Potentially risky loans helped ease recession, new research shows

Murillo Campello says a survey of corporate executives found that many small and mid-sized firms survived the economic storm by tapping easy, low-cost lines of credit locked in ahead of the downturn, during an era of loose lending that also included sub-prime home mortgages.

“These lines of credit were so liquid and so accessible that it made this recession far less acute than it would have been otherwise,” he said.

In hindsight, Campello says the economy-sparing credit was likely ill advised, similar to the risky mortgages doled out to under-qualified homebuyers that contributed to an economic collapse now dubbed the Great Recession.

Extended amid a robust economy, the credit became potentially toxic for banks when the downturn hit, he said. Interest rates were not adequately risk-adjusted, and banks gave themselves no outlet to deny firms that needed money just to survive, rather than for business-building projects the credit is designed to finance.

“Some bankers made mistakes by authorizing these lines of credit and we’re lucky they made those mistakes,” Campello said.

“It saved those firms’ skin during this recession, but probably won’t be as easy to access next time. There will be stricter terms and, of course, higher interest rates.”

The research illustrates the value of easing rather than tightening credit during bad times, said Campello, who co-wrote two earlier studies on the perils of financial constraints that were cited this year in a report by President Obama on the state of the economy.

He says lines of credit not only spared small and mid-sized firms from bankruptcy, but also let them emerge from the recession on more solid financial ground. As a result, those firms may now be poised hire and spend, providing a needed jolt as the economy rebounds.

“These companies have more cash, more profits and it may be nearing the point where they will start to hire,” said Campello, a U. of I. finance professor and faculty research fellow with the National Bureau of Economic Research.

The nation’s unemployment rate remained flat at 9.7 percent in February after peaking at 10.1 percent in October, but analysts say the job market is beginning to show signs of recovery.

Campello says the February jobless report offers promise, including stable manufacturing employment and a 30,000 increase in temporary workers who sometimes move up to full-time in the aftermath of recessions.

How quickly hiring escalates depends on when consumer confidence rebounds and whether the government pumps money into job-creating programs, he said.

“A wild guess would be that employment will stay roughly where it is for six months, then pick up in the third quarter,” Campello said. “But everything is still uncertain now. Obama calls this the recession of our lifetime and it is. It’s a unique situation, even the recovery we may be looking at.”

The earlier research by Campello that was cited in the presidential report also stemmed from surveys of top executives to gauge how corporate spending is affected by a credit crisis.

One, co-written by U. of I. finance professors Heitor Almeida and Scott Weisbenner, showed that firms curbed investment when long-term debt came due amid the latest crisis, which increased refinancing costs.

Another study found that firms facing financial constraints trimmed employment, investment and other spending sharply during the recession compared with companies with access to credit.

Media Contact

More Information:

http://www.illinois.eduAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

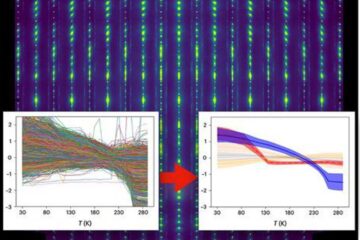

Machine learning algorithm reveals long-theorized glass phase in crystal

Scientists have found evidence of an elusive, glassy phase of matter that emerges when a crystal’s perfect internal pattern is disrupted. X-ray technology and machine learning converge to shed light…

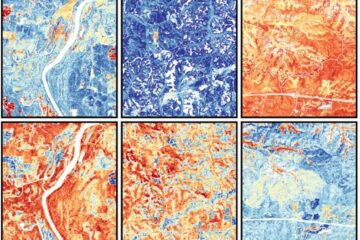

Mapping plant functional diversity from space

HKU ecologists revolutionize ecosystem monitoring with novel field-satellite integration. An international team of researchers, led by Professor Jin WU from the School of Biological Sciences at The University of Hong…

Inverters with constant full load capability

…enable an increase in the performance of electric drives. Overheating components significantly limit the performance of drivetrains in electric vehicles. Inverters in particular are subject to a high thermal load,…