KfW serves investors with a new 5 year USD global – Again strong demand from Asia

After its overwhelming 3- and 10-year transactions in January, KfW is the only issuer who has launched in all benchmark maturities so far, bringing its total funding under the USD programme to USD 11 billion year to date. For the remainder of the year, KfW envisages at least two more USD global issues under the programme.

For 2010 KfW had announced the need to raise a funding volume of EUR 70-75 billion. So far this year approximately EUR 20.8 billion (27.7%) have been raised in 14 different currencies. 62% of this amount were refinanced under the KfW Benchmark Programmes in EUR and USD, whereas the remaining 38% were funded through other public transactions (32%) and private placements (6%) respectively. “With its three USD global issues, KfW starts off on the right foot in the first two months. The strong international demand – 44% coming from Asia – for our USD globals and for our first-class rating is unbroken”, Dr. Günther Bräunig, member of the Managing Board of KfW Bankengruppe commented. “This transaction leaves the market in great shape for further KfW dollar issuance later this year”, added Bräunig.

The USD 3 billion issue matures on March 3rd 2015 with a coupon of 2.625% paid semi-annually. The reoffer price was set at 99.526%, corresponding to a yield pick-up of 40 basis points over the current US Treasury, maturing in January 2015. In line with all KfW bonds, this issue has an AAA/Aaa/AAA rating from Fitch Ratings, Moody's and Standard & Poor's. Lead manager of the transaction are Citi, Deutsche Bank and Royal Bank of Canada CM; Co-Lead Managers are Bank of America / Merrill Lynch, Barclays, BNP Paribas, DZ Bank, Goldman Sachs, HSBC, Mitsubishi UFG, Morgan Stanley, Nomura and Royal Bank of Scotland.

Books were opened on Tuesday New York morning and built quickly, reaching USD 1.5 billion in two hours. From the start there was continuous broad based demand from high quality investors out of the US-time zone. The final order book was well oversubscribed with 94 orders totalling over USD 4.4 billion and of extremely high quality.

The breakdown of the order book by sectors is as follows:

Breakdown by investor type:

Central Banks: 46%

Banks: 30%

Funds: 18%

Others: 6%

Geographical Breakdown:

Asia: 44%

Europe: 35%

Americas: 20%

Middle East: 1%

This press release is not an offer of securities for sale in the United States. Securities may not be offered or sold in the United States absent registration or an exemption from registration. KfW has registered the securities that are the subject of this press release for sale in the United States. The offering of the securities in the United States will be made by means of a prospectus that may be obtained from KfW and will contain detailed information about KfW and its management, financial statements and information about the Federal Republic of Germany.

Term Sheet KfW USD III/2010

USD 3 billion – 2.625% – 2010/2015

ISIN: US500769DR22

Issuer: KfW (Kreditanstalt für Wiederaufbau)

Guarantor: Federal Republic of Germany

Rating: AAA (Fitch Ratings)/Aaa (Moody's)/AAA (Standard & Poor's)

Size: USD 3,000,000,000.–

Maturity Date: March 3rd 2010 – March 3rd 2015

Coupon: 2.625% p.a., semi-annual coupon Payment Dates: March 03rd and September 03rd

Re-offer-Price: 99.526%

Yield: 2.727% semi-annually

Format: Global

Stock Market Listing: Luxembourg

Lead Managers (3):

Citi

Deutsche Bank

Royal Bank of Canada CM

Co-Lead Managers (10):

Bank of America / Merrill Lynch,

Barclays

BNP Paribas

DZ Bank

Goldman Sachs

HSBC

Mitsubishi UFG

Morgan Stanley

Nomura

Royal Bank of Scotland

Media Contact

More Information:

http://www.kfw.deAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Silicon Carbide Innovation Alliance to drive industrial-scale semiconductor work

Known for its ability to withstand extreme environments and high voltages, silicon carbide (SiC) is a semiconducting material made up of silicon and carbon atoms arranged into crystals that is…

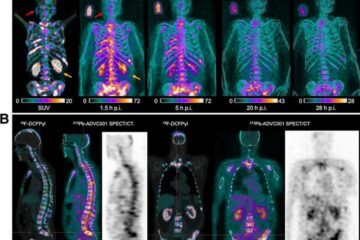

New SPECT/CT technique shows impressive biomarker identification

…offers increased access for prostate cancer patients. A novel SPECT/CT acquisition method can accurately detect radiopharmaceutical biodistribution in a convenient manner for prostate cancer patients, opening the door for more…

How 3D printers can give robots a soft touch

Soft skin coverings and touch sensors have emerged as a promising feature for robots that are both safer and more intuitive for human interaction, but they are expensive and difficult…