Risk Management Critical to Corporate Strategy

In the “MIT Roundtable on Corporate Risk Management” that appears in the Fall 2008 issue of Morgan Stanley’s Journal of Applied Corporate Finance, a distinguished group of academics and practitioners assess how risk management affects corporate growth and value.

For many companies, effective corporate risk management begins with an equity cushion in the capital structure. This helps to avoid raising prohibitively expensive capital following an adverse event. Excessive leverage contributed to the problems of many banks, leading to the current industry-wide de-leveraging.

Andrew Lo, Professor of Finance at the MIT Sloan School of Management and director of MIT’s Laboratory for Financial Engineering, contends that too often what passes for risk management at many financial companies is really risk measurement. This offers little prescriptive advice on how to actually manage the risks, as opposed to corporate governance structures for actively and effectively managing risks. In addition, some of the current problems can be attributed to the failure of risk managers and their models to account for highly improbable events.

A paradox of risk-reducing financial innovation is that it tends to encourage market participants to increase risk-taking in other ways. Robert Merton of Harvard Business School and Nobel laureate in economics points out that the challenge from a regulatory standpoint is to find the right balance between these two offsetting forces.

“Moving forward, we need more financial engineers, not fewer – risk and innovation, including derivatives, are not going away, and we need senior managements, boards, and regulators of financial institutions who understand them,” Merton notes.

This study is published in the Journal of Applied Corporate Finance. Media wishing to receive a PDF of this article may contact journalnews@bos.blackwellpublishing.net.

Don Chew, Editor of the Journal of Applied Corporate Finance, can be reached for questions at don.chew@morganstanley.com.

Published since 1988 and reaching a broad audience of senior corporate policy makers, this highly regarded quarterly brings together academic thinkers and financial practitioners to address topics driving corporate value. The Journal covers a range of topics, including risk management, corporate strategy, corporate governance and capital structure. The Journal also features its popular roundtable discussions among corporate executives and academics, on topics such as integrity in financial reporting.

Media Contact

All latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Properties of new materials for microchips

… can now be measured well. Reseachers of Delft University of Technology demonstrated measuring performance properties of ultrathin silicon membranes. Making ever smaller and more powerful chips requires new ultrathin…

Floating solar’s potential

… to support sustainable development by addressing climate, water, and energy goals holistically. A new study published this week in Nature Energy raises the potential for floating solar photovoltaics (FPV)…

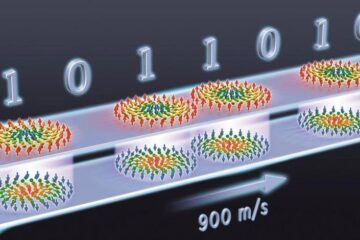

Skyrmions move at record speeds

… a step towards the computing of the future. An international research team led by scientists from the CNRS1 has discovered that the magnetic nanobubbles2 known as skyrmions can be…