Electronic mandates for SEPA direct debit transactions

The migration to the SEPA payment instruments in February 2014 poses new challenges to payment service providers and users.

From that date on, a creditor needs to be in possession of a mandate signed by the debtor in order to collect direct debit payments. Fraunhofer IAO has conducted a comparative study of solutions for SEPA-compliant electronic mandates with regard to the advantages and disadvantages for debtors, creditors, and banks.

Until now, direct debit has been the payment method of choice for many payers and payees, especially in Germany. This method is appreciated by all parties for its convenience, and especially the simplicity of setting up direct debit arrangements. As of February 2014, banks and payees (creditors) must adapt their direct debit processes to the requirements of the SEPA Direct Debit (SDD) Schemes.

Among other things, the payer (debtor) needs to sign a SEPA-compliant mandate to give his or her consent to a one-off or recurrent direct debit. Given the increasingly widespread use of electronic payment orders, there is a need for suitable electronic mandate solutions that provide the required security while being easy to implement.

This is the subject of Fraunhofer IAO’s white paper entitled “Electronic Mandates for SEPA Direct Debit Transactions”. The white paper was produced with the financial support of EBA CLEARING, the provider of the electronic authorisation solution MyBank. The study looks at various alternative forms of electronic mandates and evaluates their advantages and limitations. The white paper compares the following alternatives:

E-mandate solutions based on the 2-corner model, which include processing by the debtor and the creditor only;

E-mandate solutions based on the 3-corner model, which additionally include processing by the debtor’s bank;

E-mandate solutions based on the 4-corner model, which additionally include processing by both the debtor’s and the creditor’s bank.

The white paper provides service providers, payees and technical providers with an overview of the system security, user-friendliness, and practicability of the different solutions.

The document is available in English and German and can be downloaded free of charge by clicking on the following link: www.e-business.iao.fraunhofer.de/emandates

Contact

Maximilien Kintz

Electronic Business

Fraunhofer IAO

Nobelstraße 12

70569 Stuttgart, Germany

Telefon +49 711 970-2182

Email maximilien.kintz@iao.fraunhofer.de

Media Contact

All latest news from the category: Information Technology

Here you can find a summary of innovations in the fields of information and data processing and up-to-date developments on IT equipment and hardware.

This area covers topics such as IT services, IT architectures, IT management and telecommunications.

Newest articles

Silicon Carbide Innovation Alliance to drive industrial-scale semiconductor work

Known for its ability to withstand extreme environments and high voltages, silicon carbide (SiC) is a semiconducting material made up of silicon and carbon atoms arranged into crystals that is…

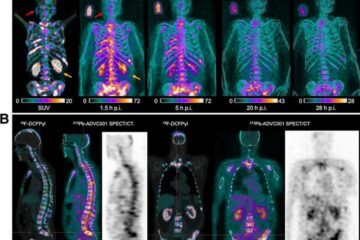

New SPECT/CT technique shows impressive biomarker identification

…offers increased access for prostate cancer patients. A novel SPECT/CT acquisition method can accurately detect radiopharmaceutical biodistribution in a convenient manner for prostate cancer patients, opening the door for more…

How 3D printers can give robots a soft touch

Soft skin coverings and touch sensors have emerged as a promising feature for robots that are both safer and more intuitive for human interaction, but they are expensive and difficult…