Do Innovations Ever Pay Off? the Value to Investing in Innovation

Management has often been criticized for an earnings-focused short term orientation that reduces or delays investments in risky, long term innovation projects in order to boost the firm’s stock price. Rarely does a discussion of corporate strategy or entrepreneurial motivation proceed these days without alluding to one significant dynamic—innovation.

For example, Clayton Christensen and Scott Anthony write in Business Week, ”The notion that managers must above all appease investors drives behavior that focuses exclusively on quarterly results. Thus, many management teams hesitate to invest in promising innovations that are likely to hurt near-term financial performance.” But do investments in innovations hurt stock prices?

Not so suggests Gerard J. Tellis, a professor of marketing at the University of Southern California’s Marshall School of Business, and Ashish Sood, an assistant professor at the of marketing at Emory University’s Goizueta Business School. They have devised a new metric for evaluating the total stock market returns to an innovation project. “We’re assessing whether markets respond negatively to investments in innovation and whether they enforce a shorter orientation,” explains Tellis.

“The key questions are: how does the stock market react to announcements about innovation and what is the total return to the innovation project?” They answer these questions in their paper, “Do Innovations Really Payoff? Total Returns to Innovation,” which is forthcoming in Marketing Science, the top journal in the marketing field.

Tellis and Sood, who have teamed up before to research areas such as technological evolution and new products adoption across global markets, set out again with this research to help managers better understand and quantify the investments they are making in innovation. In this case, they want them to recognize the power of innovation to do everything from fueling the growth of new products to promoting the global competitiveness of nations. “Firms may underinvest in innovation because of the high costs, the long delay in reaping market returns if any, the uncertainty of those returns, and the difficulty of adequately measuring them,” suggests Tellis. “Indeed, accurately assessing the market returns to innovation may be critical to motivating firms to invest in innovation.”

The authors argue that the best approach is for firms to examine the market returns to an entire innovation project. They demonstrate this by using the so-called event study method, also known as the Fama-French-Momentum 4 Factor Model, to analyze 5,481 announcements—everything from the start of a project to joint ventures and key approvals—from 69 firms in five markets and 19 technologies during the period from 1977 to 2006. The event study method, popular for the last 30 years, captures the stock market’s reaction to an announcement and actually predicts the valuation that the stock market puts on that particular announcement.

The authors analyze all announcements related to a project and the returns to each announcement. This all-inclusive approach sets their research apart from existing studies. “A big limitation of prior research is that they were looking at one event,” notes Sood. ” It’s necessary to look at the entire project and all the announcements that the firm makes. That gives us a better estimate of the returns to the investments.” As a means of organizing the announcements, Sood and Tellis separate them into three groups: the activities related to the setup of the innovation project; the activities related to the development of the product; and the market activities related to the commercialization of the product.

The authors find that total market returns to an innovation project are $643 million, more than 13 times the $49 million due to an average innovation event.

Returns to overall projects are substantially more than returns to individual events. “Focus on only one or two types of events or announcements will lead to underestimation of total returns,” notes Sood. “Any conclusion based on that lower, wrong estimate might actually make the manager decide that innovation is no good or the markets are not receptive.”

The research also reveals that, of the three sets of innovation activities, returns to the development activities are consistently the highest across and within categories. “The big surprise was that the markets actually react more to the development phase than the commercialization phase, which shows that the stock market is not so short-term in its outlook,” says Sood. “Because the stock markets reward firms for making announcements in the development phase, it is in the firms’ interest to be open to the market and to update progress on an innovation project.”

It’s important to note, adds Tellis, that quality, not quantity, defines market reactions to announcements. A firm that decides to simply increase the number of project-related announcements it makes to inspire market reaction will not necessarily yield a greater return on investment. Says Tellis: “A mere increase in the number of announcements will not improve your returns.”

Sood and Tellis already have continued down their path of innovation research. They are using existing data to develop a statistical model that will help firms look at the returns in the initial phases of an innovation project and predict how the stock market will react in future phases. After all, the market returns to innovation are among the best assessments of the true rewards of innovation.

About the USC Marshall School of Business

Based at the crossroads of the Pacific Rim, in Los Angeles at the University of Southern California, the USC Marshall School of Business is dedicated to training global leaders to make a difference. USC Marshall is the best place to learn the art and science of business.

The school’s complete array of programs annually serve more than 5,000 undergraduate, graduate, professional and executive-education students, who attend classes at the main University Park campus in Los Angeles, and in satellite facilities in Irvine and North San Diego County.

In conjunction with Jiao Tong University in Shanghai, USC Marshall also operates a Global Executive MBA program in China.

Media Contact

More Information:

http://www.marshall.usc.eduAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Superradiant atoms could push the boundaries of how precisely time can be measured

Superradiant atoms can help us measure time more precisely than ever. In a new study, researchers from the University of Copenhagen present a new method for measuring the time interval,…

Ion thermoelectric conversion devices for near room temperature

The electrode sheet of the thermoelectric device consists of ionic hydrogel, which is sandwiched between the electrodes to form, and the Prussian blue on the electrode undergoes a redox reaction…

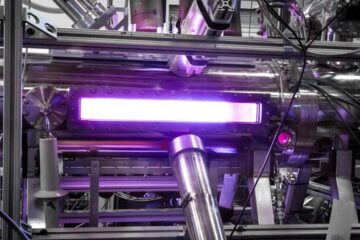

Zap Energy achieves 37-million-degree temperatures in a compact device

New publication reports record electron temperatures for a small-scale, sheared-flow-stabilized Z-pinch fusion device. In the nine decades since humans first produced fusion reactions, only a few fusion technologies have demonstrated…