Microcredit in Burkina Faso: a culture shock

The specificity of this mutual credit system is that the material guarantees (savings, mortgage, etc) required in the conventional banking system are replaced by mutual guarantees from people who choose to set up a group. However, this period of crisis caused by events outside Mossi society has demonstrated the weak spot in the system: once repayment becomes a problem, solidarity no longer works.

Repayment rates – the sums actually repaid divided by the theoretical amount – fall to 50 or even 30%. What lies behind this? The usual reasons quoted are local market imperfections, for instance lack of access to inputs, but according to Jacques Marzin, economist and Head of the CIRAD “Policies and Markets” Research Unit, the reality lies elsewhere: he suggests that falling repayment rates are in fact due to the contradiction between how the workers employed by the system and borrowers see credit. His study was conducted in a village on the Mossi central plateau.

Jacques Marzin and Moussa Tassembedo, from the Lessokon microfinance organization, surveyed various social groups in Gandaogo village. They based their work on three years of accounts from roughly thirty concessions, representing 90 households or 150 people. They listened to village elders, but also to younger men and women who had benefited from loans.

In Mossi society, loans are intended to prevent social disparity within the community by transferring surplus cash from one family to another with a cash shortage. Western-style bank loans, on the other hand, allow for individual accumulation of capital or immediate consumption. Thus whereas credit is seen as a factor for social cohesion, loans are being granted that enable people to become independent. This results in a divergence of views concerning the system.

Moreover, according to the principles of mutual guarantees, when one person can no longer repay his or her loan, the group takes over repayment. However, in the event of problems beyond the group's control, such as drought, numerous individuals and families are inevitably in difficulty and groups tend to expect the credit system to lighten the repayment burden. The system, on the other hand, often fails to get the message and maintains its usual debt recovery requirements. It is this that leads to disputes. Groups generally react immediately and all their members stop repaying their loans. This “inverted mutual guarantee pressure” leads to a drop in repayment rates.

In Africa, social cohesion is much more important for the Mossi than personal enrichment. Unless it really allows for this, microfinance will not be enough to alleviate poverty. To make the two visions compatible, a share of the interest has to be used as a social “buffer”. It may be held in structures such as associations – even informal ones – or mutual guarantee groups. For instance, if the interest on loans is 12%, 10% could go direct to the banking system and the remaining 2% into the village coffers for use in an emergency. This respects the community spirit. Within villages, it is also important to encourage debates aimed at striking new social balances between social cohesion and individual dynamism. In this case, yet again, it is the community that prevails.

Media Contact

More Information:

http://www.cirad.fr/en/actualite/communique.php?id=622All latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

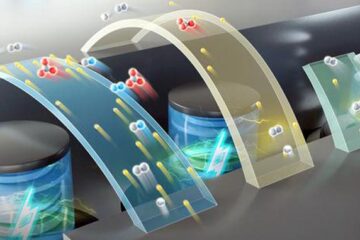

High-energy-density aqueous battery based on halogen multi-electron transfer

Traditional non-aqueous lithium-ion batteries have a high energy density, but their safety is compromised due to the flammable organic electrolytes they utilize. Aqueous batteries use water as the solvent for…

First-ever combined heart pump and pig kidney transplant

…gives new hope to patient with terminal illness. Surgeons at NYU Langone Health performed the first-ever combined mechanical heart pump and gene-edited pig kidney transplant surgery in a 54-year-old woman…

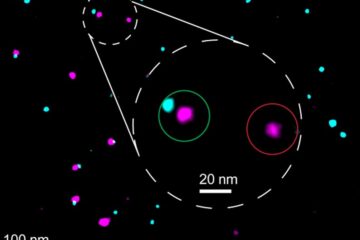

Biophysics: Testing how well biomarkers work

LMU researchers have developed a method to determine how reliably target proteins can be labeled using super-resolution fluorescence microscopy. Modern microscopy techniques make it possible to examine the inner workings…