New measure helps determine how much risk investors can tolerate

An Ohio State University researcher has helped develop a new measure that he says is a better way to calculate how much risk people are willing to take in their investments.

The issue of measuring risk tolerance will become more important than ever under President Bush’s proposal to allow Americans to invest some of their Social Security taxes in stocks and bonds.

Measuring risk tolerance will also be important to baby boomers retiring in the next decade, some of whom will spend 30 years or more in retirement and will have to decide how to allocate investment portfolios. “Financial planners agree that measuring risk tolerance in their clients is important, but there has been no generally accepted way to do that,” said Sherman Hanna, co-author of the new measure and professor of consumer sciences at Ohio State. “A lot of the measures that are used are based on intuition and are not backed by solid research.”

In addition, many of the currently used measures ask questions that are so complex that it is doubtful people fully understand them, Hanna said. The result is that many surveys measuring risk tolerance among investors come up with findings that don’t seem plausible, he said. For example, one widely quoted survey found that nearly one-fourth of respondents aged 51 to 61 – nearing retirement age and presumably interested in protecting their investments – had very high risk tolerance, suggesting that they would be willing to take great risks with their portfolios.

The new measure, and a study testing it, are published in the current issue of the journal Financial Counseling and Planning. Hanna said the new measure responds to the shortcomings in other surveys in several ways. It uses a series of questions which, unlike most other measures, are based on economic theory about risk aversion as it relates to optimal investment portfolios.

The questions give respondents hypothetical scenarios in which they have to choose between pensions that offer varying amounts of risk. For example, one question asks respondents to choose between two pensions: One will provide a pension income equal to pre-retirement income. The other has a 50-percent chance it will double pre-retirement income and a 50-percent chance that income will be 20 percent less than pre-retirement income.

Questions like this can be difficult to understand for some people as they try to keep all the numbers in their heads, Hanna said. So the new survey presents these options using bar charts to graphically show potential increases or decreases in investment value resulting from investment decisions. “Using illustrations increases the chance that a person will understand the hypothetical choices and give a response better related to his or her true level of risk tolerance,” he said.

The researchers tested the new measure with a sample of 152 Ohio State students. The results seem more reasonable than other surveys, Hanna said. Most respondents had risk-tolerance levels consistent with an all-stock retirement portfolio until middle age, then stock allocations decreasing to about 40 percent by retirement. Compared to previous surveys, this is more in line with what most financial planners would recommend for young investors. “I believe showing options with illustrations makes it easier to understand the choice you’re making, so the results are better,” he said.

In order to further test the validity of the new measure, the researchers also asked the student respondents a risk-tolerance question that has been used each year in the national Survey of Consumer Finances (SCF) sponsored by the Federal Reserve Board.

The results showed a strong correlation between the students’ answers on the new measure and on the SCF risk aversion question.

“While we believe our new measure does a better job than the SCF question at measuring risk tolerance, it was reassuring that there was some correlation between the results of the two measures,” Hanna said.

The survey needs to be repeated with a larger, more diverse sample in order to validate it with people of all ages, he said. Anyone can take the survey on the web at: http://hec.osu.edu/people/shanna/rts/

“People need to understand their level of risk tolerance in order to make the proper investment decisions,” Hanna said. “We need to find the best possible measures in order to help people make their decisions.”

Media Contact

More Information:

http://www.osu.eduAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

High-energy-density aqueous battery based on halogen multi-electron transfer

Traditional non-aqueous lithium-ion batteries have a high energy density, but their safety is compromised due to the flammable organic electrolytes they utilize. Aqueous batteries use water as the solvent for…

First-ever combined heart pump and pig kidney transplant

…gives new hope to patient with terminal illness. Surgeons at NYU Langone Health performed the first-ever combined mechanical heart pump and gene-edited pig kidney transplant surgery in a 54-year-old woman…

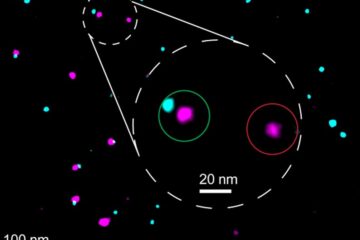

Biophysics: Testing how well biomarkers work

LMU researchers have developed a method to determine how reliably target proteins can be labeled using super-resolution fluorescence microscopy. Modern microscopy techniques make it possible to examine the inner workings…