Researchers: Mutual Fund Fee Could Make Money for Investors

Short-term redemption fees could boost returns for mutual fund investors by as much as 3.27 percent a year, according to researchers in Texas Tech University’s Division of Personal Financial Planning.

The three authors of Redemption Fees: Reward for Punishment, presented at the 2010 Morningstar Ibbotson Conference in Orlando, Fla., found that fees that penalize investors for selling a fund before a certain period of time discourage investors from trading in and out of mutual funds, protecting long-term investors.

Redemption fees have enjoyed a recent surge in popularity, the study noted; the proportion of funds employing such fees more than tripled following the mutual fund market timing scandal of 2003.

Authors included Michael S. Finke, associate professor of personal financial planning, and David Nanigian of the Texas Tech College of Human Sciences and William Waller of the Kenan-Flagler Business School at University of North Carolina at Chapel Hill.

“Mutual funds initiated redemption fees mainly to show investors that they were serious about reducing abusive short-term trading practices,” Finke said. “The fees didn’t improve performance in funds that invested in larger, more liquid securities. However, micro-and small-cap funds saw a significant increase in performance after they imposed the fees.

“Unfortunately, redemption fees have a marketing problem since they are labeled a fee instead of what they actually are – a transfer from short-term to long-term investors.”

They found that short-term redemption fees benefit funds that invest in illiquid securities, or financial assets that are not easily sold or exchanged for cash.

They also noticed a link between the size of the penalty and the length of time investors are required to hold shares. Those funds that charged the maximum 2 percent penalty allowed by law and that imposed a holding period of more than two months produced the greatest returns over those funds that didn’t charge penalties.

“Many investors don't appear to be paying attention to redemption fees when making fund choices,” Finke said. “Unfortunately, we're already beginning to see many fund families eliminating them. Our research shows that long-term investors should seek out funds that impose fees on short-run redemptions.”

To view the entire article, visit http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1118959

Michael S. Finke, associate professor of personal financial planning, College of Human Sciences, Texas Tech University, at (806) 742-5050 ext. 25 or Michael.s.finke@ttu.edu

Media Contact

More Information:

http://www.ttu.eduAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Silicon Carbide Innovation Alliance to drive industrial-scale semiconductor work

Known for its ability to withstand extreme environments and high voltages, silicon carbide (SiC) is a semiconducting material made up of silicon and carbon atoms arranged into crystals that is…

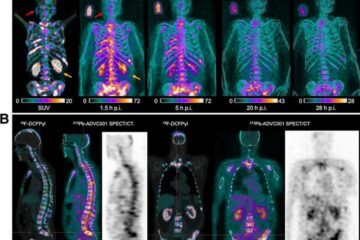

New SPECT/CT technique shows impressive biomarker identification

…offers increased access for prostate cancer patients. A novel SPECT/CT acquisition method can accurately detect radiopharmaceutical biodistribution in a convenient manner for prostate cancer patients, opening the door for more…

How 3D printers can give robots a soft touch

Soft skin coverings and touch sensors have emerged as a promising feature for robots that are both safer and more intuitive for human interaction, but they are expensive and difficult…