Corporate coworking as a driver of innovation

© Fraunhofer IAO Coworking – Awareness of the term and practical experiences

Three years ago, the Fraunhofer Institute for Industrial Engineering IAO released “The Fascination of Coworking – Potentials for Companies and their Employees.”

This study explored in depth the topic of coworking and its potential significance for companies. The recently published “Coworking – Driver of Innovation for Companies” expands on the 2014 document by examining to what extent coworking can effectively foster a company’s innovative capacity.

The study’s authors do not regard corporate coworking as a one-size-fits-all solution. They instead distinguish between nine different organizational models of coworking. Klaus-Peter Stiefel, one of the authors, has this to say: “We can think of many different versions of corporate coworking, with different layouts at very different companies. One company might rent workstations in coworking spaces, for example. Another business will try to set up its own coworking space. It’s even conceivable to schedule a coworking project at a vacation destination, though that would admittedly be a bold decision.”

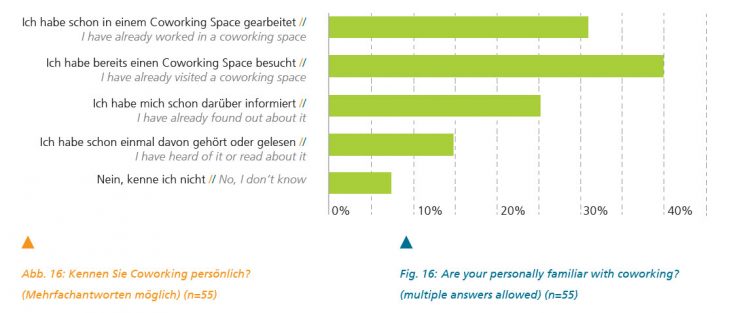

An online survey asked companies to assess nine models. Where are the opportunities? And which models present which risks? Which coworking models are already reality? Can survey respondents imagine implementing coworking models at their companies?

The data indicates that most companies surveyed believe they can leverage corporate coworking to achieve a diverse array of strategic competitive edges. On the whole, survey respondents feel that the opportunities considerably outweigh the risks. Since each coworking model offers a unique mixture of opportunities and risks, the new IAO study supplies an initial basis to help decision-makers select an appropriate model.

As Stiefel says: “Corporate coworking provides a blueprint for many companies, especially those looking to boost their innovative strength.”

The “Coworking – Driver of Innovation for Companies” study is a product of the Office 21®joint research project. This joint research project aims to identify current and future developments as quickly as possible. The project team also strives to define specific courses of action for designing and implementing new work environments that will succeed in the business world. Please click on the following link to access the “Coworking – Driver of Innovation for Companies” study.

Contact:

Klaus-Peter Stiefel

Information Work Innovation

Fraunhofer IAO

Nobelstraße 12

70569 Stuttgart

Phone +49 711 970-5474

E-Mail: klaus-peter.stiefel@iao.fraunhofer.de

https://www.iao.fraunhofer.de/lang-en/press-and-media/latest-news/1369-corporate…

https://www.office21.de/Office21/

Media Contact

All latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Superradiant atoms could push the boundaries of how precisely time can be measured

Superradiant atoms can help us measure time more precisely than ever. In a new study, researchers from the University of Copenhagen present a new method for measuring the time interval,…

Ion thermoelectric conversion devices for near room temperature

The electrode sheet of the thermoelectric device consists of ionic hydrogel, which is sandwiched between the electrodes to form, and the Prussian blue on the electrode undergoes a redox reaction…

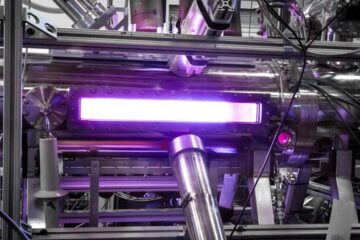

Zap Energy achieves 37-million-degree temperatures in a compact device

New publication reports record electron temperatures for a small-scale, sheared-flow-stabilized Z-pinch fusion device. In the nine decades since humans first produced fusion reactions, only a few fusion technologies have demonstrated…