A question of trust

The index, a wholly new approach to the measurement of trust among the general public, shows that brokers and advisers are the most trusted, followed by building societies, then banks, then investment companies.

At the bottom of the Index, credit card firms and life insurance companies received the lowest ratings of all the financial services institutions (FSIs), when more than 2,800 interviews were conducted with members of the public about their perceptions of the bodies they deal with on a day-to-day basis.

The Trust Index has been developed to monitor levels of consumer trust in the industry — against a background of increasing concern about declining levels of consumer trust in financial services, perceived industry malpractice such as mis-selling of pensions and endowments, and the impact of recent stock market difficulties.

Media coverage of the financial services sector frequently highlights poor relationships between customers and FSIs, which in many cases appear to be underpinned by a lack of trust.

Professor Christine Ennew, of Nottingham University Business School, has led work on the Trust Index funded by the Financial Services Research Forum, which is based at the University and is the only independent university-based academic Forum which brings together and actively networks a large sample of the major retailers of financial services, supplier companies and consumer interest groups.

Professor Ennew said: “Trust and trustworthiness are at the heart of any exchange relationship and nowhere is this more apparent than in financial services.

“Intangibility, product complexity, the long-term nature of many products and the importance of financial assets in relation to individual well-being mean that customers experience high levels of risk when making purchase decisions. They typically lack specialist knowledge and may have difficulty in judging product performance. The costs of making a mistake are considerable.

“Faced with such risk and uncertainty, many customers are dependent on financial services institutions (FSIs) to offer products of an appropriate type and quality — and must trust them to do so.

“However, there is growing concern about the extent to which FSIs are trustworthy and the extent to which consumers trust them.”

The Trust Index was set up to look at the issue in far greater depth than has ever been done before. Previous surveys of the sector have been limited in their design — often being limited to simple yes/no answers.

But the Trust Index broadens this out to give a uniquely detailed analysis, by looking at how customers rated FSIs on two levels:

•Low-level trust — relates to the extent to which an organisation can be relied on to do what it says it will do.

•Higher level trust — relates to the extent to which the organisation is concerned about the interests of its customers.

The result is a new insight into how key determinants of the quality of customer relationships are changing, as well as an aid to understanding the factors that determine them.

The findings of the Trust Index indicate, for example, that many FSIs get their highest customer ratings in relation to ability and expertise in their field — ie. in the area of ‘low-level’ trust. But they find it much harder to present themselves to customers in terms of ‘higher level’ trust, particularly in relation to shared values.

In other words, while many customers might trust their building society to operate effectively in its sector, fewer feel that it has their interests at heart.

Organisational trustworthiness, which is defined as the extent to which customers perceive that an FSI is worthy of their trust, is determined by communications, shared values, integrity, ability/expertise and benevolence.

The Trust Index also complements the ongoing concerns of the Financial Services Authority (FSA), about ‘Treating Customers Fairly’, which reflects the inherent link between fairness and trust.

As part of the study, FSIs were compared with other major institutions, which yielded some surprising results. This part of the exercise found that the level of trust in FSIs was in fact rather better than for bodies such as the BBC, the NHS and major high-street supermarkets chains.

Interestingly, the study also found that levels of trust in the BBC and NHS have dropped noticeably between 2006 and 2007, while levels of trust in FSIs have remained fairly consistent.

Professor Ennew concluded that overall levels of trust in FSIs were in fact ‘surprisingly high’ when considered in relation to existing anecdotal evidence, although it did vary between different types of institution.

However, the analysis by age suggests this position might be vulnerable in the longer term – because the younger the customer, the less trusting they were.

Professor Ennew said: “Those under 55 show significantly lower degrees of trust in FSIs, perhaps reflecting different experiences of the financial services sector. This is suggestive of a significant challenge for FSIs in the future management of their relationships with customers outside this age group.”

Media Contact

More Information:

http://www.nottingham.ac.ukAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Bringing bio-inspired robots to life

Nebraska researcher Eric Markvicka gets NSF CAREER Award to pursue manufacture of novel materials for soft robotics and stretchable electronics. Engineers are increasingly eager to develop robots that mimic the…

Bella moths use poison to attract mates

Scientists are closer to finding out how. Pyrrolizidine alkaloids are as bitter and toxic as they are hard to pronounce. They’re produced by several different types of plants and are…

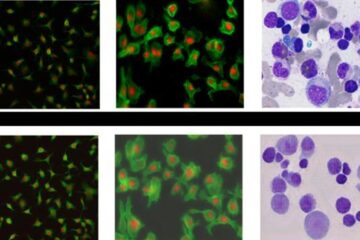

AI tool creates ‘synthetic’ images of cells

…for enhanced microscopy analysis. Observing individual cells through microscopes can reveal a range of important cell biological phenomena that frequently play a role in human diseases, but the process of…