Our money is still safe in the bank

Roles and Responsibilities of Auditors' from Professor Peter A.M. Diekman RA. He contends that both the internal and public accountant have an important duty in monitoring the financial market. On Thursday, 15 May 2008 Diekman accepted the special chair in Compliance & Risk Management, endowed by the Stichting Toezicht en Compliance (Supervision and Compliance Foundation), at the School of Law, Erasmus University Rotterdam, the Netherlands.

In his lecture Diekman gives an overview of the growing number of measures that have been taken in the past decades to protect the financial markets. As early as 1980 the EU agreed on regulations to protect the financial market against abuse. At that time, fighting the drug trade was a major concern, as was reigning in the financial yields from that activity. Fighting terrorism also became an important motive, especially after the terrorist attacks in New York and Washington in September 2001.

Diekman says the regulations have been successful and supervision has been strengthened. Both public and internal accountants play an important role in this. The law has assigned public accountants various obligations to report to regulators like the Nederlandsche Bank, the Netherlands Authority for the Financial Markets, and the Financial Intelligence Unit Nederland. Diekman shows that public accountants apply this reporting obligation broadly in practice. They pass on more information than strictly required by law.

The internal accountant also has an important task in the context of monitoring integrity and interprets his tasks more broadly than the law prescribes. The internal accountant works largely independently and reports to the highest level of leadership in the business, with a direct reporting line to the Supervisory Board. Within financial companies there are separate departments for Compliance, Risk Management and Internal Audit.

Diekman says there is still enough reason to have trust in the banks, despite the great unrest on the financial markets. “I see the current credit crisis primarily as a necessary economic correction. Accountants have played an important role in valuing the assets on the balance sheet via their audit of banks’ annual statements. They put pressure on the US banks to write off outstanding loans that could no longer be repaid. It shows that the system of checks and balances between banks’ management, regulators and accountants actually works.”

Peter Diekman (1954) studied business economics and accountancy at Erasmus University Rotterdam. He started his career at KPMG in Amsterdam and went on to serve as head of Internal Audit at four major companies. Until March 2008 he was Global Head of Group Audit at ABN AMRO Bank NV. He has been involved in non-degree education for accountancy at the EUR for twenty years.

Media Contact

More Information:

http://www.eur.nl/englishAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Bringing bio-inspired robots to life

Nebraska researcher Eric Markvicka gets NSF CAREER Award to pursue manufacture of novel materials for soft robotics and stretchable electronics. Engineers are increasingly eager to develop robots that mimic the…

Bella moths use poison to attract mates

Scientists are closer to finding out how. Pyrrolizidine alkaloids are as bitter and toxic as they are hard to pronounce. They’re produced by several different types of plants and are…

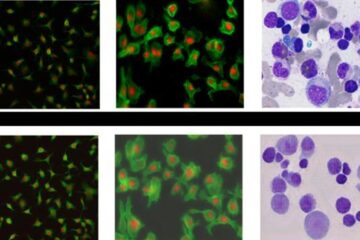

AI tool creates ‘synthetic’ images of cells

…for enhanced microscopy analysis. Observing individual cells through microscopes can reveal a range of important cell biological phenomena that frequently play a role in human diseases, but the process of…