Demographics not key to adoption of banking technology

When it comes to people’s desire to use ATMs and online banking, it’s not just the young, educated, and affluent who are interested.

That’s the finding of a new study at Ohio State University that examined the role that factors such as age, income, and education level play in people’s adoption of electronic banking technology.

While conventional wisdom suggests that young, affluent, and highly educated people are more apt to try new technology, the study found that these groups use electronic banking more often only because banks market the technology to them.

“Banks are driving the demographics of their customers with their own targeted marketing campaigns,” said Jinkook Lee, professor of consumer and textile sciences at Ohio State University, and lead author of the study. “We found that once people were introduced to a banking service, what really mattered was their personal attitude about the technology, regardless of their age, income, or education.”

People who believed that banking technology was useful, reliable, secure, and easy to use were more likely to try it, regardless of background, she explained.

The study, which was based on data from the 1999 Survey of Consumers collected by the University of Michigan Institute of Social and Political Research, appears in the current issue of the Journal of Consumer Affairs.

Lee was inspired to begin the study around the time the 1999 survey was taken — a time when the dot-com “bubble” caused rapid growth in online banking and investing, and researchers were predicting that the United States was quickly evolving into a paperless society.

“The reality turned out to be quite different. People were not so easy to sell on certain Internet technology, even when it was convenient,” Lee said.

The researchers focused on the opinions of approximately 900 of the survey’s telephone respondents, all of whom had accounts with a bank, thrift institution, or credit union.

They found that almost everyone had access to ATM machines, and two-thirds used the technology. In contrast, only two-thirds of respondents had access to online banking, and of those, less than one-quarter used it.

People’s belief in the security of electronic banking was key to their willingness to try it, the researchers found. An opportunity to try the technology firsthand also boosted people’s adoption of it.

The need for human interaction played a role. Even people who use ATMs and computer banking for shopping and making payments tend to deposit checks in person. By handing the check to a human teller at the bank, people feel they’ve attained an extra level of security beyond depositing an envelope into an ATM.

“I do that too,” Lee said, laughing. “Many people do. It’s a persistent trend.”

Banks save money when customers use ATMs and computer banking, so the federal government is trying to encourage the use of these technologies. But banks have also been trying to save money on their marketing efforts by offering these services only to young, affluent, educated people.

One possible strategy for banks to increase the use of online banking would be to market to “early adopters” — people who like to try new products and services — regardless of demographic. The early adopters would then influence others, Lee said.

“Not everyone young and affluent is interested in banking technology,” she pointed out. “People who are interested in new innovative things, such as computer technology or fashion, are not automatically interested in other innovations, such as new banking technology.”

The Federal Reserve Board commissioned the study, and the U.S. Department of Agriculture funded the study.

Next, the researchers want to examine people’s attitudes about electronic technologies for other financial products, such as insurance and investments.

Jinkook Lee’s coauthors on the Journal of Consumer Affairs paper included Eun-Ju Lee of California State University and David Eastwood of University of Tennessee.

Contact: Jinkook Lee, (614) 247-7892; Lee.42@osu.edu

Written by Pam Frost Gorder, (614) 292-9475; Gorder.1@osu.edu

Media Contact

More Information:

http://researchnews.osu.edu/archive/ebank.htmAll latest news from the category: Communications Media

Engineering and research-driven innovations in the field of communications are addressed here, in addition to business developments in the field of media-wide communications.

innovations-report offers informative reports and articles related to interactive media, media management, digital television, E-business, online advertising and information and communications technologies.

Newest articles

Combatting disruptive ‘noise’ in quantum communication

In a significant milestone for quantum communication technology, an experiment has demonstrated how networks can be leveraged to combat disruptive ‘noise’ in quantum communications. The international effort led by researchers…

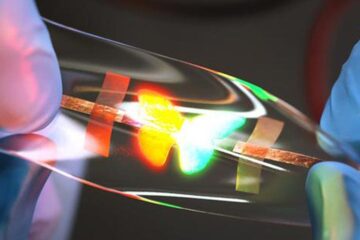

Stretchable quantum dot display

Intrinsically stretchable quantum dot-based light-emitting diodes achieved record-breaking performance. A team of South Korean scientists led by Professor KIM Dae-Hyeong of the Center for Nanoparticle Research within the Institute for…

Internet can achieve quantum speed with light saved as sound

Researchers at the University of Copenhagen’s Niels Bohr Institute have developed a new way to create quantum memory: A small drum can store data sent with light in its sonic…