Stock Options Improve Executive Performance but Have Minimal Effect on Rank-and-File Workers

It’s become an article of faith in Silicon Valley that those rewards create incentives for employees to work harder and smarter, in turn rewarding the companies that lavish options on the workforce with better performance and greater shareholder value.

But does that assumption stand up to careful scrutiny?

The answer: It depends on who is receiving the options, according to a new study co-authored by Assistant Accounting Professor Nicole Bastian Johnson, University of California, Berkeley’s Haas School of Business.

“Our findings provide evidence that options provide incentive effects at the executive level that are sufficiently large to be reflected in firm performance, but no evidence for similar incentive effects for non-executive employees,” wrote Johnson and co-authors, Professor David Aboody of UCLA’s Anderson School of Management and Associate Professor Ron Kasznik of Stanford’s Graduate School of Business.

Their paper, “Employee Stock Options and Future Firm Performance: Evidence from Option Repricings,” will be published in the Journal of Accounting and Economics later this year. Learning that granting options to a broad selection of employees may not be an effective tool is the paper’s most important contribution to the literature, Johnson says.

Options and their effect on corporate performance have been frequently studied. However, nearly all of the research has focused on options for executive-level employees. Few researchers have looked at companies that granted options to rank-and-file employees, largely because obtaining data is so difficult, says Johnson.

Public companies generally disclose option grants on regularly scheduled proxy statements, but usually for only top-level managers. Digging through hundreds of corporate filings with the Securities and Exchange Commission to find who else may have received options is extremely time-consuming. But that’s exactly what Johnson and her colleagues did.

The researchers identified 1,364 companies with employee stock options whose stock price declined by 30 percent or more annually in any of the years between 1990 and 1996. Of those companies, 300 repriced and formed a basis of comparison to a control group of the 1,064 that didn’t.

The researchers theorized that when a company’s stock price falls below the exercise price of an option, much of any incentive effect the options may have had disappears. Repricing those options should restore those incentives, the researchers assumed. A situation in which options have been repriced should be similar to that of a newly instituted option-grant program.

The researchers first asked whether companies that repriced outperformed the companies that didn’t, as measured by cash flow and operating income over one, three, and five years. Companies that repriced options did significantly outperform the control group, and the performance gap grew over time.

Johnson and her colleagues also found that companies that had re-priced options for only executive-level employees significantly outperformed the companies that had not repriced at all. But firms that repriced options for only non-executive employees did not outperform the control group.

While Johnson is confident that the study’s results are meaningful, there are, she says, a number of caveats.

The researchers chose to study performance before significant accounting changes were made to the treatment of options, particularly the rule instituted in 2005 requiring companies to expense the cost of options. However, while that rule may have prompted some firms to cut back on granting stock options, the researchers do not have any reason to assume it would have changed the effect that option grants have on employee behavior—the focus of their study.

More on Nicole Bastian Johnson: http://www2.haas.berkeley.edu/Faculty/johnson_nicole.aspx

See the full paper: http://bit.ly/bOdS0B

Media Contact

More Information:

http://www.haas.berkeley.eduAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

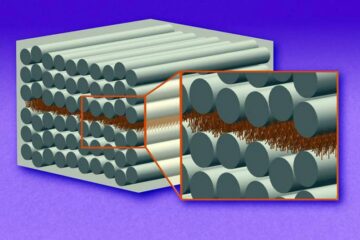

“Nanostitches” enable lighter and tougher composite materials

In research that may lead to next-generation airplanes and spacecraft, MIT engineers used carbon nanotubes to prevent cracking in multilayered composites. To save on fuel and reduce aircraft emissions, engineers…

Trash to treasure

Researchers turn metal waste into catalyst for hydrogen. Scientists have found a way to transform metal waste into a highly efficient catalyst to make hydrogen from water, a discovery that…

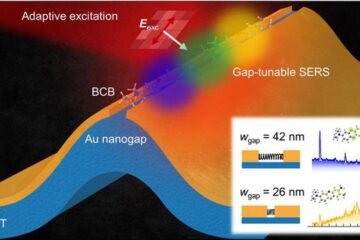

Real-time detection of infectious disease viruses

… by searching for molecular fingerprinting. A research team consisting of Professor Kyoung-Duck Park and Taeyoung Moon and Huitae Joo, PhD candidates, from the Department of Physics at Pohang University…