US tax breaks subsidize foreign oil production

The research demonstrates that the federal government provided substantially larger subsidies to fossil fuels than to renewables. Fossil fuels benefited from approximately $72 billion over the seven-year period, while subsidies for renewable fuels totaled only $29 billion.

More than half the subsidies for renewables—$16.8 billion—are attributable to corn-based ethanol, the climate effects of which are hotly disputed. Of the fossil fuel subsidies, $70.2 billion went to traditional sources—such as coal and oil—and $2.3 billion went to carbon capture and storage, which is designed to reduce greenhouse gas emissions from coal-fired power plants. Thus, energy subsidies highly favored energy sources that emit high levels of greenhouse gases over sources that would decrease our climate footprint.

The U.S. energy market is shaped by a number of national and state policies that encourage the use of traditional energy sources. These policies range from royalty relief to the provision of tax incentives, direct payments, and other forms of support to the non-renewable energy industry. “The combination of subsidies—or 'perverse incentives'— to develop fossil fuel energy sources, and a lack of sufficient incentives to develop renewable energy and promote energy efficiency, distorts energy policy in ways that have helped cause, and continue to exacerbate, our climate change problem,” notes ELI Senior Attorney John Pendergrass. “With climate change and energy legislation pending on Capitol Hill, our research suggests that more attention needs to be given to the existing perverse incentives for 'dirty' fuels in the U.S. Tax Code.”

The subsidies examined fall roughly into two categories: (1) foregone revenues (changes to the tax code to reduce the tax liabilities of particular entities), mostly in the form of tax breaks, and including reported lost government take from offshore leasing of oil and gas fields; and (2) direct spending, in the form of expenditures on research and development and other programs. Subsidies attributed to the Foreign Tax Credit totaled $15.3 billion, with those for the next-largest fossil fuel subsidy, the Credit for Production of Nonconventional Fuels, totaling $14.1 billion. The Foreign Tax Credit applies to the overseas production of oil through an obscure provision of the U.S. Tax Code, which allows energy companies to claim a tax credit for payments that would normally receive less-beneficial treatment under the tax code.

ELI researchers applied the conventional definitions of fossil fuels and renewable energy. Fossil fuels include petroleum and its byproducts, natural gas, and coal products, while renewable fuels include wind, solar, biofuels and biomass, hydropower, and geothermal energy production. A graphic chart that will be released on Friday presents general conclusions about the overall subsidies for fossil fuels versus renewables other than corn-derived ethanol. Nuclear energy, which also falls outside the operating definition of fossil and renewable fuels, was not included.

The Environmental Law Institute® is an independent, non-profit research and educational organization based in Washington, DC. The Institute serves the environmental profession in business, government, the private bar, public interest organizations, academia, and the press. We deliver insightful and impartial analysis to opinion makers, including government officials, environmental and business leaders, academics, members of the environmental bar, and journalists. ELI is a clearinghouse and a town hall, providing common ground for debate on important environmental issues. For further information from the Environmental Law Institute, please contact Brett Kitchen at (202) 939-3833.

The Woodrow Wilson International Center for Scholars is the living, national memorial to President Wilson established by Congress in 1968 and headquartered in Washington, D.C. It is a nonpartisan institution, supported by public and private funds, engaged in the study of national and world affairs. The Wilson Center establishes and maintains a neutral forum for free, open, and informed dialogue. The Center commemorates the ideals and concerns of Woodrow Wilson by: providing a link between the world of ideas and the world of policy; and fostering research, study, discussion, and collaboration among a full spectrum of individuals concerned with policy and scholarship in national and world affairs.

Media Contact

More Information:

http://www.nanotechproject.orgAll latest news from the category: Studies and Analyses

innovations-report maintains a wealth of in-depth studies and analyses from a variety of subject areas including business and finance, medicine and pharmacology, ecology and the environment, energy, communications and media, transportation, work, family and leisure.

Newest articles

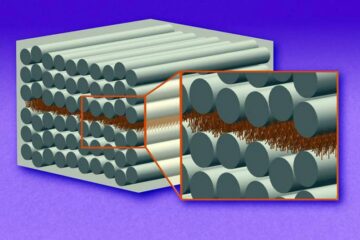

“Nanostitches” enable lighter and tougher composite materials

In research that may lead to next-generation airplanes and spacecraft, MIT engineers used carbon nanotubes to prevent cracking in multilayered composites. To save on fuel and reduce aircraft emissions, engineers…

Trash to treasure

Researchers turn metal waste into catalyst for hydrogen. Scientists have found a way to transform metal waste into a highly efficient catalyst to make hydrogen from water, a discovery that…

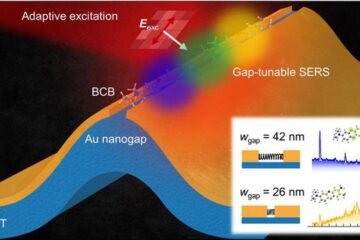

Real-time detection of infectious disease viruses

… by searching for molecular fingerprinting. A research team consisting of Professor Kyoung-Duck Park and Taeyoung Moon and Huitae Joo, PhD candidates, from the Department of Physics at Pohang University…