UN issues analysis of global investors' sustainable energy 'gold rush'

Climate change worries coupled with high oil prices and increasing government support top a set of drivers fueling soaring rates of investment in the renewable energy and energy efficiency industries, according to a trend analysis from the UN Environment Programme.

The report says investment capital flowing into renewable energy climbed from $80 billion in 2005 to a record $100 billion in 2006. As well, the renewable energy sector’s growth “although still volatile … is showing no sign of abating.”

The report offers a host of reasons behind and insights into the world’s newest gold rush, which saw investors pour $71 billion into companies and new sector opportunities in 2006, a 43% jump from 2005 (and up 158% over the last two years. The trend continues in 2007 with experts predicting investments of $85 billion this year).

In addition to the $71 billion, about $30 billion entered the sector in 2006 via mergers and acquisitions, leveraged buyouts and asset refinancing. This buy-out activity, rewarding the sector’s pioneers, implies deeper, more liquid markets and is helping the sector shed its niche image, according to the report.

While renewables today are only 2% of the installed power mix, they now account for about 18% of world investment in power generation, with wind generation at the investment forefront. Solar and bio-fuel energy technologies grew even more quickly than wind, but from a smaller base.

Renewables now compete head-on with coal and gas in terms of new installed generating capacity and the portion of world energy produced from renewable sources is sure to rise substantially as the tens of billions of new investment dollars bear fruit.

Says UNEP Executive Director Achim Steiner: “One of the new and fundamental messages of this report is that renewable energies are no longer subject to the vagaries of rising and falling oil prices—they are becoming generating systems of choice for increasing numbers of power companies, communities and countries irrespective of the costs of fossil fuels.

“The other key message is that this is no longer an industry solely dominated by developed country industries. Close to 10 per cent of investments are in China with around a fifth in total in the developing world. We will need many sustained steps towards the de-carbonizing of the global economy. It is clear that in respect to renewables those steps are getting underway.”

Says Yvo de Boer, Executive Secretary of the UN Convention on Climate Change: “As governments prepare to launch a new round of post-2012 climate change-related negotiations later this year, the report clearly shows that, amid much discussion about the ‘technologies of tomorrow,’ the finance sector believes the existing technologies of today can and will ‘decarbonize’ the energy mix provided the right policies and incentives are in place at the international level.”

The report represents “a strategic tool for understanding the energy sector’s development in both OECD and developing countries,” says Michael Liebreich, CEO of New Energy Finance Ltd, a leading provider of research and analysis on the clean energy and carbon markets, which prepared the report for UNEP’s Paris-based Sustainable Energy Finance Initiative.

The report attributes the sector’s boom to a range of global concerns – climate change, increasing energy demand and energy security foremost among them.

It credits as well the November 2006 U.S. mid-term elections, which confirmed renewable energy as “a mainstream issue,” moving it up the political agenda.

Also spurring the sector’s growth has been the persistently high price of oil – averaging more than $60 a barrel in 2006 (although one report conclusion is that the sector is becoming more independent of the price of oil).

“Growing consumer awareness of renewable energy and energy efficiency – and their longer term potential for cheaper energy, and not just greener energy – has become another fundamental driver,” it says. “Most importantly governments and politicians are introducing legislation and support mechanisms to enable the sector’s development.”

Among the report’s other key points and conclusions:

– Renewable energy and efficiency markets are growing more global and enjoying easier access to capital markets;

– Capital is coming from the venture investment community, the stock markets and internal refinancings, signaling the sector’s a shift to a more mainstream status;

– Risk and uncertainly can be reduced through diversification across technologies and geography;

– Energy efficiency is a significant but largely invisible market, attracting increasing attention as investors realize its important role in meeting rising energy demand;

– Capital investors are now more closely aligned with industry proponents in their views of expected growth.

Wind, solar, biofuels attract greatest investment dollars

Renewable energy sectors attracting the highest investment levels are wind, solar and biofuels, “reflecting technology maturity, policy incentives and investor appetite,” according to the report, adding that the NEX index (www.tsx.com/en/nex/) of clean energy stocks increased 64% in the 15 months to April.

Stock market investments in technology development, commercialization and manufacturing firms leapt 140% in 2006 compared with 2005, while venture capital and private equity investments jumped 163%. Financings of energy generation assets and capacity grew at “a more sedate 22.9%,” the analysis says.

Asset financing of new generation capacity, the largest single source of renewable energy investment, accounted for nearly 40% of the $70.9 billion invested in 2006, a reflection of the sector’s coming of age, the report says. The trend continues in 2007. Most asset financing deals were in the relatively mature wind sector, with biofuels (which experienced a surge of interest in 2006) in second place.

Venture capital and private equity investors in 2006, meanwhile, poured $2.3 billion into biofuels, $1.4 billion into solar and $1.3 billion in wind, much of it to increase manufacturing capacity.

Around 40% of the capital invested in solar went towards new technology development. In biofuels, the proportion was about 20%, reflecting a surging corn-based ethanol industry in the U.S., as well as research into second generation biofuels, including cellulosic ethanol.

Renewable energy investment is almost evenly split geographically between United States and Europe. U.S. companies receive more technology and private investment (with high profile investment interest shown in biofuels during 2006 by entrepreneurs such as Vinod Khosla, Bill Gates and Richard Branson). Europe’s publicly quoted companies attracted the most public stock market investment dollars: $5.7 billion compared to $3.5 billion in the U.S.

The pattern reflects the earlier arrival of enthusiasm for renewable energy in Europe and its ratification of the Kyoto Protocol, unlike the US and Australia. As well, government support is particularly strong in some European countries.

The European markets’ relative maturity also helps explain its dominance of merger and acquisition activity in 2006, with deals worth more than $20 billion in 2006 compared with $8.8 billion in the U.S., many of the corporate acquisitions being made by investors from developing countries, notably India.

Comparing the renewable energy and dotcom booms, the report says the former is “underpinned by real demand and growing regulatory support (which the dotcom boom did not enjoy), considerable tangible asset backing, and increasing revenues.”

Most energy efficiency investment has been in early-stage funding. Venture capital and private equity investment rose 54% between 2005 and 2006 to $1.1 billion. Some merger and acquisition activity also occurred in the energy efficiency industry, notably the Australian Bayard group’s $705 million acquisition of US smart-metering company Cellnet in December.

Among other insights:

– Investment in sustainable energy is still mostly in OECD countries, with the US and EU together accounting for more than 70% in 2006. However, investment in developing countries is growing quickly: 21% of the global total in 2006 occurred in developing countries, compared with 15% in 2004;

– A healthy 9% of global investment occurred in China, helped by significant asset financing activity in wind and biomass as well as the waste sectors. Investments in China came from across the spectrum, from venture capital through to public markets, “reflecting the country’s increasingly prominent position in renewable energy”;

– India lagged a little behind China but was the largest buyer of companies abroad in 2006, most of them in the more established European markets;

– Latin America took 5% of global investment, most of which financed Brazilian bio-ethanol plants;

– Sub-Saharan Africa notably lagged behind other regions;

– Global government and corporate research and development spending rose 25% to $16.3 billion;

– Investments in small-scale projects rose 33% from an estimated $7 billion in 2005 to $9.3 billion in 2006.

Small-scale projects attract growing interest, driven partly by opportunities in developing countries, which stand to benefit most from small-scale installations (e.g. solar roof panels and micro turbines).

“The finance community has been investing at levels that imply expected disruptive change is now inevitable in the energy sector,” says Eric Usher, Head of the Energy Finance Unit at UNEP’s Paris-based Division of Technology Industry and Economics. “This report puts full stop to the idea of renewable energy being a fringe interest of environmentalists. It is now a mainstream commercial interest to investors and bankers alike.

“This is a powerful signal of the arrival of an alternative future for today’s fossil fuel-dominated energy markets,” he says. “Signals move markets and the signal in these investment numbers is that the sustainable energy markets are becoming more liquid, more globalized and more mainstream.”

This is full-scale industrial development, he added, not just a tweaking of the energy system. Growth is underpinned by a widening array of clean energy and climate policies at the federal, state and municipal levels.

With respect to the energy efficiency sector, the investment trends are harder to identify but the impacts of improving energy efficiency can be valued economically, notes Virginia Sonntag-O'Brien of UNEP’s Sustainable Energy Finance Initiative (SEFI). Investments in supply side and demand side efficiency have been helping decrease global energy intensity, which on average has been dropping 1% to 1.5% per year.

Since 1990, energy efficiency has met one-half of all new demand for worldwide energy services. These savings – 3 billion tonnes of oil equivalent – have a value of $6 trillion if an average oil price of $27 is assumed. The challenge is to accelerate energy intensity improvement to levels of 2% or above, which compounded to 2030 would mean a 61% improvement from today.

Says Mohamed El-Ashry, Chair of the Renewable Energy Global Policy Network REN21: “The findings in this report are adding to the mounting evidence that renewable energy is going to play a far greater role in the energy mix than many expected.”

Media Contact

More Information:

http://www.unep.orgAll latest news from the category: Ecology, The Environment and Conservation

This complex theme deals primarily with interactions between organisms and the environmental factors that impact them, but to a greater extent between individual inanimate environmental factors.

innovations-report offers informative reports and articles on topics such as climate protection, landscape conservation, ecological systems, wildlife and nature parks and ecosystem efficiency and balance.

Newest articles

Silicon Carbide Innovation Alliance to drive industrial-scale semiconductor work

Known for its ability to withstand extreme environments and high voltages, silicon carbide (SiC) is a semiconducting material made up of silicon and carbon atoms arranged into crystals that is…

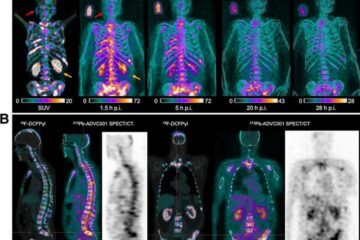

New SPECT/CT technique shows impressive biomarker identification

…offers increased access for prostate cancer patients. A novel SPECT/CT acquisition method can accurately detect radiopharmaceutical biodistribution in a convenient manner for prostate cancer patients, opening the door for more…

How 3D printers can give robots a soft touch

Soft skin coverings and touch sensors have emerged as a promising feature for robots that are both safer and more intuitive for human interaction, but they are expensive and difficult…