The Great Crash of 2008: special issue of NIER explores evolution of the current financial crisis

THE GREAT CRASH OF 2008

AT A GLANCE . . .

The UK economy

•The economy will contract in the second half of 2008 and GDP will fall by 0.9 per cent in 2009, the first full-year recession since 1991.

•Consumer spending will decline by 3.4 per cent next year.

•The other main factor dragging the economy down next year is a big fall in housing and business investment.

•Public sector net borrowing will increase from 2.5 per cent of GDP in 2007–8 to 4.5 per cent this year and 5.3 per cent in 2009–10.

The British economy will suffer next year as it experiences the worst setback among the G7 countries. This reflects an especially pronounced reverse to consumer spending, which will fall by 3.4 per cent in 2009, easily the biggest decline among the G7. The economy will also be dragged down by the collapse in private housing investment, which will fall by 17.1 per cent, and lower business investment, which will decline by 3.8 per cent. A sizeable contribution from net trade (mainly reflecting lower imports) is not sufficient to stave off recession in 2009.

The forecast assumes a further half-point cut in interest rates in early 2009, reducing the Bank rate to 4.0 per cent. The Bank of England has more scope to cut rates now that consumer-price inflation has probably peaked, although it will still be above the 2 per cent target until the end of 2009. However, it takes time for rate cuts to stimulate activity in normal times. And in current conditions the effectiveness of monetary policy is limited by credit rationing by banks and falling demand for loans. Even a very big cut in the Bank rate would not be sufficient to avoid a recession in the UK.

The UK is especially vulnerable to the credit crisis because of imbalances that had developed in recent years. The current account balance worsened to 3.8 per cent of GDP in 2007. Household debt rose to 170 per cent of income by the end of 2007 and the household saving ratio fell to negligible levels. The sharp fall in consumer spending next year will occur as the saving ratio rises from 0.7 per cent of disposable income in 2008 to 4.4 per cent in 2009 at a time when real income growth remains paltry.

The outlook for the public finances is poor. Public sector net borrowing will rise to 4.5 per cent of GDP in 2008–9, and then climb further to 5.3 per cent next year and 6.1 per cent in 2010–11. Public sector net debt will rise to 50.5 per cent of GDP in 2008-9. The deterioration in public sector net borrowing reflects the impact of the recession, together with weaker receipts from the financial and property sectors.

The world economy

•Global growth will weaken from 4.0 per cent this year to 2.8 per cent in 2009, the slowest since 2002.

•National output will fall in the United States by 0.5 per cent in 2009, the first full-year decline since 1991 and the largest since 1982.

•The Euro Area and Japan will each grow by only 0.3 per cent next year.

•China will act as a growth counterpole as its economy slows only modestly, from 9.9 per cent this year to 8.6 per cent in 2009.

This autumn’s banking panic will take a severe toll on world growth especially in developed economies. GDP growth in the OECD group of mainly rich countries will slow to 0.4 per cent in 2009, the weakest since 1982. Among the G7, the American and British economies will contract next year and the best performer among the other five countries will be Canada, with GDP growth of just 0.5 per cent. The key downside risk is that the bailout packages may not succeed, in which case financial turmoil will persist and the recession will be deeper and more prolonged than we are forecasting.

The financial shock will pull down growth through three main channels. First, credit will become scarcer for both businesses and households. Second, firms and consumers have become more cautious, which will also make them cut back. Third, lower equity prices will reduce consumption and bear down on business investment by making it harder for companies to raise capital.

The crisis in the financial sector will thus spread out to the wider economy mainly by curbing consumer spending and private investment, both of which will fall next year in all the G7 economies except for Japan. Personal consumption will decline by 1.8 per cent in the US and by 0.5 per cent in the Euro Area. American business investment will decline by 3.3 per cent while housing investment will fall by 18.8 per cent, only a little less than this year. Private investment will contract by 5.5 per cent in the Euro Area.

The forecast incorporates the coordinated half-point cut in interest rates on 8 October by several central banks and assumes that the resulting rates are held until mid-2009, apart from a further half-point reduction in the UK at the turn of this year. If central banks were to deliver a further coordinated cut of 2.5 percentage points, this would raise annual output growth by a quarter of a percentage point over the next two years in the US and UK, and a little less in the Euro Area. The scope for alleviating the economic reverse through fiscal policy is relatively limited, but it may become the only effective tool available for economies like the US whose policy rates are already very low.

The causes of and lessons from the financial crisis are examined in six special articles in the Review. The main message is that while monetary policy should ‘lean against the wind’ when asset bubbles are developing, the crucial fault was a lack of macroprudential regulation, partly because of an institutional silo mentality. Central banks and the BIS had given warning about risks, but the remedies often lay with separate financial regulators, who did not respond adequately to these worries. Reforms will require those responsible to take a synoptic view of the financial system and should focus on higher capital requirements for banks. Those expanding their loan book rapidly should have to increase their capital ratios. Capital reserves should also be linked to reliance on wholesale funding markets. And complex new products should also require more capital. Regulators will have to remain vigilant to new developments as these changes to rules are ‘fighting the last war’.

Media Contact

All latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

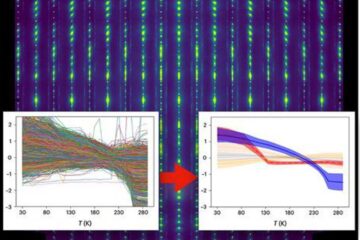

Machine learning algorithm reveals long-theorized glass phase in crystal

Scientists have found evidence of an elusive, glassy phase of matter that emerges when a crystal’s perfect internal pattern is disrupted. X-ray technology and machine learning converge to shed light…

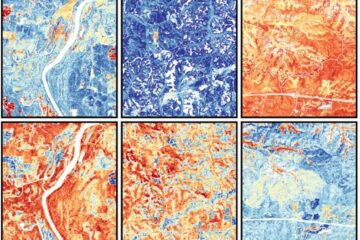

Mapping plant functional diversity from space

HKU ecologists revolutionize ecosystem monitoring with novel field-satellite integration. An international team of researchers, led by Professor Jin WU from the School of Biological Sciences at The University of Hong…

Inverters with constant full load capability

…enable an increase in the performance of electric drives. Overheating components significantly limit the performance of drivetrains in electric vehicles. Inverters in particular are subject to a high thermal load,…