Northern Rock crisis underlines need for greater disclosure to plug ‘information gap’

Changes are needed to plug an ‘information gap’ that currently makes it difficult to judge the relative risk exposure of different banks before problems become apparent.

In recent research, a team of risk experts at Nottingham University Business School concluded that any such revision to the regulations should ideally include requirements to disclose specific categories of information that are useful for the evaluation of risk exposure.

The Northern Rock crisis has already seen customers withdraw over £2bn of their savings from the bank since it applied to the Bank of England for emergency funds on September 13. Northern Rock’s share price had fallen by one third by close of business on Friday, September 14, and fell even further in trading on Monday, September 17.

Margaret Woods, Associate Professor at Nottingham University Business School (NUBS), said the crisis has raised a number of issues relating to the economics of banking, but also questions of risk management and the related accounting regulations.

She said: “Press comment has so far ignored one very important dimension which is the subject of research within NUBS, and that is the nature and usefulness of the information available to capital markets relating to a bank’s credit exposure and lending quality.

“NUBS researchers have identified significant variations in both the level and the usefulness of risk disclosures across the major world banks and also across the UK banking sector. The variations in disclosure are found in both bank trading books and banking books.

“Even for the very largest banks it is extremely difficult, if not impossible, for an outside party to assess aggregate risk exposures and compare this information with competitor institutions.

“The disclosures risk further potential dilution with the replacement of bank-specific accounting regulations (IAS 30) with generic disclosure rules under IFRS7. We believe that this results in a significant information gap that requires the attention of both banking and accounting regulators.

“Additionally, the adoption of sophisticated risk management systems within banking institutions does not negate, and may actually exacerbate the systemic risks within global financial markets. One obvious example is the internal use of Value at Risk models for control of market risk, which it has been suggested may increase the level of systemic risk.”

Mrs Woods said the problems highlighted by the Northern Rock crisis demonstrated the need for further consideration of:

•The role of the Bank of England as lender of last resort, and the risk of moral hazard that may encourage banks to take deploy increasingly risky strategies

•The relationship between bank liquidity and bank solvency, or the relative importance of cash flow versus collateral

•The potential limitations of existing capital-based banking regulations which largely ignore liquidity issues

•The case for extending the Basel regulatory requirements to incorporate restrictions on a bank’s dependence upon specific sources of funding

•The interface between institutional risk management and systemic risk in the financial markets

Media Contact

More Information:

http://www.nottingham.ac.ukAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

High-energy-density aqueous battery

…based on halogen multi-electron transfer. Traditional non-aqueous lithium-ion batteries have a high energy density, but their safety is compromised due to the flammable organic electrolytes they utilize. Aqueous batteries use…

First-ever combined heart pump and pig kidney transplant

…gives new hope to patient with terminal illness. Surgeons at NYU Langone Health performed the first-ever combined mechanical heart pump and gene-edited pig kidney transplant surgery in a 54-year-old woman…

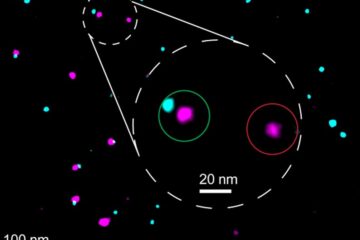

Biophysics: Testing how well biomarkers work

LMU researchers have developed a method to determine how reliably target proteins can be labeled using super-resolution fluorescence microscopy. Modern microscopy techniques make it possible to examine the inner workings…