Euro Area Business Cycle: Stylized Facts and Measurement Issues

In recent years, studies of the euro area business cycle have flourished. However, national statistics have only recently been harmonized and aggregate statistics have only been available for a short period of time. Clearly, there is a need to establish stylized facts for the euro area economies and European Monetary Union gives an opportunity to analyse questions such as whether the loss of independence in the conduct of monetary policy has affected national business cycles. A new Volume published by the Centre for Economic Policy Research (CEPR), ‘The Euro Area Business Cycle: stylized facts and measurement issues’ presents four papers by leading economists that examine different aspects of business cycle measurement for the euro area. CEPR Research Fellow Lucrezia Reichlin, who will begin as head of research at the European Central Bank in February 2005, has edited the Volume.

In their Paper ‘Euro Area and US Recessions, 1970-2003’, Domenico Giannone (ECARES, Université Libre de Bruxelles) and Lucrezia Reichlin (ECARES, Université Libre de Bruxelles and CEPR) analyse the relation between (1) the level cycle: the level of economic activity, and (2) the growth cycle: the rate of economic growth. They use both definitions of economic activity to compare the behaviour of the economies of the euro area and the United States. The Paper starts from the observation that, although level cycles are strikingly similar in the euro area and the US, the growth rate of output in the euro area is less volatile than in the US and more protracted. This implies that the effect of an economic shock from outside the euro area lasts longer than in the US. Giannone and Reichlin use a statistical model of joint US-euro area output behaviour that is able to simulate characteristics of both definitions of economic activity. The model implies that a world technological shock would be immediately absorbed by the US economy but would take longer to be absorbed by the euro area economies. The euro area does eventually catch up with the US but this takes around ten years.

The authors also analyse consumption and conclude that the welfare cost associated with output fluctuations is likely to be larger in the euro area than the US. The Paper provides food for thought for understanding the causes of differences in the economic performance of the euro area and the US and the role played by policy.

‘Predicting Growth Regimes for European Countries’ by Denise Osborn (Centre for Growth and Business Cycle Research, University of Manchester), Marianne Sensier (Centre for Growth and Business Cycle Research, University of Manchester) and Dick van Dijk (Econometric Institute, Erasmus University Rotterdam) analyses national business cycles rather than the euro area aggregate cycle. The authors study the role of a wide range of macroeconomic and financial variables as potential predictors of expansions and recessions in Germany, France, Italy and the UK. The results indicate that international variables matter in most cases and that financial variables are also found to be particularly important. Although the focus of the Paper is forecasting, the analysis helps assess the question of how open the euro area economy is with respect to the US and also how sensitive it is to changing events in financial markets.

‘Dating the Euro Area Business Cycle’ by Michael Artis (European University Institute and CEPR), Masimiliano Marcellino (Università Bocconi, IGIER and CEPR) and Tommaso Proietti (Università di Udine and European University Institute) proposes a number of improvements to standard techniques to detect the peaks and troughs of business cycles that allow them to isolate major fluctuations in economic activity. For the US economy their model produces a good approximation of the turning points in the business cycle that have been identified by the National Bureau of Economic Research. When their model is applied to quarterly output ‘cleaned’ of high-frequency variations, the authors are able to reproduce the dates identified for the euro area business cycle by the CEPR Euro Area Business Cycle Dating Committee. Also, applying their model to GDP growth that has been filtered to extract cycles that are longer than five quarters roughly produces the dates identified by EuroCOIN, CEPR’s monthly indicator of euro area GDP growth.

‘Estimates of Potential Output: Benefits and Pitfalls from a Policy Perspective’ by Jean-Philippe Cotis (OECD Economics Department), Jaergen Elmeskov (OECD Economics Department) and Annabelle Mourougane (OECD Economics Department) discusses the advantages and disadvantages of different measures of potential output and the output gap. The Paper also defines criteria on the basis of which to judge different methodologies.

Media Contact

More Information:

http://www.cepr.orgAll latest news from the category: Social Sciences

This area deals with the latest developments in the field of empirical and theoretical research as it relates to the structure and function of institutes and systems, their social interdependence and how such systems interact with individual behavior processes.

innovations-report offers informative reports and articles related to the social sciences field including demographic developments, family and career issues, geriatric research, conflict research, generational studies and criminology research.

Newest articles

Silicon Carbide Innovation Alliance to drive industrial-scale semiconductor work

Known for its ability to withstand extreme environments and high voltages, silicon carbide (SiC) is a semiconducting material made up of silicon and carbon atoms arranged into crystals that is…

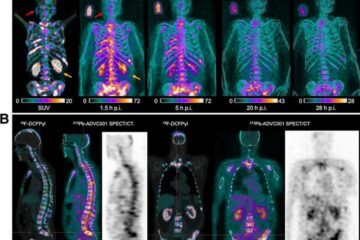

New SPECT/CT technique shows impressive biomarker identification

…offers increased access for prostate cancer patients. A novel SPECT/CT acquisition method can accurately detect radiopharmaceutical biodistribution in a convenient manner for prostate cancer patients, opening the door for more…

How 3D printers can give robots a soft touch

Soft skin coverings and touch sensors have emerged as a promising feature for robots that are both safer and more intuitive for human interaction, but they are expensive and difficult…