now engage in direct relationships, and courts play a significant role only when borrowers explicitly request it. The law avoids unnecessary trials, reduces the reliance on courts, and increases the enforceability of auto loan contracts.”

The change also enabled consumers to buy newer, more expensive cars. The banks’ ability to sell foreclosed cars encouraged them to offer better contractual terms, including longer maturities and lower spreads. This in turn allowed borrowers to spend more on cars.

The use of micro-level data enabled researchers to separate the direct effect of the legal change on contracts from the composition effect that resulted in increased lending to riskier borrowers. This is the “democratization of credit” identified by the researchers. The strengthening of the ability of lenders to foreclose, repossess, and sell assets increased the supply of credit to those who need it most.

The change did lead to higher rates of delinquency and default. The researchers found an increase of approximately 30% in late payments and defaults.

The Consortium on Financial Systems and Poverty at the University of Chicago provided financial support for the study. The CFSP is a private research organization comprised of leading and emerging economists. Their goal is to improve the lives of the world’s poor and to reduce poverty through helping to identify, design and implement more efficient financial systems. Principal researcher for the program is Robert M. Townsend, Elizabeth and James Killian Professor of Economics in the Department of Economics at MIT. The paper can be found on their website at www.cfsp.org.

Juliano Assunção and Fernando Silva are in the Department of Economics at PUC-Rio. Assunção is also a research member of CFSP. Efraim Benmelech is affiliated with the Department of Economics at Harvard University and the National Bureau of Economic Research.

Media Contact

More Information:

http://www.uchicago.eduAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Silicon Carbide Innovation Alliance to drive industrial-scale semiconductor work

Known for its ability to withstand extreme environments and high voltages, silicon carbide (SiC) is a semiconducting material made up of silicon and carbon atoms arranged into crystals that is…

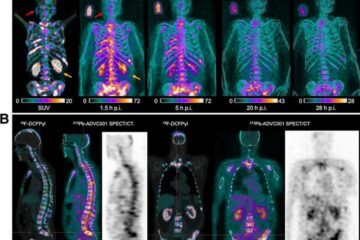

New SPECT/CT technique shows impressive biomarker identification

…offers increased access for prostate cancer patients. A novel SPECT/CT acquisition method can accurately detect radiopharmaceutical biodistribution in a convenient manner for prostate cancer patients, opening the door for more…

How 3D printers can give robots a soft touch

Soft skin coverings and touch sensors have emerged as a promising feature for robots that are both safer and more intuitive for human interaction, but they are expensive and difficult…