How major lenders could help hard-up borrowers avoid the slide into debt

Mainstream financial service providers should help their rejected borrowers improve credit ratings and avoid sinking deeper into debt, by collaborating with high-interest lenders, many of which they own, argues a new report sponsored by the ESRC.

Better liaison and advice might prevent shocking cases such as that of the Meadows family of Southport, who hit the headlines last October after a loan of £5,750 shot up to a staggering debt of £380,000, says a study at Keele University led by Professor David Knights.

Professor Knights, now at the University of Exeter, said: “The Meadows case placed the whole issue of credit and lending into sharp focus. It was a particularly graphic example of how a relatively benign loan can get way beyond the ability of ordinary people to cope.”

Redundancy for salesman Tony Meadows led to payments on the loan not being paid. As a result, not only were arrears charged at 34.9 per cent, but also the basic repayments.

Around 20 years ago, the introduction of credit scoring pushed less well off consumers further into using what are known as ‘sub-prime’ lenders. These firms offer loans to people rejected by the mainstream lending companies, and cover their risks by charging very high interest rates.

Understanding of financial implications of borrowing remains low, says the report. And though ‘sub-prime’ firms help people consider whether they can afford credit, advice tends to be limited to that necessary to comply with legislation or codes of practice.

More recently, the decline of door-to-door savings and insurance services has cut further the already limited range of options available to the socially disadvantaged.

Many failed the strict and rigid restrictions of credit scoring, resulting in a gap in the credit market, which soon began to be filled by the rapidly expanding ‘sub-prime’ suppliers who do operate door-to-door.

We have also seen the development of what are called ‘near-prime’ lenders, operating through mass-market advertising in daily newspapers and on daytime TV. These also charge high rates of interest, but collect through banks, imposing penalties through ‘ratchet’ increases in charges immediately a repayment is missed.

Professor Knights said: “The ‘ratchet’ system and encouragement to check ability to repay may help consumers improve their financial understanding, but the effect is extremely limited, since it remains focused on the repayment rather than on other aspects of the contract.

“It does not provide any warnings of the kinds of financial trouble which can be experienced, where comparatively trivial unsecured loans escalate into debts that lead to the repossession of homes and probably into the bankruptcy courts.”

The study suggests that one positive outcome from the financial self-discipline encouraged through ‘near-prime’ lending is that it possibly helps consumers move up to the mainstream market, where interest rates are much lower.

But says Professor Knights: “This would be achieved much more rapidly if major lenders collaborated with ‘near-prime’ providers with the aim of assisting borrowers to graduate to mainstream credit.

“Many ‘near prime’ providers are wholly-owned subsidiaries of mainstream corporations, although operating under a different name to protect the brand of the owner.

“A more responsible way of behaving would be to seek to move borrowers up to the mainstream when they have reasonably long histories of not defaulting on their payments.

“This would require better liaison between the owner and the subsidiary, but it would not only be educational and good PR, it might also prevent customers switching to other lenders as they improve their ratings.”

Media Contact

More Information:

http://www.esrc.ac.ukAll latest news from the category: Social Sciences

This area deals with the latest developments in the field of empirical and theoretical research as it relates to the structure and function of institutes and systems, their social interdependence and how such systems interact with individual behavior processes.

innovations-report offers informative reports and articles related to the social sciences field including demographic developments, family and career issues, geriatric research, conflict research, generational studies and criminology research.

Newest articles

High-energy-density aqueous battery based on halogen multi-electron transfer

Traditional non-aqueous lithium-ion batteries have a high energy density, but their safety is compromised due to the flammable organic electrolytes they utilize. Aqueous batteries use water as the solvent for…

First-ever combined heart pump and pig kidney transplant

…gives new hope to patient with terminal illness. Surgeons at NYU Langone Health performed the first-ever combined mechanical heart pump and gene-edited pig kidney transplant surgery in a 54-year-old woman…

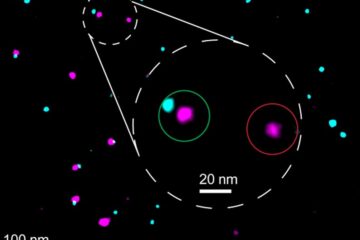

Biophysics: Testing how well biomarkers work

LMU researchers have developed a method to determine how reliably target proteins can be labeled using super-resolution fluorescence microscopy. Modern microscopy techniques make it possible to examine the inner workings…