High Demand for Goods in the U.S. Is Not the Problem

A reduction in U.S. consumption, increased savings and the adoption of flexible exchange rates in Asia would trigger global instability, according to a Conference Board analysis released today.

Says Gail Fosler, Executive Vice President and Chief Economist of The Conference Board: “Not only would these actions not have the intended effect but they would add to global instability and further slow an already disturbing slowdown in long-term global growth.”

The analysis appears in the latest issue of StraightTalk, a newsletter prepared by Fosler for The Conference Board’s global business network.

When Traders Head Out The Door

Despite a rapid expansion in wealth by such fast-growing economies as China and India, the global economic growth in the 1990s was the slowest in 40 years. Financial instability, volatile exchange rates and their costs in emerging markets all played a role in slowing world economic growth. “Given the size of global financial flows,” Fosler points out, “there is almost no reasonable trade or foreign exchange policy that can protect these countries’ currencies when traders run for the door.”

Global Markets Are Becoming Increasingly integrated

National borders are becoming less important in analyzing trade and other economic activity, since global markets are increasingly integrated in the same way that national markets are.

“Transactions are increasingly based on complex intra- and inter-company relationships,” says Fosler. “Multinational companies are like bees in the spring, spreading technology from country to country.”

Although the U.S. trade deficit has been running at 5% to 6% of Gross Domestic Product, many of the dynamics surrounding global trade today have been around for many years. They simply accelerated in the 1990s. Today, cross-border trade is almost 50% higher in volume terms than global GDP.

U.S. imports have always been greater than exports, whether the dollar is high or low or whether there is a federal budget surplus or deficit. The U.S. will continue to be the major market for the rest of the world – indefinitely.

Specialization and regional growth opportunities trump comparative labor and resource cost advantage, as companies develop centers of excellence around high technology products and components. The workings of competitive markets drive costs down – even, in some sectors, in very low-cost environments like China. But cost is only one part of the equation.

Some countries, such as Japan and Germany, grow faster than others more because of the advantages of the institutional and regulatory structures in their own domestic markets than because they enjoy relative advantages with regard to trade.

“Trade is like a card game against the house,” says Fosler. “Either you are in or you are out. But no matter your skill, it is very difficult to walk away with big winnings on a consistent basis.”

Much of what is recorded as global trade represents only those economic relationships that cross national borders and are counted in customs receipts. In a sense, this is the narrowest definition of trade. The balance on goods and services includes tourism and important service industries, but it does not capture intermediate services within a company, which may involve offshoring, or the cross-border creation of intellectual property – which is often carried over the Internet or through the mail.

Global economic relationships are increasingly based on value propositions and core capabilities that are not particularly price-sensitive. They often represent long-term relationships in which knowledge and trust develops between the supplier and the customer.

Capital Goods Flows Just As Important As Consumer Spending

Capital goods dominate cross-border transactions, with industrial machinery and office equipment and telecom ranking number one and number three, respectively. In 2003, these two categories accounted for almost 30% of total cross-border trade. When non-oil materials and chemicals (another 13.5%) are added, it becomes clear that cross-border global trade patterns have as much to do with investing as with consuming.

Consumer spending in the U.S. is about 70% of GDP. In emerging markets, by contrast, investment can be relatively large – in China, fixed investment is almost 45% of GDP. Even more striking is how these kinds of domestic market imbalances evolve. During global recessions, U.S. domestic demand shoots up as a share of global domestic demand. In other words, the U.S. is the fundamental counter-cyclical stimulus that helps the rest of the world get back on its feet again. But the stimulus from the U.S. appears to have had little effect on creating sustained domestic demand growth in the rest of the world.

The U.S. may not be the only market of “first resort” for long. As Europe expands its global reach, particularly in Asia, and as the euro becomes more of a global currency, Europe’s trade balance will likely erode, says Fosler.

“Unless the decade reverses the tendency toward economic instability and slowing global growth, it would appear that it is the structure of the global economy that is unbalanced, not just the U.S. trade accounts,” concludes Fosler.

Source: StraightTalk, Volume 16, No. 3, The Conference Board

The Conference Board’s Mission

The Conference Board creates and disseminates knowledge about management and the marketplace to help businesses strengthen their performance and better serve society. Working as a global independent membership organization in the public interest, The Conference Board conducts conferences, makes forecasts and assesses trends, publishes information and analysis, and brings executives together to learn from one another. The Conference Board is a not-for-profit organization and holds 501(c)(3) tax-exempt status in the United States.

Media Contact

More Information:

http://www.conference-board.orgAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Properties of new materials for microchips

… can now be measured well. Reseachers of Delft University of Technology demonstrated measuring performance properties of ultrathin silicon membranes. Making ever smaller and more powerful chips requires new ultrathin…

Floating solar’s potential

… to support sustainable development by addressing climate, water, and energy goals holistically. A new study published this week in Nature Energy raises the potential for floating solar photovoltaics (FPV)…

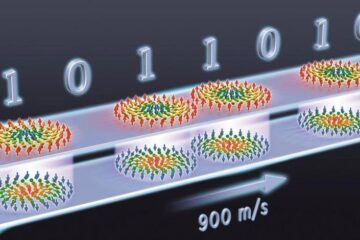

Skyrmions move at record speeds

… a step towards the computing of the future. An international research team led by scientists from the CNRS1 has discovered that the magnetic nanobubbles2 known as skyrmions can be…