New Report by BCG and HHL on Diversified Companies

By combining better capital management and a strategic approach to portfolio streamlining, diversified companies can actively address the “conglomerate discount,” which reduces their valuations compared with pure-play companies, according to a new report by The Boston Consulting Group (BCG) and HHL Leipzig Graduate School of Management (HHL). The report, entitled Invest Wisely, Divest Strategically: Tapping the Power of Diversity to Raise Valuations, is being released today.

After shrinking during the financial crisis, the conglomerate discount rebounded to its typical range during the global economy’s tenuous recovery. Among companies publicly listed in the United States, the discount has increased to its precrisis range of 10 to 15 percent after shrinking to approximately 7 percent during the crisis. These findings are based on an extensive analysis of diversified and focused companies conducted jointly by BCG and HHL.

“While the conglomerate discount shrinks during recessionary periods and typically increase during economic recoveries, it does not disappear by itself over time,” says Jens Kengelbach, a Munich-based partner at BCG and coauthor of the report. “To improve their relative valuations, diversified companies need to actively employ means to overcome or reduce the discount. This effort begins with understanding what drives their undervaluation, which was a key focus of our research.”

Capital Allocation Efficiency Strongly Influences Lower Relative Valuations

“Our research points to inefficiency in allocating capital among their businesses as the major driver of diversified companies’ chronic undervaluation,” says Hady Farag, a Hamburg-based principal at BCG and another coauthor of the report. “All else being equal, companies that are better at matching capital investments to businesses’ attractiveness in terms of returns and growth prospects have higher valuations, whereas lower efficiency in allocating capital reduces relative valuation.”

Establishing capital allocation inefficiency as the link between diversification and the conglomerate discount has major implications for diversified companies seeking to improve their valuations. “Diversified companies suffer from lower relative valuations not because of diversification per se, but because their portfolio complexity makes it challenging to allocate capital efficiently,” explains Kengelbach. “This insight points to greater efficiency in capital allocation as the primary objective for diversified companies’ efforts to shrink the conglomerate discount or even turn it into a premium.”

Diversified Companies Can Drive Greater Efficiency in Capital Allocation

Excellence in capital management—steering capital flows among businesses to maximize returns—provides a powerful means for diversified companies to achieve higher relative valuations. In fact, many of the diversified companies studied have attained high relative valuations by maintaining highly efficient capital allocation.

This lever should be considered in combination with portfolio streamlining. The research found that reducing the number of businesses in a portfolio significantly increases diversified companies’ capital-allocation efficiency, while increasing the number of businesses significantly reduces their efficiency. This indicates that diversified companies may be able to reduce their capital-allocation disadvantages and drive substantially higher valuations by making strategic divestments.

“Diversified companies should also be particularly careful to consider how expansion into new business segments will affect their capital-allocation efficiency,” cautions Farag. “Expansion that initially can be accomplished at a reasonable cost could carry the unintended consequence of rendering capital allocation more difficult.”

Applying the Levers Requires a Plan Tailored to the Company’s Situation

A stringent, value-focused approach to portfolio management can be implemented through a role-based method of managing businesses and the capital flows among them. To apply such a method, the company determines specific roles for the individual businesses with respect to the outlook for cash generation and growth and sets investment guidelines for each role.

“If a diversified company finds that it has both attractive and unattractive businesses, the role-based approach will lead to a rebalancing of capital allocation in favor of higher-value businesses and to strategic divestments,” explains Kengelbach. “If its businesses permanently require larger investments than they generate in cash, the company should seek to raise additional capital or pursue joint ventures in order to fully capture the value from its priority segments.” Conversely, a company that lacks high-value investment opportunities for all the cash generated by its businesses should consider distributing excess cash to shareholders through dividends or buybacks.

“Our latest research supports BCG’s perspective that diversification in itself is not detrimental to value creation,” says Kengelbach. “Rather, it is how a company manages its diversified business that determines its performance. Although the management challenges are indeed significant, leading diversified companies have demonstrated that efficient capital allocation and a clear and consistent portfolio strategy can drive superior value.”

A copy of the report can be downloaded at http://www.bcgperspectives.com.

About HHL Leipzig Graduate School of Management

Founded in 1898, HHL Leipzig Graduate School of Management was the first business school in Germany. Currently, HHL is one of the country’s leading graduate schools, offering a variety of academic programs for different graduate degrees, including MSc, MBA, PhD, as well as Executive Education. The Center for Corporate Transactions, headed by Prof. Dr. Bernhard Schwetzler, is HHL’s major research unit in the field of mergers and acquisitions. It is designed to bring together scientists of HHL and its research partners working in the areas of corporate finance, accounting, law, and game theory to analyze and discuss problems in corporate transactions. For more information, please visit http://www.hhl.de/finance.

About The Boston Consulting Group

The Boston Consulting Group (BCG) is a global management consulting firm and the world’s leading advisor on business strategy. We partner with clients from the private, public, and not-for-profit sectors in all regions to identify their highest-value opportunities, address their most critical challenges, and transform their enterprises. Our customized approach combines deep insight into the dynamics of companies and markets with close collaboration at all levels of the client organization. This ensures that our clients achieve sustainable competitive advantage, build more capable organizations, and secure lasting results. Founded in 1963, BCG is a private company with 81 offices in 45 countries. For more information, please visit http://www.bcg.com.

About bcgperspectives.com

Bcgperspectives.com features the latest thinking from BCG experts as well as from CEOs, academics, and other leaders. It covers issues at the top of senior management’s agenda. It also provides unprecedented access to BCG’s extensive archive of thought leadership stretching back 50 years to the days of Bruce Henderson, the firm’s founder and one of the architects of modern management consulting. All of our content—including videos, podcasts, commentaries, and reports—can be accessed by PC, mobile, iPad, Facebook, Twitter and LinkedIn.

http://www.hhl.de/finance

http://www.bcg.com

http://www.bcgperspectives.com

Media Contact

All latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Bringing bio-inspired robots to life

Nebraska researcher Eric Markvicka gets NSF CAREER Award to pursue manufacture of novel materials for soft robotics and stretchable electronics. Engineers are increasingly eager to develop robots that mimic the…

Bella moths use poison to attract mates

Scientists are closer to finding out how. Pyrrolizidine alkaloids are as bitter and toxic as they are hard to pronounce. They’re produced by several different types of plants and are…

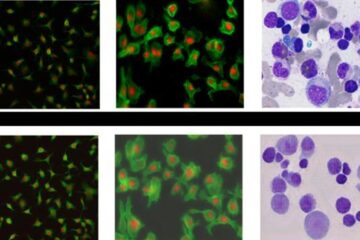

AI tool creates ‘synthetic’ images of cells

…for enhanced microscopy analysis. Observing individual cells through microscopes can reveal a range of important cell biological phenomena that frequently play a role in human diseases, but the process of…