Moving ‘Natural Capital’ From Metaphor to Reality

Photo courtesy of John Rae

But so far, achieving an actual measurable value for this “natural capital” has remained elusive, says Eli Fenichel, an assistant professor of bioeconomics and ecosystems management at the Yale School of Forestry & Environmental Studies.

In a new paper, Fenichel and co-author Joshua Abbott of Arizona State University report developing an approach to calculate a fair and consistent price for natural capital stocks that is grounded in the same theory of economic capital that governs the pricing of other capital assets, from stock prices to factories.

The researchers show the importance of valuing natural resources as a capital asset that stores wealth for the long term rather than simply as commodities that are bought and sold in the day-to-day by developing a formula that combines economic with biophysical measurements and quantifies the feedbacks between nature and human behavior.

“Our approach to valuation illustrates the critical importance of understanding the feedbacks between the state of natural capital stocks, human behavior impacting those stocks, and the role of policy in shaping that feedback,” Fenichel said.

Reef fish in Gulf of Mexico provide a useful example. According to the study, live reef fish in the Gulf were worth just over $3 per pound in 2004. Three years later, when policymakers reformed and improved management by introducing a conservation incentive, allowing fishermen to trade the rights to catch a pound of fish — and thus creating a market for the fish as a capital asset — the price per pound jumped to just below $9 per pound.

Overall, their analysis found that the Gulf’s reef fish contributed more than $256 million to the national wealth in 2004 — and perhaps triple that amount by 2007 as a result of the management change. But existing models of national wealth have neglected these contributions, Fenichel said.

The paper was published as the lead article in the inaugural issue of the Journal of the Association of Environmental and Resource Economists.

Although economists have attempted for decades to put a price on nature, earlier models failed to measure the “opportunity cost” of losing future units of natural capital stock: for example, the cost of harvesting a fish today rather than letting it reproduce and harvesting some of its babies later.

“We have learned a lot about natural resource management using models that ask how would we make decisions under idealized market conditions,” Fenichel said. “But those models generate prices based on the assumption that resource use is optimally balanced through time — thus revealing the maximum potential value of a natural asset. Unfortunately, most natural capital or natural stocks are not particularly well managed.”

The new framework moves beyond idealized management by basing prices on policies that are actually in place, inefficient as they may be, to create an accurate picture of a society’s wealth, the authors say. These insights can inform policies that would manage natural resources more sustainably.

“It’s similar to investors being able to see the share price of a firm, assess the capital it holds, and then determine whether they can do a better job managing the company,” said Abbott, an associate professor at ASU’s School of Sustainability. In that scenario, the investor can reorganize the firm, improving management, and enjoy the increase in wealth as the share price increases. “The problem with nature,” he says, “is that we don’t see those share prices for natural assets, which is why an approach like this is needed.”

Fenichel said, “I’d love to see this approach applied to all U.S. fish stocks, forests, groundwater, and other resources. Until we have credible prices for natural assets that policymakers can put into national accounting schemes, the value of these natural assets is treated as if it were ‘zero.’

“And we’re not going to effectively manage those things that matter most to us as long as we’re valuing them as ‘zero.’”

Critically, he added, the paper also calls attention to the importance of interdisciplinary perspective when assessing the value for natural systems. “This paper lays out a strong, conceptual framework for how economists and natural scientists must come together to really understand how we are currently valuing our environment.”

Media Contact

All latest news from the category: Ecology, The Environment and Conservation

This complex theme deals primarily with interactions between organisms and the environmental factors that impact them, but to a greater extent between individual inanimate environmental factors.

innovations-report offers informative reports and articles on topics such as climate protection, landscape conservation, ecological systems, wildlife and nature parks and ecosystem efficiency and balance.

Newest articles

Superradiant atoms could push the boundaries of how precisely time can be measured

Superradiant atoms can help us measure time more precisely than ever. In a new study, researchers from the University of Copenhagen present a new method for measuring the time interval,…

Ion thermoelectric conversion devices for near room temperature

The electrode sheet of the thermoelectric device consists of ionic hydrogel, which is sandwiched between the electrodes to form, and the Prussian blue on the electrode undergoes a redox reaction…

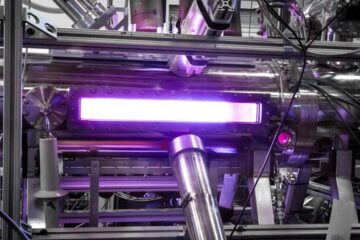

Zap Energy achieves 37-million-degree temperatures in a compact device

New publication reports record electron temperatures for a small-scale, sheared-flow-stabilized Z-pinch fusion device. In the nine decades since humans first produced fusion reactions, only a few fusion technologies have demonstrated…