The wisdom of retail traders

A forthcoming paper in the Journal of Finance by Professor Paul Tetlock, Roger F. Murray Associate Professor of Finance at Columbia Business School, and Eric Kelley, Assistant Professor, Finance, the Eller College of Management at the University of Arizona, finds that retail investors' are not as unsophisticated as many think: they can actually predict future stock returns.

The study shows that retail traders buy in advance of price increases and sell in advance of price decreases that occur over the next month. This research is of particular interest to institutional and retail investors whose profits depend on monthly stock price movements. Columbia Business School's Ideas at Work also covered this research when it was a working paper.

The researchers analyzed proprietary trading data that includes retail orders in nearly all common stocks listed in the United States routed to two market centers from February 26, 2003 through December 31, 2007. The data includes $2.6 trillion in executed trades, which was roughly one-third of all self-directed retail trading in the US during that time period. The researchers first measured retail trader order imbalances, adding up all buys and subtracting all sells, and found that the net buying activity of retail investors positively predicts future stock returns for at least one month and up to three months. They then combined the order data with comprehensive newswire data from Dow Jones (DJ) to test if certain hypotheses could account for retail traders' ability to predict returns.

The study distinguishes retail traders' aggressive (market) orders – directives to trade regardless of price – from their passive (limit) orders – instructions to wait for a certain price before trading. Although both types of orders predict stock returns, they do so for different reasons. Only buying activity from aggressive orders predicts positive news events about a stock, such as an announcement that a firm's earnings beat analysts' expectations. This evidence suggests that aggressive retail investors trade on information that others aren't yet aware of, and that a stock's price takes some time to reflect this information. Professor Tetlock explains, “Suppose there are a relatively large number of physicists in the United States who know a lot about microchips. They may know something about AMD, the microchip producer that stock analysts on Wall Street don't know. We should see newswire stories with many positive words about AMD start to appear in the weeks after the physicists started buying AMD, when the market and the financial press become aware of that private information. And it does turn out that aggressive buying usually precedes positive news.”

In contrast, retail traders' passive orders may predict returns because they provide liquidity to other investors with urgent trading needs. Professor Tetlock describes this hypothesis, “Maybe AMD suffered a negative liquidity shock if a mutual fund had to sell it to meet client withdrawals. Retail traders who recognize this can step in and buy AMD stock cheap, which provides liquidity to the mutual fund. The traders eventually realize profits when the stock rebounds, once people see that AMD's profits haven't changed and there is nothing fundamentally wrong with the firm.” Consistent with this hypothesis, the researchers found that retail traders' passive orders did not predict news about stocks.

Part of the unexpected skill exhibited by retail traders may come from a change in the trader population. “Traders holding Internet stocks in 2000 would have lost about 80 percent of their money over the following two years, whereas traders with more diversified investments would have kept most of their wealth,” Professor Tetlock says. “It's an evolution argument: survival of the fittest. Those who were actively trading and doing poorly simply lost their money.”

About Columbia Business School

Led by Dean Glenn Hubbard, the Russell L. Carson Professor of Finance and Economics, Columbia Business School is at the forefront of management education for a rapidly changing world. The school's cutting-edge curriculum bridges academic theory and practice, equipping students with an entrepreneurial mindset to recognize and capture opportunity in a competitive business environment. Beyond academic rigor and teaching excellence, the school offers programs that are designed to give students practical experience making decisions in real-world environments. The school offers MBA and Executive MBA (EMBA) degrees, as well as non-degree Executive Education programs. For more information, visit www.gsb.columbia.edu.

Media Contact

More Information:

http://www.columbia.eduAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

High-energy-density aqueous battery based on halogen multi-electron transfer

Traditional non-aqueous lithium-ion batteries have a high energy density, but their safety is compromised due to the flammable organic electrolytes they utilize. Aqueous batteries use water as the solvent for…

First-ever combined heart pump and pig kidney transplant

…gives new hope to patient with terminal illness. Surgeons at NYU Langone Health performed the first-ever combined mechanical heart pump and gene-edited pig kidney transplant surgery in a 54-year-old woman…

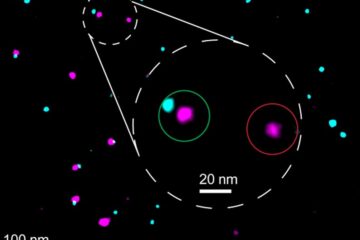

Biophysics: Testing how well biomarkers work

LMU researchers have developed a method to determine how reliably target proteins can be labeled using super-resolution fluorescence microscopy. Modern microscopy techniques make it possible to examine the inner workings…