Financial experts may not always be so expert new Notre Dame study reveals

Bodnaruk and Simonov studied 84 mutual-fund managers in Sweden to determine how well they manage their own finances.

“We asked the question whether financial experts make better investment decisions than ordinary investors,” Bodnaruk said.

“We identified a group of investors who have an extensive knowledge of finance attained through prior training and day-to-day experience with financial markets, namely mutual fund managers, and compared private investment decisions by these financial experts to those made by individual investors who are similar to them along a number of socio-economic characteristics, but presumably lack financial expertise.”

Bodnaruk noted that he and Simonov did not investigate the performance of the mutual funds managed by these managers, but instead looked at the manager's own personal portfolios.

“We found that financial experts are no different from peer investors: they do not have ability to pick outperforming stocks, they do not manage risk of their portfolios in better ways, and they trade as often as other investors,” Bodmaruk said. “The only time experts do better than non-experts is when they have access to better information stemming from their workplace.”

The study implies that for an average investor, particularly for wealthy, educated investors, paying for financial advice or investing in actively managed mutual funds is not worth it.

“Most experts will not help you improve your performance beyond what could be achieved by investing in passive indexes,” Bodnaruk said.

However, don't be too hard on professed mutual-fund managers. The researchers point out that theirs is not an easy task.

“Outperforming the stock market is very difficult and the overwhelming majority of investors, including experts, do not have the skill to do it,” Bodnaruk said. “Markets by and large are efficient to the degree that very few investors can consistently perform better than a fair reward for the risk assumed. Given this, investors should not chase expert talent, but instead focus on passive strategies which help minimize trading costs.”

The study appears in the Journal of Financial Intermediation.

Media Contact

More Information:

http://www.nd.edu/All latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Superradiant atoms could push the boundaries of how precisely time can be measured

Superradiant atoms can help us measure time more precisely than ever. In a new study, researchers from the University of Copenhagen present a new method for measuring the time interval,…

Ion thermoelectric conversion devices for near room temperature

The electrode sheet of the thermoelectric device consists of ionic hydrogel, which is sandwiched between the electrodes to form, and the Prussian blue on the electrode undergoes a redox reaction…

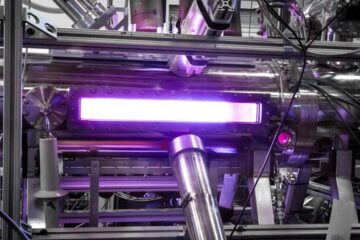

Zap Energy achieves 37-million-degree temperatures in a compact device

New publication reports record electron temperatures for a small-scale, sheared-flow-stabilized Z-pinch fusion device. In the nine decades since humans first produced fusion reactions, only a few fusion technologies have demonstrated…