International investment could ease global infrastructure woes, researchers say

Natural disasters can take a tremendous toll on life when infrastructure fails, particularly in developing countries. Ryan Orr, executive director of the Collaboratory for Research on Global Projects (CRGP) at Stanford University, says that private investors could be a solution to global infrastructure woes. “If we can mobilize more private finance, we could potentially help to solve these problems both at home and abroad,” Orr said. “But the investors need to be confident that they will be repaid and earn a fair return.”

At a recent roundtable meeting at Stanford, CRGP members discussed ways to improve the security of infrastructure investments and thus encourage private shareholders to put money into badly needed transportation, energy and water systems worldwide—even in the United States, where the problem of failing infrastructure was vividly demonstrated by Hurricane Katrina, which resulted in the deaths of more than 1,800 people and caused $75 billion in damage. Although construction began on the New Orleans levee system more than 40 years ago, inflexible plans and flagging funding left the system incomplete when the big hurricane hit, Orr said.

“The roundtable is seeking to create a more stable framework for infrastructure projects that will minimize risk,” added Barry Metzger, a partner at the law firm Baker & McKenzie and co-moderator of the roundtable. In addition to Metzger and other senior legal advisers, the roundtable also has drawn on the expertise of business executives from companies and financial institutions—such as Bechtel Corp., the World Bank, the Asian Development Bank and Citigroup—and from Stanford researchers representing a wide range of disciplines, including engineering, sociology, business, law and political science.

As policymakers face tax cuts and dwindling funding, many are wondering where all the money will come from. Large investors, including commercial banks and pension funds, may be able to help—and earn some money in the process, according to the CRGP roundtable report. For example, Australia's Macquarie Bank has demonstrated that infrastructure can be profitable, earning an average return of 19 percent on its infrastructure investments over 11 years. Following Macquarie's lead, 10 large investment firms, including the Carlyle Group and Goldman Sachs, have announced new infrastructure funds of up to $1 billion in the past six months.

Minimizing risk

How does an investor earn money building a bridge? Typically, Orr said, the investor pays to build the bridge, and then owns and operates it for a set period of time—say, 30 years. During that time, the bank collects tolls to recover its investment and bring in a profit. This has proven to be a lucrative business for Macquarie Bank, he noted.

Historically, most investors have been wary of infrastructure ventures, especially in the developing world, because of the potentially large risks, Orr said. In the United States, citizen protests over high tolls or changes in political priorities could pull the rug out from under expensive projects. In the developing world, the risks are even greater, as war, famine, political unrest and corruption all threaten investments, Orr said. “When you invest in a foreign society, how can you tie the hands of that government and guarantee that they're not going to take what you've invested?”

With the fall of the Soviet Union in 1991, large private investors began pumping money into infrastructure throughout the world. “The Western business community really felt that it could fix a lot of the world—reduce poverty, reduce the economic ills in Asia and Africa—by mobilizing the private sector,” Orr said. But in the wake of large economic crises at the end of the 1990s, many large projects became distressed or failed, and some governments, including those of Argentina and Indonesia, repossessed the infrastructure that foreign investors had helped to build.

According to Orr, recent international laws have made it possible for investors to hold foreign governments responsible for the assets they seize and to arbitrate disputes in a neutral court. But the trend toward privatization of infrastructure also has its critics, he said, noting that some opponents fear that profit-hungry investors could cut corners, potentially endangering citizens with poorly designed or poorly maintained roads, bridges and airports.

Encouraging investment

The participants at this year's CRGP roundtable meeting expressed hope that continued improvements to the system will encourage private investors to take a chance with infrastructure investments abroad, Orr said.

“We think that the evolution of large private infrastructure funds is a major development,” Orr said. “But is it just another wave of euphoria that's going to come crashing down in eight to 10 years, or have we actually learned something?”

Infrastructure problems in the United States are not unique to New Orleans, he pointed out. Across the nation, the rehabilitation of failing and inadequate infrastructure is expected to cost $1.6 trillion over the next five years, according to the American Society of Civil Engineers.

In California, the backlog for infrastructure improvements may top $70 billion, with an estimated $17 billion needed for drinking water improvements over the next 20 years alone. Statewide, the debate about how to fund infrastructure is thickening. The government is already seeking private investment to repair failing transportation, schools and flood control. The state legislature recently placed a $38 billion infrastructure bond measure on the November ballot. Although bonds raise private money, the government manages the money and guarantees to repay it in a set period of time. Truly private investments could come from the state's pension funds. On April 3, state Treasurer Phil Angelides encouraged the public employees and state teachers retirement systems to invest $15 billion in state infrastructure, but neither pension fund has committed to the investment so far.

“The money belongs to the school teachers and public employees,” Orr said. “Why not invest it back into the roads and the infrastructure that they all use every day? Why not have the pension funds both earning their returns and improving the lifestyle for all?”

Media Contact

More Information:

http://www.stanford.eduAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

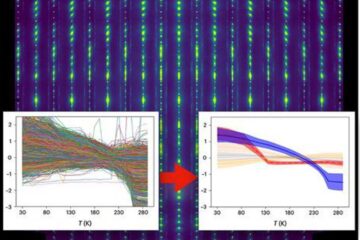

Machine learning algorithm reveals long-theorized glass phase in crystal

Scientists have found evidence of an elusive, glassy phase of matter that emerges when a crystal’s perfect internal pattern is disrupted. X-ray technology and machine learning converge to shed light…

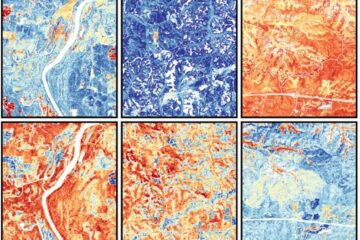

Mapping plant functional diversity from space

HKU ecologists revolutionize ecosystem monitoring with novel field-satellite integration. An international team of researchers, led by Professor Jin WU from the School of Biological Sciences at The University of Hong…

Inverters with constant full load capability

…enable an increase in the performance of electric drives. Overheating components significantly limit the performance of drivetrains in electric vehicles. Inverters in particular are subject to a high thermal load,…