Unpredictable Exchange Rates—The Present and Future of Yen Exchange Rates

Just when we thought that the value of the yen would drop due to the tremendous damage that the major earthquake disaster had on the Japanese economy, the yen reached its highest prices against the dollar since the war. This unpredictable way of fluctuation of the yen has a charm reminiscent of a woman who makes you want to know her better all the more because she is hard to know well.

Therefore, rather than considering about the changeable yen-dollar exchange rates in the immediate future, I would like to look at where the yen-dollar rates are headed in the long term by clarifying the yen’s present situation in the international financial markets as well as the situation the yen will face in the future.

The Yen—The Third Currency

Foreign exchange markets are not actual physical places, but rather consist of negotiated transactions made through electronic terminals. In general, foreign exchange markets refer to those confined to foreign exchange transactions between institutions such as banks of different countries. According to the reports released by the Bank for International Settlements (BIS), the daily average total value of spot exchange rates of all currency pairs traded in inter-bank markets was 1.49 trillion dollars in fiscal 2010. This is equivalent to one-third of Japan’s annual gross domestic product (GDP). The yen is the third most-traded currency in foreign exchange transactions where it is traded, after the US dollar and the euro. Transactions that involve at least one of these three currencies account for over 70 percent of all currency transactions.

Problems in the Euro Zone Economy

Following fiscal 2010, Greece is forced to avoid the default of its government debts by receiving loans from EU countries and the IMF in fiscal 2011. In addition, the three economies that comprise PIGS with Greek, such as Portugal, Italy and Spain, are raising concern among international financial markets as having relatively large budget deficits among EU member states. Influenced by the situations of these countries, there is anxiety within international financial markets about the economies of the EU member nations as a whole. It is unlikely that funds from outside the zone will steadily flow into Euro area under these circumstances, and therefore, there is not any aggressive buying of the euro in international financial markets in general.

Problems in the US economy

The budget deficit of the US, which has been financing its huge military spending with the issuing of national bonds as a part of its antiterrorism measures after the 9.11 attacks, has already reached the limits of its legal standards. In addition, the US government was in a situation where it would lapse into default if it did not relax these limits. Furthermore, it has been rumored in the markets that the investment ratings of US Treasury bonds will be lowered in response to this situation (as of early August, when this article was written). The unemployment rates in the US also remain high, which indicates that the recession in the US economy remains a serious problem. The predominant view is that the credit relaxation measures will continue in the US under these circumstances. Moreover, the difficulty in issuing new national bonds (the government’s new debts) made the supply and demand of US Treasury bonds stringent and reversed the difference in interest rates between Japan and the US as the distribution rates of some short-term US Treasury bonds fell below those of Japan’s. Taking the current state of the US economy into consideration, it is unlikely that a lot of money seeking higher interest rates will flow into the US.

The Buying of the Yen as a Result of Elimination of Options

These economic situations in the euro zone and the US are making the market to expect there will unlikely be strong inflow of international capital to these economic zones, and such expectation is resulting in reluctant attitudes towards buying of the euro or the dollar at inter-bank markets.. As a result, the third currency, the Japanese yen, is likely to be bought as a method of elimination. This passive buying of the yen becomes evident, for example, when looking at exchange rates with the Australian dollar, which is a commodity currency. The yen exchange rate to the Australian dollar in 2009 was in the 50 yen range, but it is now close to the 90 yen range. Therefore, there is a relative appreciation of the yen against the euro and the dollar, but this is limited to the euro, dollar, and yen markets that are large on an international scale and does not signify the absolute appreciation of the yen. In other words, it can be said that this is yen appreciation based on a negative rating of it where it is simply chosen from among currencies of large market shares. Because of this situation, the US dollar and the euro can quite possibly be bought, making a conversion for sharp yen depreciation in the near future if the policy makers in the United States and the EU countries could present new budget deficit reduction measures that are trusted in the markets.

The Future of the Yen

As stated above, the current yen appreciation is based on negative evaluations and by no means reflects Japan’s economic strength. It is true that Japan’s situation is different from that of Greece’s, where they heavily rely on international funding to fill in their budget deficit in the future, as over 90% of Japan’s national bonds are held domestically and the government deficit is being filled in domestically with domestic private sector surplus. Furthermore, when looking at the macro balance of the Japanese economy, the private sector surplus is compensating not only for the Japanese government’s lack of money, but is filling in for the lack of money in the US and other countries overseas as well.

Basically, Japan’s private sector surplus is by far the biggest in the world, and this provides a sense of security for the time being. That surplus money was accumulated from the previous stages of economic development, however, and we cannot deny that these surpluses will greatly decrease and Japan will have to depend on funds from overseas for filling in the budget deficit when considering the declining birthrate and growing proportion of elderly people, and the stagnation of economic development. Therefore, financial reconstruction must be made quickly before such a situation raises international anxiety and the yen plunges. In order to do this, taxes must be increased. In addition to reducing the budget deficit, distributing a portion of the revenues from tax increases to newly emerging industries including renewable energy with the aim of achieving further sustainable economic growth will help raise the value of the yen in the true sense. With Japan’s technological capabilities, I believe that sustainable development in such earth-friendly fields is certainly possible, and I also feel that this is something that we most certainly should have faith in.

About the author

Yoshihiro Kitamura

Associate Professor, Faculty of Social Sciences, Waseda University

Appointed to current post in April 2011 after graduating from School of Social Sciences, Waseda University, completing the Doctorate Course in Economics at Graduate School of Economics, Waseda University (Ph.D.), and serving as Associate Professor on the Faculty of Economics at the University of Toyama.

Latest paper: “The impact of order flow on the foreign exchange market: A copula approach” (2011) Asia-Pacific Financial Markets. Volume 18, Number 1, 1-31

Media Contact

All latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Bringing bio-inspired robots to life

Nebraska researcher Eric Markvicka gets NSF CAREER Award to pursue manufacture of novel materials for soft robotics and stretchable electronics. Engineers are increasingly eager to develop robots that mimic the…

Bella moths use poison to attract mates

Scientists are closer to finding out how. Pyrrolizidine alkaloids are as bitter and toxic as they are hard to pronounce. They’re produced by several different types of plants and are…

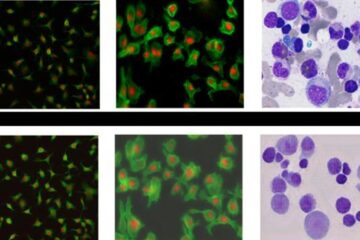

AI tool creates ‘synthetic’ images of cells

…for enhanced microscopy analysis. Observing individual cells through microscopes can reveal a range of important cell biological phenomena that frequently play a role in human diseases, but the process of…