Money illusion and the market

To illustrate, compare a situation in which money wages increase 2.3% and prices increase 3.1% over one year with a situation in which money wages fall by 0.8% at constant prices. The two situations are equivalent in “real terms”, i.e. if inflation is taken properly into account. People who perceive these situations differently are said to be prone to money illusion.

Economists have only begun to understand when money illusion affects market outcomes. It was commonly thought that the impact of irrational behaviour is limited in markets because “smart agents” can take advantage of irrational traders. However, recent evidence from the field and the experimental laboratory suggests that money illusion can affect markets.

Effects on the housing market

A striking example comes from the housing market. Housing prices have risen sharply in several countries, and booms followed by busts are common in housing markets. Money illusion in the guise of a confusion of nominal and real interest rates may be partly to blame. When inflation is low, monthly nominal interest payments on mortgages are low compared to the rent of a similar house. Housing prices therefore seem cheap, causing illusion-prone buyers to buy rather than rent which, in turn, causes an upward pressure on housing prices when inflation declines. However, decreasing inflation also increases the real cost of future mortgage payments. Investors who base their decision on the salient low nominal mortgage payments but ignore the less visible effect of inflation on the future real mortgage cost are prone to an illusion.

Experimental evidence

Economists have remained sceptical because field evidence consistent with money illusion may also be consistent with alternative accounts, involving fully rational agents. Such alternative accounts can convincingly be ruled out in the laboratory. Experimental studies complement field studies by investigating simpler markets but under more controlled conditions, allowing researchers to isolate the effect of money illusion.

Experiments conducted by Ernst Fehr (University of Zurich) and Jean-Robert Tyran (University of Copenhagen) show that money illusion can have a profound impact on market prices. In the experiments, decision makers are presented with either real or nominal information on profits under otherwise identical conditions to test the effect of inflating or deflating all nominal values. The authors find that firms are reluctant to cut nominal prices with deflation in an attempt to avoid lower nominal profits associated with lower price levels, but are much less reluctant to increase nominal prices with inflation. The studies also show that money illusion has stronger effects on market prices when rational agents have incentives to “follow the crowd” rather than to “go against the tide”, i.e. when they compensate the choices of those prone to money illusion.

Media Contact

More Information:

http://www.ku.dkAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Silicon Carbide Innovation Alliance to drive industrial-scale semiconductor work

Known for its ability to withstand extreme environments and high voltages, silicon carbide (SiC) is a semiconducting material made up of silicon and carbon atoms arranged into crystals that is…

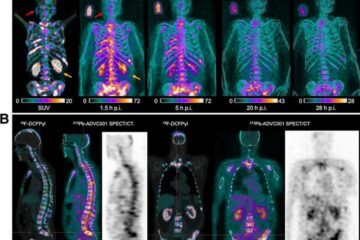

New SPECT/CT technique shows impressive biomarker identification

…offers increased access for prostate cancer patients. A novel SPECT/CT acquisition method can accurately detect radiopharmaceutical biodistribution in a convenient manner for prostate cancer patients, opening the door for more…

How 3D printers can give robots a soft touch

Soft skin coverings and touch sensors have emerged as a promising feature for robots that are both safer and more intuitive for human interaction, but they are expensive and difficult…