Smaller companies hit hardest during emerging market crises

This unexpected result suggests the significant impact that investors’ actions can have during emerging market crises. During these crises, investors flee to the perceived safety of big companies and shed stocks of smaller companies, despite comparable levels of international exposure during normal periods.

“The take-away is, just because you invest locally doesn’t mean you are protected from the global market,” said David Berger, an assistant professor of finance at Oregon State University.

Looking at almost 20 years of data that covered about eight large emerging market crashes, Berger and H.J. Turtle of Washington State University uncovered this flight-from-risk trend on the part of investors that flee from small stocks. The results are published in the current issue of the Global Finance Journal.

“We would expect that stock markets in two different, but related economies would crash at the same time,” Berger said. “But we found that during big market crashes, investors adjust their holdings towards bigger corporate stocks that they perceive as being safer, even after controlling for economic exposures.”

Berger said the results of his study are unexpected because past research has focused on the aggregate U.S. market as a whole and found little impact during emerging market crises.

“Investors see these big blue chip stocks as the safer ones, and small, R&D intensive stocks for example, as riskier,” Berger said. “So the stock of a smaller domestic company could take a hit because of an international shock.”

Berger studies U.S. equity markets and international stocks, and said the findings from this study have important implications for investors, even those who tend to invest mainly in the domestic market.

“Interestingly, larger stocks often benefited from emerging market crises and exhibited positive returns,” Berger added. “Because investors started dumping smaller stocks in favor of safer, larger ones, the irony is that larger multinational corporations potentially see positive benefits during international crises.”

About the OSU College of Business: The College of Business educates students for success in managing and developing sustainable, innovative enterprises in a dynamic economy. With strong graduate and undergraduate programs, internationally recognized scholarly research, and an emphasis on experiential learning, the college helps students and businesses succeed.

Media Contact

More Information:

http://www.oregonstate.eduAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

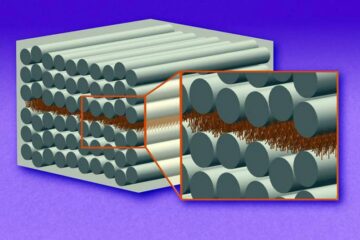

“Nanostitches” enable lighter and tougher composite materials

In research that may lead to next-generation airplanes and spacecraft, MIT engineers used carbon nanotubes to prevent cracking in multilayered composites. To save on fuel and reduce aircraft emissions, engineers…

Trash to treasure

Researchers turn metal waste into catalyst for hydrogen. Scientists have found a way to transform metal waste into a highly efficient catalyst to make hydrogen from water, a discovery that…

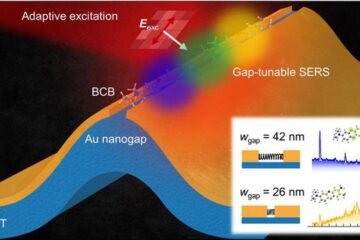

Real-time detection of infectious disease viruses

… by searching for molecular fingerprinting. A research team consisting of Professor Kyoung-Duck Park and Taeyoung Moon and Huitae Joo, PhD candidates, from the Department of Physics at Pohang University…