Modeling, Valuation and Risk Management of Commodity Derivatives

Harri Toivonen, M.Sc. (Econ), will defend his PhD dissertation at the Helsinki School of Economics (HSE) on Friday, December 2, 2005. The dissertation is entitled “Modeling, Valuation and Risk Management of Commodity Derivatives” and is in the field of Finance. The public defense will start at 12:00 in the auditorium of the Chydenia building (address Runeberginkatu 22-24). The opponent is Professor Petri Sahlström (Tampere University of Technology) and the custos is Professor Hannu Seristö (HSE).

In his study Toivonen examines modeling, valuation and risk management of commodity derivatives. According to United Nations International Trade Statistics more than 40% of world trade consists of primary commodities. Both long-term trends and short-term fluctuations in commodity prices have important consequences for global economic growth. On the supply side of the market many developing countries still continue to rely heavily on commodities for their export earnings. On the demand side, commodity markets play a major role in transmitting business cycle disturbances and consequently affecting the revenues of corporations and the inflation rates of economies across industrial nations. Toivonen aims to contribute to the existing literature through four interrelated essays using unique long-term commodity swap data in Brent crude oil and NBSK pulp commodity markets.

The first essay, Modeling Term Structure of Commodity Prices – Swapping the Convenience, studies the modeling of long-term commodity forward prices. We find support for the existence of the theory of storage. There is a statistically significant inverse relationship between the convenience yield, the return to the holder of the physical commodity, and the level of physical inventories. The paper also finds support for the so-called maturity effect, i.e. a declining volatility term structure, in long-term commodity forward markets. This decreasing volatility term structure implies mean-reverting spot commodity prices in the long-run.

The second essay, Volatility of Commodity Forward Prices, compares alternative multivariate models of volatility in order to model volatility of commodity forwards. We find that the Multivariate Stochastic Volatility model (MSV) and the simpler Exponentially Weighted Moving Average (EWMA) method outperform different Multivariate Generalized Autoregressive Conditional Heteroskedasticity (GARCH) models and simpler methods in both markets. The findings also suggest that there is a negative relationship between the spot volatility and the level of inventories as the theory of storage stipulates.

The third essay, Hedging Long-Term Commodity Forward Price Risk, investigates the problem of hedging long-term commitments with short-term futures empirically, to our knowledge for the first time in the existing literature, with actual long-term commodity market data. This problem is also known as the Metallgeschellschaft problem in the existing literature. Empirical evidence is found that neither simple time-series-based nor one-factor model-based hedging strategies can sufficiently capture the characteristics of the term-structure of forward prices.

The fourth essay, Pricing Quanto Commodity Swaptions, presents a formula for pricing quanto commodity swaptions. Quanto or cross currency effects are particularly common in commodity markets as most of the markets are US dollar denominated. Toivonen utilizes the forward price based approach and the change of measure technique to derive a simple closed-form solution for European quanto commodity swaptions.

Media Contact

All latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Properties of new materials for microchips

… can now be measured well. Reseachers of Delft University of Technology demonstrated measuring performance properties of ultrathin silicon membranes. Making ever smaller and more powerful chips requires new ultrathin…

Floating solar’s potential

… to support sustainable development by addressing climate, water, and energy goals holistically. A new study published this week in Nature Energy raises the potential for floating solar photovoltaics (FPV)…

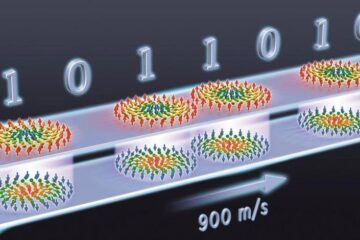

Skyrmions move at record speeds

… a step towards the computing of the future. An international research team led by scientists from the CNRS1 has discovered that the magnetic nanobubbles2 known as skyrmions can be…