Financial Restructuring in Fresh-start Chapter 11 Reorganizations

But are these firms really getting the “fresh start” they need? In a recent edition of Financial Management, researchers Randall Heron, Erik Lie, and Kimberly Rodgers argue that the Chapter 11 process is flawed and fails to offer the clean slate needed to establish new capital structure.

Their article, “Financial restructuring in fresh-start Chapter 11 reorganizations”, looks at the debt ratio of 172 firms emerging from Chapter 11 “fresh start” accounting rules. Using a range of variables, they analyze how differing firm characteristics and the reorganization process affect capital structures.

Although a company's debt burden is substantially reduced by reorganizing, they found, the firm still winds up with higher debt ratios than industry norms. Debt is sticky — in fact, a firm's long-term debt ratio is particularly high after Chapter 11. The median total at the end of the first year a firm emerges is 0.392 as compared to an industry norm of 0.283. In two years, the median debt ratio declined to 0.362, compared to an industry norm of 0.272.

Total debt is also substantially higher – due, in part, to inefficiencies in the Chapter 11 process which block firms from discarding old capital structures in favor of a fresh start. Even in organizations where at least 50 % of equity ownership is transferred to creditors, holdout problems plague emerging capital structure. Creditors are reluctant to trade senior claims for equity, seeing them as a way to force liquidation should the firm's profitability lag.

A key factor in the speed of emergence appears tied to the circumstances leading up to the bankruptcy. Those firms struggling with financial difficulty — not economic distress — spent less time in Chapter 11. “The data suggest that firms that fit this profile are able to emerge more quickly perhaps because they have fewer, more concentrated creditor classes, and/or because they were simply over-levered, but still clearly economically viable,” the article states.

Finally, the data pokes holes in claims about so-called pro-debtor vs. pro-creditor bankruptcy courts by examining filings in the District of Delaware and the Southern District of New York. “There is no support for the notion that post-emergence debt ratios for firms that reorganize under the supervision of Delaware courts are abnormally high,” the study concludes.

This study is published in the Winter 2009 issue of Financial Management. Media wishing to receive a PDF of this article may contact scholarlynews@wiley.com.

Media Contact

More Information:

http://www.wiley.comAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Superradiant atoms could push the boundaries of how precisely time can be measured

Superradiant atoms can help us measure time more precisely than ever. In a new study, researchers from the University of Copenhagen present a new method for measuring the time interval,…

Ion thermoelectric conversion devices for near room temperature

The electrode sheet of the thermoelectric device consists of ionic hydrogel, which is sandwiched between the electrodes to form, and the Prussian blue on the electrode undergoes a redox reaction…

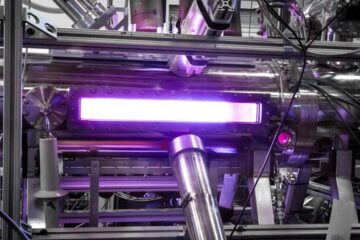

Zap Energy achieves 37-million-degree temperatures in a compact device

New publication reports record electron temperatures for a small-scale, sheared-flow-stabilized Z-pinch fusion device. In the nine decades since humans first produced fusion reactions, only a few fusion technologies have demonstrated…