Micro-finance alleviates poverty

Micro-finance really came under the spotlight after Professor Mohammad Yunus and Grameen Bank in Bangladesh won the Nobel Peace Prize for their work relating to micro-finance.

Grameen Bank is far from being alone in the micro-finance arena. Today, there are around 3,000 micro-finance institutes in existence worldwide. In total, they have more than 80 million clients, impacting on more than 400 million people (including the client’s families), many of them among the world’s poorest.

“Micro-finance is a simple, interest-bearing small loan for poor people who wish to support themselves,” explains Professor Torger Reve at BI Norwegian School of Management.

Reve has for many years been following the growth of micro-finance through his position as chief consultant for the Strømme Foundation, the biggest Norwegian-based player within micro-finance.

Torger Reve, who is Professor of Strategy and International Competitiveness at the Norwegian School of Management BI, gave an introduction to the phenomenon of micro-finance to almost 200 participants at BI Norwegian School of Management’s annual conference, the Johan Throne Holst Conference 2007.

The conference presented BI’s newly established research centre Micro, a centre for development studies and micro-finance, which is led by Professor Anne Welle-Strand.

Finance turned upside down.

“Micro-finance is in many ways conventional finance turned upside down,” says Reve and provides an overview of the seven hallmarks of micro-finance:

1. Lending money to the poor (while traditional finance institutions lend to the rich)

2. Lending primarily to women (while traditional finance institutions lend mostly to men)

3. No security conditions (where traditional finance requires security)

4. Meeting the clients locally

5. Investing in the most important resources – people

6. Emphasis on credibility, opportunities and sustainability

7. Building on local entrepreneurship

According to the BI professor, micro-finance has proved to be an effective tool for creating bread-and-butter businesses that lift families out of the worst poverty.

Success with women

The biggest success is with women. “Micro-finance has proved to be most successful when it is aimed at women in the developing world. It is these people who take on the most responsibility and prove to be the best entrepreneurs,” states Reve, who however warns against viewing micro-finance as being an open sesame. Micro-finance is only the first step of the ladder for business development, which requires at least three steps: micro-finance, talent finance, and market finance.

1) Micro-finance is a small loan combined with training based on life experience. This creates a large number of small bread-and-butter businesses.

2) Talent finance is a more long-term loan combined with training in management school subjects and practical skills, along with an offer of venture capital. Talent finance helps to develop the most promising micro-finance entrepreneurs into viable small businesses providing several jobs.

3) Market finance is a joint long-term loan for the development of a co-operative organisation on the market side. Market finance helps to develop market channels that bring the products to profitable markets.

This article is based on Torger Reve’s lecture “Micro-finance as a tool for development” at the BI Norwegian School of Management’s annual conference, the Johan Throne Holst Conference 2007, held on 14 June 2007.

Media Contact

More Information:

http://www.bi.no/Content/Article____61157.aspxAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Combatting disruptive ‘noise’ in quantum communication

In a significant milestone for quantum communication technology, an experiment has demonstrated how networks can be leveraged to combat disruptive ‘noise’ in quantum communications. The international effort led by researchers…

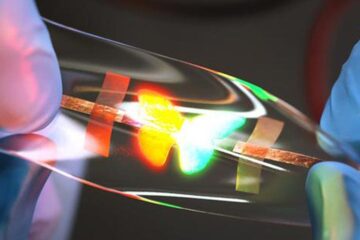

Stretchable quantum dot display

Intrinsically stretchable quantum dot-based light-emitting diodes achieved record-breaking performance. A team of South Korean scientists led by Professor KIM Dae-Hyeong of the Center for Nanoparticle Research within the Institute for…

Internet can achieve quantum speed with light saved as sound

Researchers at the University of Copenhagen’s Niels Bohr Institute have developed a new way to create quantum memory: A small drum can store data sent with light in its sonic…