New Insights into Mutual Funds

Funds that display strong (weak) performance over a past period continue to do so in future periods. More importantly, Huij demonstrates that some fund managers are able to outperform a strategy that invests in passive indexes for a short period of time. He defends his thesis on Thursday March 8, 2007 at Erasmus University Rotterdam.

These results add new insights to long-running debates on the benefits of actively managed funds vis-à-vis passive portfolios. Furthermore, Huij tests the cross-sectional explanatory power of multi-factor models to explain mutual fund returns. Performance estimates resulting from these models are biased because the factor proxies do not incorporate transaction costs and trading restrictions, says Huij. He suggests that factor proxies based on mutual fund returns rather than stock returns provide better benchmarks to evaluate professional money managers. Finally, Huij investigates the impact of fund marketing on investor flows to other funds in the family. High-marketing funds generate spillovers, and enhance cash inflows to low-marketing funds in the family. An explanation of this observation is that funds with low marketing expenses are directly subsidized by family members with high marketing expenses. At least part of the spillovers can be attributed to favoritism. These findings suggest that conflicts of interest between investors and fund families have been exacerbated by competition in the mutual fund industry.

The Erasmus Research Institute of Management (ERIM) is the research school in the field of management of the Erasmus University Rotterdam. The founding participants of ERIM are RSM Erasmus University and the Erasmus School of Economics. ERIM was founded in 1999 and officially is accredited by the Royal Netherlands Academy of Arts and Science (KNAW). The objective of ERIM is to carry out first rate research in management and to offer an advanced doctoral programme in Research of Management.

Media Contact

More Information:

http://www.eur.nl/english/pressroom/releases/2007/february/huijAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

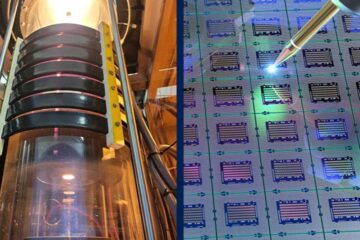

Silicon Carbide Innovation Alliance to drive industrial-scale semiconductor work

Known for its ability to withstand extreme environments and high voltages, silicon carbide (SiC) is a semiconducting material made up of silicon and carbon atoms arranged into crystals that is…

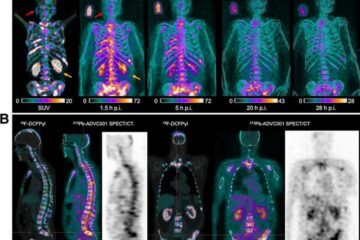

New SPECT/CT technique shows impressive biomarker identification

…offers increased access for prostate cancer patients. A novel SPECT/CT acquisition method can accurately detect radiopharmaceutical biodistribution in a convenient manner for prostate cancer patients, opening the door for more…

How 3D printers can give robots a soft touch

Soft skin coverings and touch sensors have emerged as a promising feature for robots that are both safer and more intuitive for human interaction, but they are expensive and difficult…