Venture capitalism as medicine for the economic crisis

“The financial crisis is an excellent example of how important it is to build up lasting values in the economy, because it has several cornerstones. Some 30,000 private venture capital investments are made each year in Sweden. These investments are often based on in-depth knowledge of regions, industries, and companies. Knowledge and personal commitment create more value than regular stock-market trading does,” says Sofia Avdeitchikova.

She has just defended her doctoral dissertation at the School of Economics and Management at Lund University about informal venture capital, that is, equity capital that private individuals invest in unlisted companies with which they have no family relation.

This field is under-researched, partly because private venture capitalists are highly invisible. The study is based on interviews with 400 Swedish investors, and it presents average numbers for the last ten years. The dissertation refutes the notion that private venture capitalists are a group dominated by so-called business angels, that is, individuals who invest privately, acquire a significant share of equity, and have a large degree of post-investment influence by working on the board of directors. Only ten percent of private investors are business angels. The rest are people who make a few small investments in their life.

“It’s important to look at these individuals in a life-cycle perspective. No one is born to be a business angel. It’s something you become, and it’s interesting to see how that happens.”

Business angels make investments averaging around fifty thousand euros in young entrepreneurial companies, while smaller investors commit everything from a few hundreds to ten thousand euros. Some small investors are called ‘Lotto’ investors, because they have neither a lot of money nor much knowledge; instead they invest a small sum and come back two or three years later to see whether the investment has resulted in any profit.

At the same time, many investors are true ‘small angels’, with a great deal of personal involvement in the companies. They mediate key contacts and work hard for the company. Their investments are therefore worth more than the sum of money they provide. Often these active investors are small business owners with a good sense for business and an entrepreneurial spirit, and every fifth one is a woman.

“In many cases these investors are more competent to make investments than regional structural funds are, and we should use their knowledge to make right kinds of investments, for example by setting up collaborative arrangements where state actors and private individuals invest 50 percent each.”

The common belief is that private venture capital is evenly spread around the country, but in practice 95 percent of investments go to metropolitan areas and university cities. In Sweden the availability of private venture capital is also rather limited. To shore up the supply of capital to companies, which is important for economic growth, tax incentives and enhancing availability of information about investment opportunities may be a way forward.

“These are measures that have worked in countries with more sophisticated venture capital markets, such as the UK and the US. At the same time, it’s always hard to transfer policy measures from other countries. They need to be adapted to the local context,” says the researcher.

Regarding investments in peripheral regions, which should be increased if we want to achieve more even economic growth, the notion is that they often come from local investors. But Sofia Avdeitchikova found that 80 percent of these investments are made outside the local region.

“This raises questions about how investors get information about the object and how contacts take place. It turns out that investors in these cases think about distance in a different way. Previous experience of the industry of the firm is more important than being close to it geographically. People invest in people in their own network, and it’s easier for them to invest in a place that has a similar business structure, size, values, and traditions as their own.”

Sofia Avdeitchikova publicly defended her dissertation Close-ups from afar: the nature of the informal venture capital market in a spatial context on October 10 at the Department of Business Administration, School of Economics and Management, Lund University.

Media Contact

More Information:

http://www.lu.seAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Bringing bio-inspired robots to life

Nebraska researcher Eric Markvicka gets NSF CAREER Award to pursue manufacture of novel materials for soft robotics and stretchable electronics. Engineers are increasingly eager to develop robots that mimic the…

Bella moths use poison to attract mates

Scientists are closer to finding out how. Pyrrolizidine alkaloids are as bitter and toxic as they are hard to pronounce. They’re produced by several different types of plants and are…

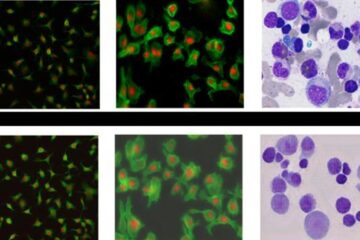

AI tool creates ‘synthetic’ images of cells

…for enhanced microscopy analysis. Observing individual cells through microscopes can reveal a range of important cell biological phenomena that frequently play a role in human diseases, but the process of…