Rich corporate life outside of the stock exchange

Listed companies are only the tip of the iceberg, states Associate Professor Janis Berzins and Professor Øyvind Bøhren at BI Norwegian School of Management.

If the overall employment in Norwegian limited companies is seen as an iceberg, the companies listed on the stock exchange more or less form the tip visible above the water.

Underneath the surface is where we find all the unlisted limited companies.

The iceberg metaphor is also suitable for the level of knowledge people have regarding limited companies. Several surveys have been conducted on conditions above the surface. But very few have studied what goes on below the surface, which is where most of the action is. This does not apply merely to Norway, but also to the rest of the world.

This is confirmed by Janis Berzins and Øyvind Bøhren at the Centre for Corporate Governance Research at BI Norwegian School of Management (BI).

Berzins and Bøhren have conducted a study of the conditions below the surface in order to obtain an overview of the unlisted limited companies in Norway. The results of the study are published in the annual report Statens Eierberetning 2007 (the Government's ownership report), issued by the Ministry of Trade and Industry.

At least twice as big

The number of limited companies in Norway is increasing. In 1994 there were roughly 100,000 limited companies in Norway. In 2005, the number of Norwegian limited companies had increased by as mush as 80 per cent to 180,000 limited companies. Berzins and Bøhren have conducted a study of approx. 80,000 selected limited companies, where adequate information on business administration and corporate governance is available.

The BI researchers document an exceptionally rich corporate life outside the Oslo Stock Exchange, and consequently out of the spotlight of the financial press. For each listed limited company, there are no less than 500 unlisted limited companies. The unlisted companies have more than four times as many employees as the listed sector. The unlisted sector is nearly twice as big as the limited companies listed, measured by sales or assets. Consequently, the unlisted sector is 2-4 times bigger than the listed sector, regardless of how we measure the size, according to Berzins and Bøhren.

It is not true that unlisted limited companies are always small. Certainly the typical company on the Oslo Stock Exchange is 100 times larger than one outside the stock exchange, but there are far more large unlisted companies than listed ones.

If we set the limit for a large company to more than 100 employees, we had around 1,000 large companies in Norway in 2005. The BI study shows that only 100 of these were listed on the stock exchange.

Unlisted companies are different

In their study, the finance researchers document that there is a big difference in the ownership structure in unlisted companies and limited companies listed on the stock exchange. In the listed limited companies the largest owner has an average of 25 per cent of the shares in the company. The three largest owners in listed companies own a total of approx. 43 per cent of the shares in the company. The unlisted companies are quite another story: the largest owner has an average of up to 70 per cent of the shares, while the company's three largest owners control 95 per cent of the company. The ownership power is therefore more concentrated in the unlisted companies. The higher the ownership interest, the more power over the company and the larger incentive to conduct active corporate governance. The picture is the same for both small and large unlisted limited companies.

There are also obvious differences in ownership types in listed and unlisted companies. In the unlisted companies, the predominant owners are individuals with an average of 77 per cent of the shares. In the listed companies the owners are mainly other companies, not individuals. On average, individuals own only 18 per cent of the shares in companies listed on the Oslo Stock Exchange, while Norwegian institutions and industry own more than half (52 per cent) of the shares.

Different management challenges

Because the ownership structure is different in the unlisted companies, they are faced with entirely different challenges relating to ownership. “This does not mean, however, that they are easier to manage,” underline Berzins and Bøhren. They outline two fundamental governance problems for limited companies:

1. Conflicts of interest between owners and managers. This problem arises when ownership and management are separated, i.e. when the owners delegate their power to a management with weak compensation incentives. The problems escalate with a low ownership concentration, more of the ownership being exercised indirectly, and where the owners are absent from the boardroom.

2. Conflicts of interest between owners – particularly between weak and strong owners. The problem arises when strong owners help themselves to parts of a jointly owned company at the cost of weak owners. This problem increases with a higher ownership concentration, and the more dominant the large owner is on the board and in the management.

“Unlisted companies avoid the first governance problem (conflicts between the owners and management), but are correspondingly more vulnerable to the other governance problem (conflicts between the owners),” claim Berzins and Bøhren.

Media Contact

More Information:

http://www.bi.noAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

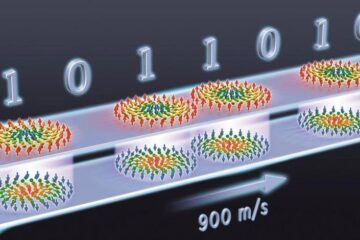

Skyrmions move at record speeds

… a step towards the computing of the future. An international research team led by scientists from the CNRS1 has discovered that the magnetic nanobubbles2 known as skyrmions can be…

A flexible and efficient DC power converter for sustainable-energy microgrids

A new DC-DC power converter is superior to previous designs and paves the way for more efficient, reliable and sustainable energy storage and conversion solutions. The Kobe University development can…

Technical Trials for Easing the (Cosmological) Tension

A new study sorts through models attempting to solve one of the major challenges of contemporary cosmic science, the measurement of its expansion. Thanks to the dizzying growth of cosmic…