KfW funding activities defy volatile markets

In a strongly shifting market environment in the first half of

2012 KfW held its own in its funding activities. As of 30 June 2012 already about EUR 50.4 billion in funding for promotional business was raised on the international capital markets.

The first half of 2012 was marked by two quarters that could not have been more different. While the first three months were dominated mostly by a positive market sentiment, thereby allowing a noticeable easing on the part of financial market actors, the second quarter was strongly shaped by returning insecurity and high volatility. However, KfW was successful with its funding in both quarters. “We are very pleased with the development thus far in our funding activities. We have already raised nearly two thirds of our planned funding volume for the entire year on the international capital markets. This success confirms the unabated demand for bonds of first-class issuers such as KfW”, explained Dr Günther Bräunig, the member of the Executive Board of KfW Bankengruppe in charge of capital markets.

The KfW Benchmark programmes in EUR and USD constitute the most important pillar with a share of over 60% of total funding. This illustrates that investors continue to prefer large volume and, in particular, highly liquid bonds. Already in the first half of the year, KfW was able to successfully issue benchmark bonds in both EUR and USD in all benchmark maturities, especially in the long end of the curve. Of note here is that in particular Asian central banks are investing even more heavily than last year in KfW euro bonds.

In total KfW issued securities in more than 120 individual transactions year-to-date. International investors again made increasing use of the currency range offered by KfW. Until now KfW has issued bonds in 14 different currencies (1st half of 2011: 10 currencies), including for the first time a bond in Chinese renminbi on the Hong Kong financial market. In this way KfW has again expanded its product range and further diversified its funding overall. “With this RMB issue we have taken an important first step in a promising market. We are closely watching the development of the Chinese capital markets due to their globally increasing importance,” said Bräunig.

As a result of the regularly performed mid-year review of its annual funding requirements, KfW is maintaining its funding volume of EUR 80 billion for the year 2012 as a whole.

It has to be assumed that also in the second half of 2012 the sovereign debt crisis will remain a determining factor on the financial markets. KfW's funding strategy allows the bank to always react flexibly, even in highly diverse market situations. While in the current environment banks must fundamentally rearrange their capital-market based funding structure, KfW can continue to rely on its established refinancing mix based on the three pillars: benchmark programmes, public bonds and private placements. “In a shifting environment KfW thereby stands for continuity and stability,” explained Bräunig. “I am convinced that our investors value the product range and the reliability of KfW's capital market activities. Thus our solid funding contributes to the fulfilment of our promotional mission”.

Detailed figures on KfW's funding in the first half of 2012 are available under www.kfw.de/funding.

Pressekontakt:

KfW, Palmengartenstraße 5-9, 60325 Frankfurt Kommunikation (KOM), Nathalie Drücke, Tel. 069 7431-2098, Fax: 069 7431-3266,

E-Mail: nathalie.dreucke@kfw.de, Internet: www.kfw.de/newsroom

Media Contact

More Information:

http://www.kfw.deAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Silicon Carbide Innovation Alliance to drive industrial-scale semiconductor work

Known for its ability to withstand extreme environments and high voltages, silicon carbide (SiC) is a semiconducting material made up of silicon and carbon atoms arranged into crystals that is…

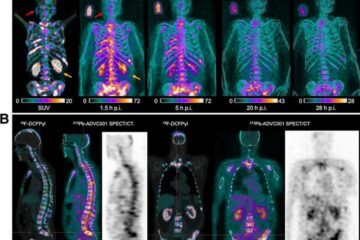

New SPECT/CT technique shows impressive biomarker identification

…offers increased access for prostate cancer patients. A novel SPECT/CT acquisition method can accurately detect radiopharmaceutical biodistribution in a convenient manner for prostate cancer patients, opening the door for more…

How 3D printers can give robots a soft touch

Soft skin coverings and touch sensors have emerged as a promising feature for robots that are both safer and more intuitive for human interaction, but they are expensive and difficult…