Economist Recommends Regulation Changes to Financial Sector

A professor at UNH’s Whittemore School of Business and Economics, Goldberg presented his analysis and recommendations at the “Emerging from the Financial Crisis” conference sponsored by the Center on Capitalism and Society at Columbia University Friday, Feb. 20, 2009, with Roman Frydman, professor of economics at New York University. Goldberg and Frydman are the authors of “Imperfect Knowledge Economics: Exchange Rates and Risk.”

Goldberg and Frydman’s analysis and recommendations on regulating the financial sector are based on their ground-breaking research and development of the Imperfect Knowledge Economics (IKE) model that asserts that exact models of purposeful human behavior are beyond the reach of economic analysis. Goldberg and Frydman argue that the longstanding empirical failures of conventional economic models stem from their futile efforts to make exact predictions about the consequences of rational, self-interested behavior. Such predictions disregard the importance of individual creativity and unforeseeable sociopolitical change, thus usually failing to predict how markets behave.

The economists presented their analysis and recommendations at an economic conference that featured some of the world’s most distinguished economists and business experts, including Paul Volcker, chair of the President's Economic Recovery Advisory Board and former chairman of the Federal Reserve Bank; George Soros, chairman of the Soros Fund Management and founder of Open Society; and Lucas Papademos, vice president of the European Central Bank.

According to the economists, in the current financial crisis, market intervention should go beyond aiming for transparency. Officials should attempt to dampen excessive swings — price movements in the aggregate that are either too high or too low.

“Excessive swings in aggregate prices are often followed by sharp reversals that have substantial systemic consequences for the functioning of the financial system and the economy as a whole,” Goldberg and Frydman say.

“History teaches us that the more excessive a price swing becomes, the sharper and more costly is the eventual reversal. But if official policy or regulatory measures could engender a reversal sooner, the social cost would be lower. Such swing-dampening intervention would not only benefit the society as a whole; it would also help markets to function better in allocating scarce capital across sectors,” they say.

The economists recommend the development and promotion of a guidance range of non-excessive values in financial markets. This range would lead bulls to moderate their positions and bears to strengthen theirs if prices were above the official range, and vice versa if prices were below it.

A guidance range would have been particularly effective in thwarting the crisis in the housing market, the researchers note.

“There is little doubt that if the government had announced on a regular basis a range of non-excessive values in key regions of the country, many participants would have re-thought their decisions about whether to buy or how much to bid. This, in turn, would have dampened the excessive increase in housing values,” Goldberg and Frydman say.

Regarding the regulation of banks and financial institutions, the researchers note that measures taken to date overlook the importance of imperfect knowledge and asset price swings for assessing risks in the financial system and for reforming the credit rating system.

“To be sure, the immediate concern is returning the banking and credit system to health in the short term, which may even involve temporary nationalization of banks. But rethinking the regulatory framework for the long term needs to begin by acknowledging that market participants – including financial institutions – and regulators alike have only imperfect knowledge of the fundamental processes that drive asset values, risk, and the broader economy,” Goldberg and Frydman say.

The economists recommend that ratings agencies be required to report at least two ratings of securities, along with the methodology used to arrive at each: one assuming that historical patterns will continue, and at least one other assuming reversals in the trends of major variables and the prices of the underlying assets.

“No single individual or institution can render a definitive judgment on the riskiness of securities. Friedrich Hayek showed that only markets can aggregate knowledge that is not given to anyone in its totality. The new regulatory regime should require rating agencies and issuers of securities have to help markets perform this function,” according to Goldberg and Frydman.

Goldberg’s complete analysis and recommendations are available at http://www.unh.edu/news/docs/022009goldberg.pdf.

The University of New Hampshire, founded in 1866, is a world-class public research university with the feel of a New England liberal arts college. A land, sea and space-grant university, UNH is the state’s flagship public institution, enrolling 11,800 undergraduate and 2,400 graduate students.

Media Contact

More Information:

http://www.unh.eduAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Properties of new materials for microchips

… can now be measured well. Reseachers of Delft University of Technology demonstrated measuring performance properties of ultrathin silicon membranes. Making ever smaller and more powerful chips requires new ultrathin…

Floating solar’s potential

… to support sustainable development by addressing climate, water, and energy goals holistically. A new study published this week in Nature Energy raises the potential for floating solar photovoltaics (FPV)…

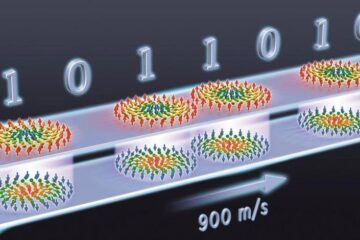

Skyrmions move at record speeds

… a step towards the computing of the future. An international research team led by scientists from the CNRS1 has discovered that the magnetic nanobubbles2 known as skyrmions can be…