Half-time gamblers give stock market insight

Research published today, Thursday 7 October 2010, in New Journal of Physics (co-owned by the Institute of Physics and German Physical Society), details how researchers from Trinity College Dublin have analysed data and identified betting trends during the 2007-08 Champions' League Tournament.

Using a complete dataset from Betfair.com, drawn from bets made during every game of the Tournament, the researchers have identified changes in the market odds which reflect real-time match events. The market odds are seen to fluctuate in response to events occurring on the pitch such as goals scored.

However, comparing the behaviour of Betfair.com gamblers to traders on the stock market, the researchers were particularly interested to analyse the activity of gamblers during half-time.

Of interest, because, unlike any moment on the stock market, football gamblers are (more often than not) free of news from the game during half-time. Gamblers are left to their own devices which, the researchers suggest, is akin to identifying the complex interactions of stock market traders.

Stephen Hardiman from the School of Physics at Trinity College Dublin, says, “Such a clear elimination of external news influences would be difficult to achieve in the case of stock market prices or foreign exchange rates.”

The researchers show that even during half-time, market fluctuations persist and exhibit, what economists call, 'long-range volatility correlations'. They also find that there is more trading on outcomes which have small odds, suggesting gamblers are more inclined to trade bets on the favourite to win.

“One might assume that memory of a team's past glories, media speculation over the health of key players, or just an overwhelming desire to see your own team win could bias a gambler's judgment.

“Gambling markets and financial markets have much in common, but possess unique differences. What we learn from gamblers may provide insight into the equally complex world of finance.”

The researchers' paper can be downloaded for free from Thursday 7 October 2010 here: http://iopscience.iop.org/1367-2630/12/10/105001/fulltext as part of a Focus Issue on Statistical Physics Modelling in Economics and Finance.

The complete Focus Issue can be found here: http://iopscience.iop.org/1367-2630/focus/Focus%20on%20Statistical%20Physics%20Modelling%20in%20Economics%20and%20Finance

Media Contact

More Information:

http://www.iop.orgAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

High-energy-density aqueous battery based on halogen multi-electron transfer

Traditional non-aqueous lithium-ion batteries have a high energy density, but their safety is compromised due to the flammable organic electrolytes they utilize. Aqueous batteries use water as the solvent for…

First-ever combined heart pump and pig kidney transplant

…gives new hope to patient with terminal illness. Surgeons at NYU Langone Health performed the first-ever combined mechanical heart pump and gene-edited pig kidney transplant surgery in a 54-year-old woman…

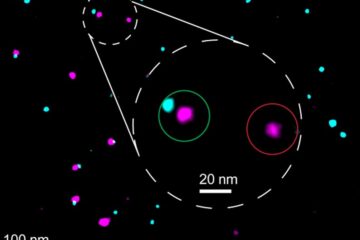

Biophysics: Testing how well biomarkers work

LMU researchers have developed a method to determine how reliably target proteins can be labeled using super-resolution fluorescence microscopy. Modern microscopy techniques make it possible to examine the inner workings…