K-State economist's research on low-income homeowners

Programs that help low-income and minority individuals and families purchase a home may be doing more harm than good, according to a Kansas State University economist.

When vulnerable homeowners don't get support after they purchase a home — maybe one they really couldn't afford in the first place — they're more likely to return to renting, said Tracy Turner, K-State assistant professor of economics. She and Marc Smith, professor of finance and director for the Institute of Housing Studies at DePaul University, are publishing their research in a forthcoming issue of the Journal of Regional Science.

“Moving vulnerable renters into homeownership without post-purchase support wastes tax dollars as well as creates great hardships for these new homeowners who lose their homes,” Turner said. “Our research sheds light on homeowner sustainability and the need for post-purchase support for vulnerable households. It suggests that past homeownership policies are in part contributing to the current home foreclosure crisis.”

Turner and Smith studied how populations with low homeownership rates also leave homeownership at high rates, either through foreclosure or selling the home. From 1970 to 2005, they found that low-income homeowners were consistently more likely to exit homeownership than higher income households. Hispanic households had higher exit rates before 1997 but not after.

They also found that a gap between blacks and whites exiting homeownership arose after 1997. Turner said this could be because policies in the 1990s that encouraged minority homeownership were not sustainable in the long term.

“Policy initiatives made resources available to move renters into owning although they could not own without assistance, and these initiatives failed to provide post-homeownership counseling or support,” Turner said. “As a result, renters who became homeowners through relatively easy entry conditions could not sustain homeownership.”

Turner said their research is the first to find that the homeownership gap before 1997 is because fewer blacks were becoming homeowners in the first place, not because they were leaving homeownership at higher rates.

Because homeownership offers many benefits, Turner said it is important to understand why black, Hispanic and low-income households are less likely to own their housing. As renters, they are missing out on the benefits homeownership can provide.

“In order to design policies that will allow underrepresented groups to attain homeownership and remain homeowners, we need to understand why certain groups have lower homeownership rates to begin with,” she said.

An important area of future research, Turner said, would be to look at how much of the foreclosure crisis is attributed to these types of policies versus how much of it is because of liberalized lending standards, predatory lending and house-price declines.

Media Contact

More Information:

http://www.k-state.eduAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Silicon Carbide Innovation Alliance to drive industrial-scale semiconductor work

Known for its ability to withstand extreme environments and high voltages, silicon carbide (SiC) is a semiconducting material made up of silicon and carbon atoms arranged into crystals that is…

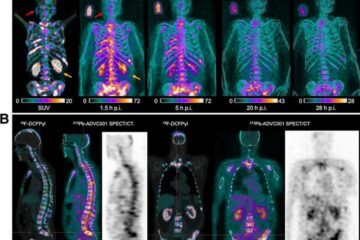

New SPECT/CT technique shows impressive biomarker identification

…offers increased access for prostate cancer patients. A novel SPECT/CT acquisition method can accurately detect radiopharmaceutical biodistribution in a convenient manner for prostate cancer patients, opening the door for more…

How 3D printers can give robots a soft touch

Soft skin coverings and touch sensors have emerged as a promising feature for robots that are both safer and more intuitive for human interaction, but they are expensive and difficult…