Debt-Ceiling Battles Have Little Effect on Financial Market

However, a University of Arkansas finance study suggests that financial markets increasingly regard such controversies as political posturing rather than serious threats to the economy and therefore the conflicts have not recently caused higher default-risk premiums in the long-term.

Findings from the study, which was published in the Journal of Banking and Finance, were recently cited by the New York Times, Washington Post, and a report to Congress by the U.S. General Accountability Office.

“Markets appear to shrug off these recurring controversies because investors believe that eventually policymakers will settle the disputes and avoid default,” said Pu Liu, finance professor in the Sam M. Walton College of Business. “Rational investors take these political controversies into account in pricing Treasury securities, but they tend to disregard them because they know the controversies will be settled before there is any real effect on the economy.”

Prior to the 1995-1996 debt-ceiling controversy between the White House and Congress, Treasury securities had been considered immune from default risk, based on the assumption that the federal government could repay its debt by imposing additional taxes or printing money. That assumption was smashed, however, when the financial market imposed a default-risk premium on Treasury securities as a result of that controversy. Since that time, the federal government has experienced four other similar debt-ceiling controversies, including the one settled in early August.

Default-risk premiums add interest on debt owed, which would significantly weaken an already struggling U.S. economy. For example, with a debt of $10 trillion, which the United States reached in September 2008, each additional basis point in the risk premium translates into $1 billion in additional annual interest expense to the Treasury. Congress can avoid this risk and the additional expense by raising the debt limit in a timely manner.

Liu and colleagues Yinging Shao, a graduate of the doctoral program in finance, and Tim Yeager, finance professor, examined responses of the financial market to four post-1996 debt-ceiling controversies. The researchers analyzed the responses by calculating the difference in yield between high-quality financial commercial paper and Treasury bills from Nov. 14, 2001, to June 16, 2006. The first date was three months before the debt-ceiling controversy of 2002, and the second date was three months after the resolution of the 2006 crisis, which had been the most recent until this year’s controversy.

Liu and colleagues found that the risk premium on Treasury securities, which disappeared after the 1995-1996 incident, resurfaced for the next two debt-ceiling controversies. But for these two incidents, the financial market charged only a small default-risk premium to Treasury securities. The researchers found no significant evidence of risk premiums in the last two occurrences.

“These findings show that the debt-ceiling controversies have had only small and temporary impact on the federal budget,” Liu said. “The repeated political stalemates have had few real economic consequences.”

Liu is chair of the finance department in the Walton College. He also holds the Harold Dulan Chair in Capital Formation and the Robert E. Kennedy Chair in Finance. Yeager is holder of the Arkansas Bankers Association Chair in Banking.

CONTACTS:

Pu Liu, professor and chair; department of finance

Sam M. Walton College of Business

479-575-6095, pliu@walton.uark.edu

Matt McGowan, science and research communications officer

University Relations

479-575-4246, dmcgowa@uark.edu

Media Contact

More Information:

http://www.uark.eduAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

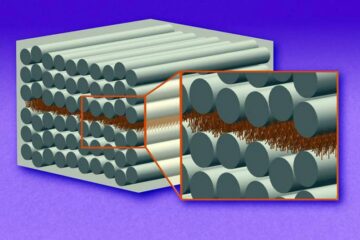

“Nanostitches” enable lighter and tougher composite materials

In research that may lead to next-generation airplanes and spacecraft, MIT engineers used carbon nanotubes to prevent cracking in multilayered composites. To save on fuel and reduce aircraft emissions, engineers…

Trash to treasure

Researchers turn metal waste into catalyst for hydrogen. Scientists have found a way to transform metal waste into a highly efficient catalyst to make hydrogen from water, a discovery that…

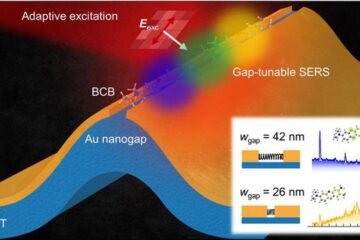

Real-time detection of infectious disease viruses

… by searching for molecular fingerprinting. A research team consisting of Professor Kyoung-Duck Park and Taeyoung Moon and Huitae Joo, PhD candidates, from the Department of Physics at Pohang University…