Three “R”s of the Recession: Recruiting, Raising Money, and Regulation

The fall of some of the largest, most respected names on Wall Street has left many financial industry workers without jobs, consumers feeling betrayed, Congress scrambling for a plan, and entrepreneurs wondering where their next infusions of cash might come from. While the country’s economic woes appear vast, the three “r”s of the recovery might boil down to job recruiting, money raising, and the future of financial regulation.

Recruiting

“With the world financial community in serious retreat, it might seem improbable to find a financial institution that is actively and aggressively recruiting,” says Mark “Goldie” Goldwasser, CEO of National Holdings Corporation (OTCBB: NHLD), a full service investment banking company operating through its wholly owned broker dealer and advisory subsidiaries. “Despite all the economic gloom and doom we’ve been hearing about in the financial sector, however, our message remains loud and clear: we’re hiring!”

National Holdings is weathering the financial storm and locating great talent while doing so. Founded sixty years ago, National Holdings’ group of companies manages over seven hundred registered reps in approximately one hundred offices throughout the U.S. and abroad. National also provides CNBC’s daily “Fair Value Report,” and offers access to over fourteen thousand mutual funds, independent money manager accounts, best of breed hedge fund managers, private equity and venture capital funds, and real estate limited partnerships.

Mr. Goldwasser believes that the independent brokerage model could eventually come to rival the dominance of investment banks and major brokerage houses.

“Most independent broker-dealers are small enough to give clients the individualized attention that they deserve, but have the resources necessary to provide products and services competitive with the very largest firms,” Mr. Goldwasser explains. “In return for covering their own direct operating overhead, these independent contractors receive a higher payout. At the end of the day, rather than the prestige that comes from having a large financial institution handling their account, what clients really want is someone that is honest and will help them invest wisely with full transparency.”

Raising Money

Meanwhile, Leonard J. Sokolow, President of National Holdings Corporation and a serial entrepreneur himself, suggests that now might be just the right time for people to embrace their entrepreneurial spirit. “The American economy is an engine that breeds entrepreneurs,” Mr. Sokolow says, “however, some might worry that finding funding might be difficult during tough economic times. Fortunately, there are resources available to help small businesses accomplish their goals and continue to grow.”

Mr. Sokolow, who is also a co-founder of vFinance Investments, Inc., a principal operating subsidiary of National Holdings that provides brokerage, trading, and investment banking services, suggests some practical advise for burgeoning entrepreneurs facing a challenging economic climate, including: considering what sectors are thriving at present and asking oneself if one’s business venture captures the spirit of the times; holding an initial round of friend and family financing; investigating the Small Business Administration’s (SBA) loan program; accessing federal funding opportunities that are beginning to proliferate; creating a detailed, well-defined, and realistic business plan with a strong advisory board/board of directors; and utilizing free resources, including www.vFinance.com, recognized as one of the primary online connection points between serious-minded entrepreneurs and the capital industry.

“Regardless of the challenges in the economic environment,” says Mr. Sokolow, “with a good idea, dogged determination, the right resources, and qualified advisors, it is always the time to thrive.”

Regulation

The final piece of the recessionary puzzle is the future of securities regulation, the financial exchange laws that are expected to undergo a seismic realignment. “In light of everything we’ve seen happen over the last twelve months, we can expect a genuine overhaul of securities regulation,” says Mr. Goldwasser. “Historically, securities laws haven’t changed significantly since the 1930s. Now they will be rewritten, and the industry is facing a regulatory perfect storm.” Mr. Goldwasser sees the regulatory debates playing out over the next two years and suggests that “similar, across-the-board regulation will help level the playing field for everyone: IRAs, hedge funds, broker-dealers, insurers.”

Mr. Goldwasser also believes that the independent broker model is particularly well-suited for the coming paradigm shift. “Generally, larger institutions find it more difficult to institute sweeping changes,” says Mr. Goldwasser. “The bigger the organization, the thicker the bureaucracy and the more ingrained the culture of the institution. Independent professionals, with smaller offices, can be more nimble and adopt best practices and enhanced processes, which will serve them now and in the future.”

For those covering financial news, National Holdings Corporation makes available Mark “Goldie” Goldwasser and Leonard J. Sokolow to discuss a variety of topics including:

• What can we expect from the future of investment banking?

• Will hedge funds still dominate the industry?

• Why does the independent brokerage model represent the future of investing?

• What are some of the investor advantages of working with independent broker-dealers?

• How might a shift away from brokerage house commissions toward fees based on assets impact investors?

• Is it easier for the government to regulate smaller, independent-brokerage houses than investment banks and major brokerage houses?

• In which financial products, if any, do independent broker-dealers specialize?

• Who might be remembered as the heroes of the financial crisis?

• What steps might burgeoning entrepreneurs take to bring their innovations to market in a challenging economic climate?

• What criteria exist for Small Business Administration loan applications?

• How does www.vFinance.com connect entrepreneurs with venture capitalists?

• What should the role of government regulation be in a free market economy?

• What is the rationale behind the notion that some financial institutions, like Bear Stearns, or some corporations, like GM, are “too big to fail?”

• What impact are we seeing from government bailouts of private financial institutions? Were all of these bailouts necessary?

• What opportunities exist in the current marketplace for investors?

Expert Biography – Mark Goldwasser, CEO of National Holdings Corporation

Mr. Goldwasser comes from a rich background having worked in managerial and executive positions at several of Wall Street’s largest firms. Mr. Goldwasser was the Managing Director and Co-head of Global High Yield Sales at ING Barings, the Managing Director of High Yield Sales at Schroders & Co., Vice President of Institutional High Yield Sales at Lazard Freres & Co., and the Associate Director of Institutional Convertible Sales and Institutional High Yield Sales at Bear Stearns & Co., Inc. “Goldie,” as he is known in the industry, joined National Securities in mid-2000 and has shown impeccable leadership by bringing the company through the difficult period of September 11, 2001, and its aftermath.

Expert Biography – Leonard J. Sokolow, President of National Holdings Corporation

Leonard J. Sokolow was the co-founder, Chairman of the Board of Directors and CEO of vFinance. “Lenny” as he is known in the industry is on the Board of Directors and Chairman of the Audit Committee for Consolidated Water Company Ltd. (NasdaqGS: CWCO). Lenny was also Founder, Chairman and Chief Executive Officer of the Americas Growth Fund, Inc., a closed-end 1940 Act investment management company, from 1994 to 1998 (NASDAQ: AGRO). From 1988 until 1993 he was a senior executive of Applica, Inc., formerly Windmere Corporation (NYSE: APN) serving as EVP and General Counsel in his last position. From 1982 until 1988, he practiced in corporate, securities and tax law and was one of the founding attorneys and a partner of an international boutique law firm. From 1980 until 1982 he worked for Ernst & Young and KPMG Peat Marwick. Lenny received his B.A. degree in Economics from the University of Florida in 1977, a J.D. degree from University of Florida Levin College of Law in 1980 and an LL.M. degree in Taxation from the New York University Graduate School of Law in 1982. Lenny is also a Certified Public Accountant. Lenny has shown vision as a business leader and an entrepreneur to create businesses and business opportunities by leveraging his vast business and professional experience in the global markets.

With their extensive experience in international financial markets, “Goldie” and “Lenny” have the balance and vision necessary to lead National Holdings Corporation. Additionally, National has an in-depth team of key management that consists of well-experienced executives and expert department heads to compliment and execute its vision.

About National Holdings Corporation

National Holdings Corporation is a holding company for National Securities Corporation, vFinance Investments, Inc., EquityStation, Inc., National Asset Management, Inc., and National Insurance Corporation. National Securities, vFinance and EquityStation are broker-dealers registered with the SEC, and members of FINRA and SIPC. vFinance is also a member of the NFA. The three principal lines of business of the broker-dealers are offering full service retail brokerage; providing investment banking, merger, acquisition and advisory services to micro, small and mid-cap high growth companies; and trading securities, including making markets in over 3,500 micro and small-cap stock, distributing direct market access platforms, and providing liquidity in the United States Treasury marketplace. National Asset Management is a federally registered investment advisor. National Insurance provides a full array of fixed insurance products to its clients. For more information, please visit our websites at www.nationalsecurities.com and www.vfinance.com.

Media Contact

All latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Superradiant atoms could push the boundaries of how precisely time can be measured

Superradiant atoms can help us measure time more precisely than ever. In a new study, researchers from the University of Copenhagen present a new method for measuring the time interval,…

Ion thermoelectric conversion devices for near room temperature

The electrode sheet of the thermoelectric device consists of ionic hydrogel, which is sandwiched between the electrodes to form, and the Prussian blue on the electrode undergoes a redox reaction…

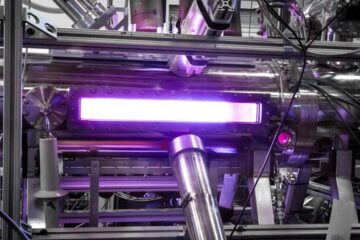

Zap Energy achieves 37-million-degree temperatures in a compact device

New publication reports record electron temperatures for a small-scale, sheared-flow-stabilized Z-pinch fusion device. In the nine decades since humans first produced fusion reactions, only a few fusion technologies have demonstrated…