China's biotech industry: An Asian dragon is growing

Backed by a government intent on promoting innovation and fuelled by the “brain gain” of talented scientists and entrepreneurs returning from abroad, China’s health biotech industry only needs a more favourable investment climate to emerge as a global force in the production of therapies and medicines – both new and low-cost generics – experts say in a new study.

Long considered a skillful product replicator, China today boasts of daring medical science innovation and stunning breakthroughs – including the world’s first commercialized gene therapy product and the sole cholera vaccine tablet. However, Chinese firms face an uphill battle in attracting high-risk venture capital needed to sustain innovative, research-driven projects, says the study published by Nature Biotechnology.

Conducted through face to face interviews with management of 22 Chinese firms, the work is the first study of China’s most innovative health biotechnology companies available in the public domain.

It says that despite substantial Chinese government funding to promote an innovative industry and entrepreneurs who will commercialize new health biotech products, the intense interest of potential international investors is typically muted by an uncertain financial system, rigid restrictions on the export of capital that limit the options for exiting investments and continuing doubts about the Chinese government’s approach to quality control and intellectual property rights.

““The Chinese biotechnology industry is like a baby dragon, which will grow quickly and soon become hard to ignore. It’s no longer the case that the industrialized world has hegemony over biotechnology innovation,” says co-author Peter A. Singer, MD, of the McLaughlin-Rotman Centre for Global Health (University Health Network and University of Toronto).

“However, for all its blossoming as an industrial and economic superpower, China still has one foot in the closed society of the past. For the sake of both national and global health, we hope China will embrace the financial and regulatory reforms needed to attract the venture capital required for sustained innovation in the health biotech sector,” he adds.

The report builds on a similar study of India’s private health biotech sector published in April 2007, opening a window on the product development capabilities and strategies used in rapidly growing economies to survive and grow amid developing country challenges. It also recommends policies that could help their biotech firms succeed.

Lead author Sarah Frew, a research associate of the McLaughlin Rotman Centre for Global Health, says the budding of biotech industries in China and India holds major implications for the global industry and for improving both health and prosperity in the developing world.

The biotech revolutions in the two countries differ significantly, she says: India’s firms are largely focussed on process innovations to improve affordability and accessibility of medicine among local and global populations; Chinese firms are striving to create novel products in such areas as gene therapy and regenerative medicine.

“Addressing the health needs of 1.3 billion people in China is global health,” says Dr. Frew. “The challenges faced by the private sector, research institutes and universities, and health care providers will be very difficult to meet unless the country’s leaders are prepared to look at new approaches.”

Drs. Singer and Frew, with co-authors Abdallah S. Daar, MD, Stephen Sammut, Alysha Shore, Joshua Ramjist, Sara Al-Bader and Rahim Rezaie, say they found a home-grown Chinese private health biotech sector motivated both financially and morally to develop innovative health products to address local and global health needs.

“The responsibility now lies with both the Chinese government and the international health community to support these companies in their ventures and ensure that these products reach their intended markets,” says Dr. Frew.

The return of the ‘sea turtles’

The report notes a strong focus on encouraging the return of Chinese scientists and entrepreneurs who left the country to study or train abroad – the so-called ‘sea turtles’ who return with scientific talent and international credibility.

“While the ‘sea turtle’ phenomenon is beneficial, the country’s industry might be better served if Chinese residents in the West built transnational companies with a footprint in both China and the West,” says co-author Stephen M. Sammut of Burrill & Company, San Francisco.

“While this practice is already common, regulations and taxation policies to encourage this approach would address many of the concerns of private and public capital, assure prospective alliance partners, and add depth to the pool of experienced managers. Such an approach would also promote China as a co-development partner rather than a purely low-cost venue to international companies to contract services.”

Population a major driving force

China’s 1.3 billion inhabitants (20% of the world’s population) create a significant demand for low-cost products with the result that biogenerics accounted for more than 90% of the $3 billion biopharmaceutical market last year. For some companies, generic products represent a low-risk entry point into the industry.

The same is true for diagnostics. Chinese companies like Beijing Wantai Biological Pharmacy Enterprise and Shanghai Huaguan Biochip Co., Ltd. play an important role in keeping local consumer prices down. Wantai has developed and marketed a large range of blood screening tests for diseases such as HIV, hepatitis B and C, sexually transmitted diseases and rotavirus. Huaguan earns most of its revenue exporting its range of fertility tests and formulations for HIV, tuberculosis, hepatitis C and STDs to other Asian, African and South American countries.

The Chinese government, however, remains intent on pushing applied research, driving Chinese firms to develop new therapies in pioneering fields such as gene therapy and stem cells.

The first commercialized gene therapy product approved anywhere in the world was Gendicine, an injection used in the treatment of head and neck cancers developed by Shenzhen SiBiono GeneTech Co., Ltd. More than 5,000 patients have been treated with Gendicine, about 400 of them from overseas. The drug is currently undergoing further clinical trials in China for several new indications, including liver, abdominal and pancreatic cancer.

Several Chinese companies are working in the field of human and animal stem cells. One of them, Beike Biotechnologies, has organized a network of satellite hospitals, clinicians and research laboratories to commercialize its stem cells therapies, which involve harvesting stem cells from the umbilical cord or amniotic membrane, in vitro expansion, and administration to patients either intravenously or by injecting directly into the spinal cord.

Beike has treated more than 1,000 patients, including 60 foreigners, for a variety of conditions including Alzheimer’s disease, autism, brain trauma, cerebral palsy, diabetic diabetic foot arteriosclerosis and spinal cord injury.

Because therapies using cells derived from the umbilical cord are considered a clinical technology in China, the State Food and Drug Administration does not require clinical trials before these treatments are approved. This absence of clinical data makes it difficult to evaluate the efficacy of these therapies.

New therapies developed for local and global health problems

The study found that the government’s focus on innovation is also driving development of new therapies to address significant local health needs, including lung fibrosis, liver cirrhosis and various problems associated with an aging population caused in part by the country’s one-child policy.

Lung fibrosis, caused by radiation treatment, is a major cause of death for the more than 275,000 Chinese who die from lung cancer every year. Inflammation and fibrosis of the liver is a side effect from hepatitis B virus infection, which afflicts over 100 million Chinese.

Shanghai Genomics Inc. has focused its efforts in this area, developing novel non-steroid anti-inflammatory therapeutics to replace currently available treatments which achieve poor results and have many side effects. The company’s first product on the market, GuBang, is a material for bone void filling that can aid bone growth and serve the growing needs of Asia’s aging citizens.

Chinese firms are also developing vaccines to address both local and global needs. They include Shanghai United Cell Biotech, which is manufacturing and marketing one of only two oral cholera vaccines available worldwide (and the only one available in tablet form). Other firms are working on an oral HIV vaccine and novel vaccines against Japanese Encephalitis, SARS and pandemic avian influenza (H5N1 strain).

Barriers to development

The study found that the lack of favourable conditions for investment in an innovative biotech sector may be actively discouraging its growth. Most Chinese biopharmaceutical companies sell generic drugs and do not invest in R&D.

“Some of the firms that are pursuing innovative R&D have incorporated hybrid business models that dilute resources to include contract services or non-innovative products, to first fund the firm’s survival and then fund R&D activities,” the report says.

These hybrid business models have fallen out of favor in the west, where venture capitalists prefer a well-defined targeted strategy over a mix of models that mitigate commercial risk. As price-based competition among domestic manufacturers continues to put pressure on profit margins, even fewer firms may be able to support in-house R&D programs.

Other barriers to growth include a lack of trust among potential international partners, particularly in discussions that involve intellectual property protection. Other barriers to international partnerships involve language, travel, culture, and differences in project management styles.

Slow-moving policy and regulatory processes hinder progress in a fast-paced research environment. Among the major issues China will need to address soon is the need to expand its capabilities in protecting intellectual property by refining civil procedures, developing a body of jurists, and accumulating a body of precedent and custom for assessment of damages.

Sales and distribution are problematic for small Chinese companies; as a result the needs of the large domestic market are unmet. The country’s health system is weak and in many cases clinicians, facilities and products are not reaching rural or isolated regions. Another challenge is the disparity between the high cost of developing an innovative health product and the price the domestic market can pay.

Other lessons learned

The government’s efforts to expand China’s innovative capacity in biotechnology are bearing fruit. According to the country’s Institute of Science and Technology Information, China in 2006 became the world’s second largest scientific research publisher (after only the U.S.), indicating improved research and innovation capacity and deeper involvement of Chinese scientists in the international academic community.

The researchers say Chinese companies need global health organizations to help them increase global access to their products.

As well, in addition to incentives to develop domestically novel products that address local health needs, more government-sponsored incentives and procurement programs are needed to ensure that innovative products reach their intended end users.

Recommendations for biotech development in China

Reform the financial environment to facilitate exit mechanisms for entrepreneurs and investors in the health biotech sector.

Create and promote specialty programs in biotechnology entrepreneurship and management.

Leverage the ‘sea turtle’ phenomenon to promote transnational companies that will be attractive to western investors and strategic partners.

Promote credibility of domestic firms to the international community by enforcing uniform financial reporting, a transparent regulatory regime and fair business practices.

Enact timely legislation and regulations to nurture scientific and economic development.

Stimulate rapid development of the IP infrastructure through academic and exchange programs.

Strengthen health systems infrastructure and distribution mechanisms in concert with the development of the industry to ensure that innovative health biotech products are available to the entire domestic population.

Media Contact

More Information:

http://www.mrcglobal.orgAll latest news from the category: Life Sciences and Chemistry

Articles and reports from the Life Sciences and chemistry area deal with applied and basic research into modern biology, chemistry and human medicine.

Valuable information can be found on a range of life sciences fields including bacteriology, biochemistry, bionics, bioinformatics, biophysics, biotechnology, genetics, geobotany, human biology, marine biology, microbiology, molecular biology, cellular biology, zoology, bioinorganic chemistry, microchemistry and environmental chemistry.

Newest articles

Silicon Carbide Innovation Alliance to drive industrial-scale semiconductor work

Known for its ability to withstand extreme environments and high voltages, silicon carbide (SiC) is a semiconducting material made up of silicon and carbon atoms arranged into crystals that is…

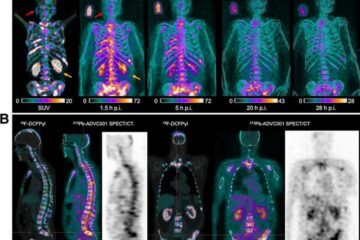

New SPECT/CT technique shows impressive biomarker identification

…offers increased access for prostate cancer patients. A novel SPECT/CT acquisition method can accurately detect radiopharmaceutical biodistribution in a convenient manner for prostate cancer patients, opening the door for more…

How 3D printers can give robots a soft touch

Soft skin coverings and touch sensors have emerged as a promising feature for robots that are both safer and more intuitive for human interaction, but they are expensive and difficult…