Research reveals best paths for success as microfinance sector grows

“Microfinance Meets the Market,” just published in the Journal of Economic Perspectives, advances the debate, presenting new research from Jonathan Morduch of the Financial Access Initiative, housed at New York University's Wagner Graduate School of Public Service, and Robert Cull and Asli Demirgüç-Kunt of the World Bank. The research reveals complementary paths to a successful expansion of the microfinance industry.

The full article is available online, here: http://financialaccess.org/sites/default/files/G4_Microfinance_

Meets_Market_0.pdf

“Arguing for a purely nonprofit or commercial approach to global microfinance services misses the point and limits the opportunities to reach a significantly broader population,” commented Professor Morduch. “We shouldn't be choosing sides. By embracing both NGO and commercial options we can leverage innovation to drive down costs and expand access.”

Roughly 40-to-80 percent of the populations in most developing economies lack access to formal banking services. There is general agreement that access to reliable financial services could improve the lives of hundreds of millions, perhaps billions, of low-income people currently without access to banks.

In examining 346 of the world's leading microfinance organizations covering 18 million borrowers, the research presented in “Microfinance Meets the Market” reveals that while commercialization is a powerful trend, commercial banks such as Mexico's Compartamos and avowedly “social businesses” like Grameen Bank are not substitutes for each other. Each has benefits and limitations.

Commercial microfinance banks, as a group, make loans that on average are about four times larger than loans from non-governmental organizations (NGOs). Since poorer customers generally demand smaller loans, average loan size is a rough proxy for the poverty level of customers. Microfinance banks tend to serve a substantially better-off group of borrowers than do NGOs, and banks also serve fewer women as a share of their customers.

While many NGOs do in fact earn profits from their microfinance activities, investors seeking only financial returns would have little interest in most of the institutions serving poorer customers. Commercial investment is necessary to fund the continued expansion of microfinance, but institutions with strong social missions, many taking advantage of subsidies, remain best placed to reach and serve the poorest customers and some are doing so at massive scale. The paper shows that social investors, foundations, and public agencies remain an important part of the microfinance equation.

About the Financial Access Initiative:

The Financial Access Initiative (FAI) is a consortium of leading development economists focused on substantially expanding access to quality financial services for low-income individuals, offering the next generation of thinking about microfinance. FAI is housed at the Wagner Graduate School of Public Service at New York University and led by managing director Jonathan Morduch and directors Dean Karlan (Yale University) and Sendhil Mullainathan (Harvard University). FAI focuses on basic research and measurement tools that reveal the most effective means of implementing microfinance initiatives. FAI studies the value of microfinance by identifying the demand for financial services; the impact of financial access on incomes, businesses, and broader aspects of well-being; and mechanisms that can increase impact and scale of microfinance.

Media Contact

All latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

High-energy-density aqueous battery based on halogen multi-electron transfer

Traditional non-aqueous lithium-ion batteries have a high energy density, but their safety is compromised due to the flammable organic electrolytes they utilize. Aqueous batteries use water as the solvent for…

First-ever combined heart pump and pig kidney transplant

…gives new hope to patient with terminal illness. Surgeons at NYU Langone Health performed the first-ever combined mechanical heart pump and gene-edited pig kidney transplant surgery in a 54-year-old woman…

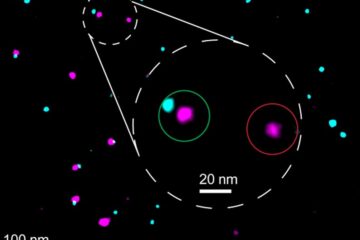

Biophysics: Testing how well biomarkers work

LMU researchers have developed a method to determine how reliably target proteins can be labeled using super-resolution fluorescence microscopy. Modern microscopy techniques make it possible to examine the inner workings…