Lack of capital not a 'death sentence' for start-ups

“Our research shows that undercapitalization is not a death sentence for start-up ventures,” says Dr. David Townsend, an assistant professor of management, innovation and entrepreneurship at NC State who co-authored the study. “There are things a venture can do to survive and succeed.” Basically, Townsend says, start-ups that fall short of their fund-raising goals can take steps to minimize their cash outflows in order to stay viable.

Undercapitalized ventures “need to engage in management strategies focused on reducing their costs. For example, outsourcing certain development tasks and accounting responsibilities or exchanging services with other companies – saying we'll build your Web site in exchange for a year's worth of accounting services, etc.,” Townsend says.

The study also found that there is little evidence to support the long-standing tenet that a great management team is the most important part of a venture company when it comes to securing investment in a start-up. The study shows that a venture with an “A,” or top notch, management team and an A technology is likely to meet its capitalization goal. But the researchers were surprised to find that the combination of a “B,” or less than ideal, management team with a B technology was also quite successful in meeting capitalization goals. Ventures that had an A management team but a B technology, or vice versa, were usually underfunded.

Townsend explains that B management teams with B technologies are probably more successful at meeting their capitalization goals because they are aware of their shortcomings, and modify their capitalization targets accordingly. For example, these B teams may minimize management salaries or restrict their marketing budgets.

Similarly, Townsend says the evidence implies that A management teams with B technologies, or vice versa, often fall short of their capitalization targets because they have not modified their fund-raising goals – and as a result investors don't buy in at a sufficient level to fully fund the venture's intended strategies.

The study, “Resource Complementarities, Trade-Offs, and Undercapitalization in Technology-Based Ventures: An Empirical Analysis,” was co-authored by Townsend and Dr. Lowell W. Busenitz of the University of Oklahoma. The study will be presented June 5 at the Babson College Entrepreneurship Research Conference in Boston and at the Brown International Advanced Research Institutes in Providence, R.I., on June 18.

The research was supported by North Carolina State University, The University of Oklahoma, and i2E – a non-profit corporation focused on wealth creation by growing the technology-based entrepreneurial economy in Oklahoma.

Media Contact

More Information:

http://www.ncsu.eduAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Bringing bio-inspired robots to life

Nebraska researcher Eric Markvicka gets NSF CAREER Award to pursue manufacture of novel materials for soft robotics and stretchable electronics. Engineers are increasingly eager to develop robots that mimic the…

Bella moths use poison to attract mates

Scientists are closer to finding out how. Pyrrolizidine alkaloids are as bitter and toxic as they are hard to pronounce. They’re produced by several different types of plants and are…

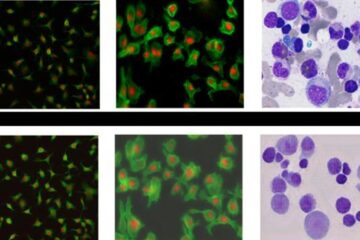

AI tool creates ‘synthetic’ images of cells

…for enhanced microscopy analysis. Observing individual cells through microscopes can reveal a range of important cell biological phenomena that frequently play a role in human diseases, but the process of…