Stock options may cost shareholders much less than previously thought

At the annual meeting of the American Mathematical Society, Leung demonstrated that, in one scenario, stock options were worth about half of what they would be valued if one were to calculate their worth using a conventional method.

Nearly half of compensation for chief executives comes in the form of stock options. Out of concern that such options might be overly burdensome on shareholders, the U.S. Financial Accounting Standards Board since 2004 has required firms to estimate and report their cost.

One model commonly used by firms to calculate the cost of options is known as the Black-Scholes model. But this model and others are not nearly as nuanced as they should be, particularly in accounting for the psychology driving employees' behavior, according to Leung, a graduate student who collaborated with Associate Professor Ronnie Sircar.

Leung and Sircar found that other models don't take into account a number of important factors, including the following:

• employees have to weigh the risk that their stock option might lose value; since most people are risk-averse, they tend to exercise their options very early, preferring to take a tiny gain rather risk losing any profit – even though it is more likely that their options will increase greatly in value down the road;

• employees who are hoping to leave or fear that they might be fired tend to exercise their options earlier than they would if they felt secure in their employment;

• employees have to forfeit their options if they leave or are fired before their options have vested.

“Taking into account these factors has a significant bearing on how employee stock options are valued,” said Leung.

Leung and Sircar submitted a paper on this research to the journal Social Science Research Network, where an abstract is published online.

Media Contact

All latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

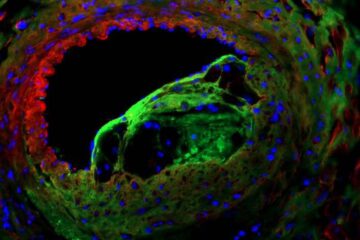

Solving the riddle of the sphingolipids in coronary artery disease

Weill Cornell Medicine investigators have uncovered a way to unleash in blood vessels the protective effects of a type of fat-related molecule known as a sphingolipid, suggesting a promising new…

Rocks with the oldest evidence yet of Earth’s magnetic field

The 3.7 billion-year-old rocks may extend the magnetic field’s age by 200 million years. Geologists at MIT and Oxford University have uncovered ancient rocks in Greenland that bear the oldest…

Decisive breakthrough for battery production

Storing and utilising energy with innovative sulphur-based cathodes. HU research team develops foundations for sustainable battery technology Electric vehicles and portable electronic devices such as laptops and mobile phones are…