Centre for Banking Studies hosts conference on banking stability

The newly created Centre for Banking Studies at Cass Business School, funded by the British Academy, Cass Business School Research Fund, and the Money, Macro and Finance Research Group (MMFRG), organised a one-day conference on the tranmission of credit risk and banking stability. Organised by Shelagh Heffernan, Professor of Banking and Finance at Cass, the day provided in depth analysis of the problems facing the global economic system, and also presented some interesting remedies.

In recent years the range of credit risk transfer instruments and how they are used has widened considerably. However, the current turmoil in the global markets for structured credit has revealed unexpectedly large bank exposures to liquidity and credit risks, and raised concerns about the systemic implication of the new markets for credit risk transfer. The opening keynote lecture by Charles Goodhart, Emeritus Professor at the LSE entitled 'The Regulatory Response to the Financial Crisis' tackled these problems and identified seven principle fields where the recent tumoil has 'thrown up issues for discussion'. During his exposition he also highlighted the '…major problems, anomolies, difficulties and shortcomings of the world banking systems'. View a video of Professor Goodhart's talk here.

In closing, Professor Anthony Saunders of Stern School of Business asked 'What Have We Learned From the Sub-Prime Crisis?' Amongst his conclusions Professor Saunders argued that there is currently an over-reliance on risk modelling, and this must be reduced if we are to steer out of the current storm: “It is dangerous to rely on risk models ex-ante because by its very nature risk is very hard to model.”

Richard Gillingwater, Dean of Cass Business School, who introduced the conference, congratulated Professor Heffernan on the organisation of an excellent event: “This event is extremely timely given the current market situation. Cass' position as the business school for the City, and with its great strength in banking research, makes us an ideal forum for just this type of timely and reflective discussion. Professor Heffernan has put forward an excellent mix of highly relevant lectures and I thank her for an excellent day.”

The oversubscribed conference included delegates from a number of central and commercial banks, regulatory authorities (e.g. the FSA and FDIC) and universities. The conference marked the official launch of the Cass Centre for Banking Studies, the purpose of which is to promote high calibre academic research in the field of banking and to foster the teaching of banking subjects to a high standard. All papers and speeches are available to download from the Centre’s website (http://www.cass.city.ac.uk/cbs/index.html)

Media Contact

All latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

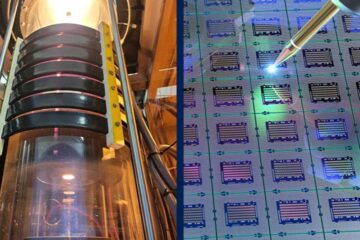

Silicon Carbide Innovation Alliance to drive industrial-scale semiconductor work

Known for its ability to withstand extreme environments and high voltages, silicon carbide (SiC) is a semiconducting material made up of silicon and carbon atoms arranged into crystals that is…

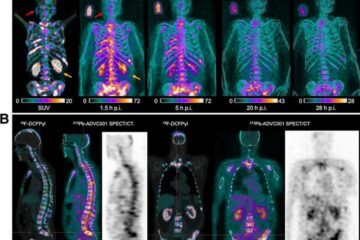

New SPECT/CT technique shows impressive biomarker identification

…offers increased access for prostate cancer patients. A novel SPECT/CT acquisition method can accurately detect radiopharmaceutical biodistribution in a convenient manner for prostate cancer patients, opening the door for more…

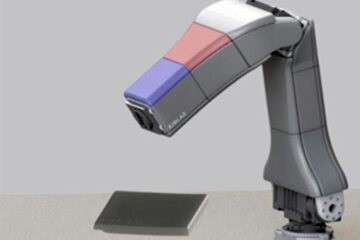

How 3D printers can give robots a soft touch

Soft skin coverings and touch sensors have emerged as a promising feature for robots that are both safer and more intuitive for human interaction, but they are expensive and difficult…