Financial sector, governments and business must act on climate change or face the consequences

Too few financial companies including banks, pension funds and insurance companies are taking the risks and opportunities posed by climate change seriously, members of the United Nations Environment Programme`s (UNEP) Finance Initiatives are warning.

Losses as a result of natural disasters appear to be doubling every decade and have reached one trillion US dollars in the past 15 years. Annual losses, in the next ten years, will reach close to $150 billion if current trends continue.

The massive economic losses stemming from the devastating summertime flooding in central Europe are in line with the kinds of increasingly severe weather events anticipated by scientists as a result of human-induced climate change. This year has also seen a failure of the Monsoon in Asia, dramatic forest fires in the United States and the onset of another El Nino event in the Pacific.

Members of the UNEP Finance Initiatives, a unique partnership between UNEP and 295 banks, insurance and investment companies, argue that climate change-driven, natural disasters, have the potential to wreak havoc across the world`s stock markets and financial centres.

“The increasing frequency of severe climatic events, threatening the social stability or coupled with significant social costs, has the potential to stress insurers, reinsurers and banks to the point of impaired viability or even insolvency,” the report, Climate Change and the Financial Services Industry, says.

The property market, where loans for houses and buildings are made over relatively large periods, could be particularly vulnerable as a result of extreme weather events. Home-owners and companies with property holdings may find that their insurance cover is cancelled at short notice, leaving them highly exposed.

Government action to arrest the problem will inevitably mean a reduction in emissions of the main sources of greenhouse gases linked with global warming. This will require cut backs and the more efficient use of fossil fuels such as coal and oil.

Asset managers, such as pension funds which are slow to appreciate the climate change threat, may see the value of energy or power company holdings decline as investors become more aware of the liabilities linked with carbon intensive industries, the report further concludes.

Yet opportunities are emerging that should allow the financial services industry to reduce or hedge against the risks and even help curb emissions of the greenhouse gases linked with the de-stabilisation of the Earth`s climate and weather systems.

The report says that the annual market in trading greenhouse gases, emerging as a result of international agreements to reduce emissions, could be worth as much as US $ two trillion by 2012. The market for clean energy could stand at $1.9 trillion by 2020, according to some estimates.

Meanwhile the financial services industry, with over $26 trillion in assets under management, could if mobilized “wield significant influence over future economic development….and therefore the future global greenhouse gas emissions” for the benefit of itself and society as a whole.

However a survey of mainstream financial institutions carried out for the report indicates that most are “unaware of the climate change issue” or have adopted a “wait and see policy”.

These attitudes are due to the prolonged wrangling over the Kyoto Protocol, the international treaty designed to deal with the threat of global warming, compounded by practical issues like the lack of solid information on emissions and delays in finalising the regulations of the new greenhouse gas markets.

As a result, only a small group of forward looking financial companies are addressing the issue many of whom are reinsurers whose businesses are already feeling the economic impact of rising, weather-related, insurance claims.

Klaus Toepfer, UNEP Executive Director, said today at the launch of the report: “This report is a wake up call for the global financial community. It highlights the real risks and economic perils they are facing as a result of human-influenced climate change. It also highlights how the industry can make a real difference through harnessing the new market instruments and mechanisms made possible by the Kyoto Protocol and by developing their own imaginative solutions.”

“It also underscores how, given the financial muscle available to them, these institutions could move markets and minds to deliver a cleaner, healthier and less vulnerable world for the benefit of the world economy, for the benefit of people everywhere,” he said.

The report and its studies, supported by a group of the world`s biggest banks, insurers and re-insurers, were launched today at the Swiss Re Greenhouse Gas conference in Zurich, Switzerland. The findings will also be presented to governments at the next round of climate change negotiations set to commence in New Delhi, India, on 23 October until 1 November.

“In addition to the emitting industry needing to take a carbon constrained future into account”, concluded John H. Fitzpatrick, CFO and member of the Executive Board of Swiss Re, “the financial services industry, of which we are a part, also has an obligation to contribute to the solution of these problems through its own investments and business expertise. After all, climate change and substantial emissions reductions – like any other strategic global business challenge – ultimately becomes a financial issue. The problems associated with environmental disasters quickly become measured in dollars and cents. Our industry needs to lead by developing financial solutions and risk mitigation techniques to assist our clients in achieving global emission reductions.”

The report has drawn up a blue-print for action, designed to galvanize the financial services industry to address the climate change threat more directly. The blue-print is also aimed at assisting governments to create the right conditions for the industry to operate swiftly and effectively in delivering new climate-related businesses and markets.

Recommendations include urging insurers and re-insurers to better reflect the risks from climate-related perils in policies and to develop public/private partnerships in high-risk areas so that cover can be maintained.

Commercial banks should fully price risks from climate change into loan agreements and give incentives to schemes that encourage energy efficiency or cleaner fuels.

Asset managers, such as pension funds, should request the companies in which they invest better information on their carbon emissions and their exposure to greenhouse gases.

Accountants, actuaries, analysts, credit rating agencies and others providing professional services should help corporate clients to better understand the threats and opportunities of climate change. Greenhouse gas trading markets need standardized accounting methods to operate and is thus another area where professional people and their professional organizations can help.

Meanwhile governments are urged to adopt a long term, global plan, to keep greenhouse gases at safe levels. This is vital because the Kyoto Protocol runs out in 2012 whereas carbon dioxide, methane and the other greenhouse gases can persist in the atmosphere for many tens of decades.

At home, governments should also take a variety of actions including a clear commitment on how greenhouse gas reduction targets will be met alongside economic incentives for investing in clean energy schemes and clean energy research and development.

Governments are also asked to work with stock market regulators to help boost understanding of the impacts of global warming on publicly listed companies and new offerings.

The report concludes by calling for a major drive to mobilise the financial sector on this issue and recommends that new financial techniques and methods are developed to help investors and project financiers factor in climate change into the valuation of their assets.

Media Contact

More Information:

http://www.unep.orgAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

High-energy-density aqueous battery based on halogen multi-electron transfer

Traditional non-aqueous lithium-ion batteries have a high energy density, but their safety is compromised due to the flammable organic electrolytes they utilize. Aqueous batteries use water as the solvent for…

First-ever combined heart pump and pig kidney transplant

…gives new hope to patient with terminal illness. Surgeons at NYU Langone Health performed the first-ever combined mechanical heart pump and gene-edited pig kidney transplant surgery in a 54-year-old woman…

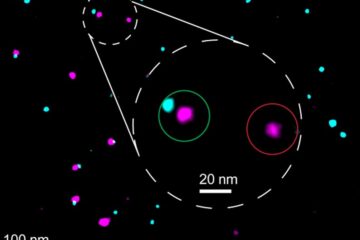

Biophysics: Testing how well biomarkers work

LMU researchers have developed a method to determine how reliably target proteins can be labeled using super-resolution fluorescence microscopy. Modern microscopy techniques make it possible to examine the inner workings…