Research shows 2008 may be the best year for M&A

Results from the latest stage the of ongoing Towers Perrin / Cass Business School research looking at the value created in the last three global M&A cycles reveals that, contrary to received wisdom, 2008 may be the best time to do a deal.

This most recent part of the study looked at the performance of companies before and after peak years of the cycles. Together with Towers Perrin, Scott Moeller, Professor of Mergers and Acquisitions at Cass, examined the two prior merger waves and found the post-peak years (1990 and 2000) delivered higher shareholder value compared with deals in the frenzy of the M&A booms. This was true for all deals, although the research focused on those between $400 million and $1.5 billion in size (adjusted for inflation).

Combining the two waves gives a clear and statistically significant picture of performance in pre-peak, peak and post-peak years. The post peak years show the performance outperformed the MSCI World Index by 5.4% on average over the two periods.

Over the past three years, the Towers Perrin / Cass Business School M&A study has found that, unlike the two previous M&A cycles, the current deal wave has seen companies creating rather than destroying value. All the evidence points to this trend continuing and therefore suggests that the post-peak year in the current merger wave will continue as the previous two and also add value.

Marco Boschetti, Global Head of M&A at Towers Perrin, said:

“Throughout the recent M&A boom people have been obsessed by volume, not value. Our research has always sought to examine what we believe to be more crucial to shareholders: has value been destroyed or created? And if so, how has it been created?

“We are all well aware of the many factors that have put a brake on M&A in the current cycle. All evidence points to 2007 being the peak year of the current wave. But what our research says is that, if you have the means, now is the time to do that deal. The evidence from previous post-peak years in the M&A show that even when previous cycles destroyed value in the boom times, the post-peak period was one of value creation.”

The study collaboration started in 2005 to provide a quantitative analysis of worldwide M&A deal success. The first phase of the study compared the first full year of the current merger wave (2004) against prior merger cycles using public data from a number of sources. It was the first study to provide extensive evidence that unlike prior merger cycles, M&A deals in this wave – on average – generated shareholder value and improved financial performance for the newly combined companies.

The studies have examined shareholder value after six and eighteen months following deals closing. Therefore the most up-to-date research as yet is based on 2006 figures. According to this, deals done in that year on average outperformed the market by 9.1%.

Numerous studies of the M&A cycles that peaked in 1989 and 1999 have shown that M&A transactions when judged over time have destroyed value.

Professor Scott Moeller said:

In this climate, more than ever, deals will be scrutinised to see if they deliver value. Our previous findings have shown that the current merger wave has consistently reversed the historical trend and has been good for value creation. In previous waves, on average, value had been destroyed. But even then, the post-peak years have shown that sense came to play as the market cooled and value was created by companies not caught up in the froth of the market. So our analysis should provide positive grounds for confidence for corporations who have the ability to do deals today and for their shareholders. Based on our analysis, there is significant potential upside to doing a deal in 2008, a post-peak year, even though it may be even more necessary than ever to select deals carefully.”

In all nine years covered by the study, the total universe of deals analysed were 38,122 deals. Various screens were then applied to be able to carry out like-for-like comparisons. All acquiring companies were publicly quoted and the deals had to be for full ownership of the target asset. The study excluded acquisitions by subsidiaries and joint ventures.

Marco Boschetti added:

“Our study was the first to identify the significant change in deal success when compared to previous cycles. We believe that lessons have been learnt from past deals and improvements have stemmed from better discipline and governance demanded by shareholders. Greater attention has also been paid to deal execution and working through the people issues which were often previously overlooked.”

The next phase of the Towers Perrin / Cass Business School global M&A cycle study will be completed in the summer of 2008 when the results from 2007, the peak of the current cycle, will be available.

Media Contact

All latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

High-energy-density aqueous battery based on halogen multi-electron transfer

Traditional non-aqueous lithium-ion batteries have a high energy density, but their safety is compromised due to the flammable organic electrolytes they utilize. Aqueous batteries use water as the solvent for…

First-ever combined heart pump and pig kidney transplant

…gives new hope to patient with terminal illness. Surgeons at NYU Langone Health performed the first-ever combined mechanical heart pump and gene-edited pig kidney transplant surgery in a 54-year-old woman…

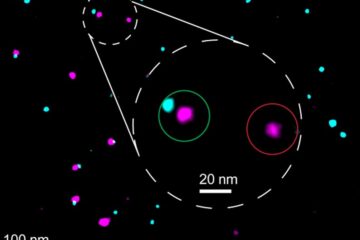

Biophysics: Testing how well biomarkers work

LMU researchers have developed a method to determine how reliably target proteins can be labeled using super-resolution fluorescence microscopy. Modern microscopy techniques make it possible to examine the inner workings…