Debt Stress Drops for Third Straight Month, Survey Finds

The Consumer Debt Stress Index (DSI) fell about two points in October, to 130.1 from 132.8 in September. The DSI has fallen for three straight months now, the first three-month drop in more than a year. It is now at the lowest point since March 2009.

“The first hints of favorable economic news have undoubtedly relieved consumers’ concerns about their debts to some extent,” said Lucia Dunn, professor of economics at Ohio State University, and one of the leaders of the study.

“However, the DSI is still high by historic standards, and that could cause consumers to tighten their purse strings in coming months.”

Dunn said the November DSI will be crucial in predicting how much consumers are willing to spend in the important holiday shopping season.

The DSI is conducted by Ohio State’s Center for Human Resource Research and is based on telephone interviews of randomly selected Americans. Each month’s index score is based on the past three months of interviews, with the average sample size being 658.

The DSI has been conducted monthly since January 2006, where its base value was set at 100.

The index fell into the 90s through most of 2006 and the first half of 2007 as the economy boomed, indicating that consumers felt comfortable with their debt levels. After the collapse of the subprime mortgage market, the index began a sharp turnaround, reaching a peak of 155.3 in July – the highest it has been since the inception of the current index. Since then, the index has started dropping.

Positive signs in the economy seem to be encouraging women more than men. Although women tend to have higher levels of debt stress than men, their stress levels have been dropping faster than those of men, Dunn said.

In October, women’s stress index was at 136, down from 143.6 the previous month. Debt stress levels for men, on the other hand, were roughly the same in both months: 122.9 in October, compared to 120.7 in September.

The negative impact of debt on family life, job performance and health also lessened for many Americans in October, the index revealed:

— 24.3 percent of respondents in October said debt caused a medium to extreme problem on their family life, down from 30.3 percent in September.

— 12.2 percent of respondents in October said debt caused a medium to extreme problem in their job performance, down from 16.2 percent in September.

— 21.9 percent of respondents in October said debt had a negative impact on their health, down from 25.7 percent in September.

“While the drop in debt stress has been encouraging the past three months, we don’t know yet if the good news will be enough to save the holiday shopping season,” Dunn said. “We should know more when we get the results in November.”

Contact: Lucia Dunn, (614) 292-8071; Dunn.4@osu.edu

Media Contact

More Information:

http://www.osu.eduAll latest news from the category: Studies and Analyses

innovations-report maintains a wealth of in-depth studies and analyses from a variety of subject areas including business and finance, medicine and pharmacology, ecology and the environment, energy, communications and media, transportation, work, family and leisure.

Newest articles

Properties of new materials for microchips

… can now be measured well. Reseachers of Delft University of Technology demonstrated measuring performance properties of ultrathin silicon membranes. Making ever smaller and more powerful chips requires new ultrathin…

Floating solar’s potential

… to support sustainable development by addressing climate, water, and energy goals holistically. A new study published this week in Nature Energy raises the potential for floating solar photovoltaics (FPV)…

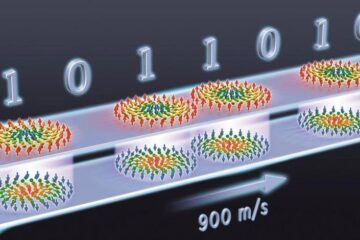

Skyrmions move at record speeds

… a step towards the computing of the future. An international research team led by scientists from the CNRS1 has discovered that the magnetic nanobubbles2 known as skyrmions can be…