Wishful betting can contaminate financial markets, study shows

In the paper, “Contagion of Wishful Thinking in Markets,” researchers from The University of Texas at Austin and Cornell University demonstrate how wishful betting can contaminate beliefs throughout markets, as other market participants infer wishful bettors possess more favorable information than they do.

As a consequence, investors who initially held accurate beliefs become overly optimistic about stock values. The research will be published in a forthcoming issue of Management Science.

“The findings of our studies contradict what many people assume about markets, that wishful thinkers will be identified and disciplined by more sophisticated investors,” said Nicholas Seybert, an assistant professor of finance at the McCombs School of Business at The University of Texas at Austin. “Instead, investors fail to recognize the existence of wishful betting even though most of them do it. As a result, wishful thinking can be contagious in financial markets.”

Seybert and co-author Robert Bloomfield, a professor of management and accounting at Cornell's Johnson Graduate School of Management, set out to determine whether investors with accurate beliefs about intrinsic stock values would invest in accordance with those beliefs. Bloomfield comments, “Our research sounds a note of caution to those who assume that market prices are always a sound basis for drawing conclusions about fundamentals. Traders in our study observe price movements driven by what Keynes called 'animal spirits,' conclude that those price movements actually reflect news, and end up exacerbating market swings by their own responses. The cure lies in encouraging investors to engage in more fundamental analysis, rather than in outsourcing that analysis to the market.”

They set up a computer-based stock market where investors could buy and sell stocks. Experimental stock markets are not new, but Seybert and Bloomfield made a significant modification by recognizing that many investors already hold stakes in the market.

Investors started with a short position in half of the stocks and a long position in the other half. The researchers reasoned that investors in short positions would desire low stock values, while those in long positions would desire high stock values. Despite all investors' initially holding unbiased beliefs about intrinsic stock values, those in short positions sold too many shares and those in long positions purchased too many shares. More surprisingly, investors did not anticipate this wishful betting behavior on the part of others. Even though they themselves purchased or sold too many shares of stock, they believed that other investors' trades were based on fundamental information about intrinsic value. By the end of trade, market prices were too extreme and the average investor appeared to be a “wishful thinker” – holding overly optimistic beliefs about intrinsic value.

Seybert and Bloomfield surmise that this contagion problem could contribute to stock market bubbles as well as other market anomalies. For example, prior studies have shown that employees overinvest in their employers' stock, and that investors prefer stocks of local companies.

“If you are an employee of a company or a resident of a city, you have many reasons to desire that your employer or local companies will be successful,” Seybert said. “Our theory suggests that one employee's investment could be viewed as a positive signal of value by other employees. Ultimately, employees might use this information to purchase too many shares of their employer's stock.”

Media Contact

More Information:

http://www.utexas.eduAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

High-energy-density aqueous battery based on halogen multi-electron transfer

Traditional non-aqueous lithium-ion batteries have a high energy density, but their safety is compromised due to the flammable organic electrolytes they utilize. Aqueous batteries use water as the solvent for…

First-ever combined heart pump and pig kidney transplant

…gives new hope to patient with terminal illness. Surgeons at NYU Langone Health performed the first-ever combined mechanical heart pump and gene-edited pig kidney transplant surgery in a 54-year-old woman…

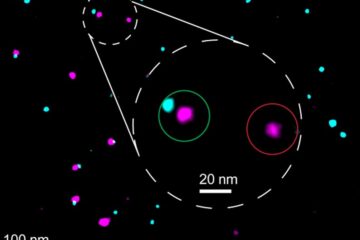

Biophysics: Testing how well biomarkers work

LMU researchers have developed a method to determine how reliably target proteins can be labeled using super-resolution fluorescence microscopy. Modern microscopy techniques make it possible to examine the inner workings…